This week, the presidential inauguration and subsequent flurry of executive orders left investors deciphering what is ‘signal’ versus ‘noise’. Fortunately, in the background, public companies have started reporting fourth quarter earnings and reveal expectations for the year ahead.

The Battle for Retail

A banana duct taped to a wall sold for $6.2 million dollars this week to a cryptocurrency founder. With bitcoin nearing $100,000 and up more than 40% in November alone, bullish sentiment may be reaching levels of excess and froth in certain corners of the capital markets.

Dog Days of Summer

Having already digested 90% of the S&P 500’s second quarter results, investors this week parsed earnings for the major retailers still left to report. Despite the likes of Home Depot and Wal-Mart continuing the recent trend of companies delivering better-than-expected earnings, the recent rise in longer-term bond yields is dampening investors’ enthusiasm for stocks.

Shifting Demand

As new parents, my wife and I have been experiencing the ongoing formula shortage firsthand as we prepare for our little one to start daycare in June. The search for formula reminds me of the early days of the pandemic when life turned into a competitive “treasure hunt” due to supply constraints and a drastic change in consumer demand.

Tug of War

Investors buffeted by the ongoing correction in stocks and bonds could be forgiven for asking this question. The Fed’s aggressive half a percentage point increase in interest rates last week coupled with another report of elevated inflation earlier this week are serving to continue the turbulence investors have experienced so far this year.

What Really Matters

With an eventful first quarter now in the history books, we can safely say that the elevated levels of volatility that we predicted for 2022 are now in play.

U.S. Economy Continues to Power Through

While news coverage is understandably focused on the devastation in Ukraine, we remain keenly focused on the fundamentals of the U.S. economy and the companies we follow. We realize that during times of stress markets become disconnected from the underlying fundamentals of the economy, but just like water always finds its equilibrium, markets similarly return to the fundamentals.

Skating to Where the Puck Is Going

Our Director and CEO Emeritus Jim Rudd, has long been a fan of the Wayne Gretzky quote, “don’t skate to where the puck is, skate to where it is going.” While it important to keep an eye on current data, it is more important to understand current data in the context of where you think the puck, or the economy in this case, is going. Let’s look at what is currently going on in Washington and the economy, and where we expect they are going later this year and into 2022.

The Writing on the Wall

“Tell me where earnings are going, and I’ll tell you where the markets are going” is common phrase you’ve heard from us over the years.

How Far into the Future?

The stock market is a discounting mechanism. What does that mean? It means the value today is explained by the economy in the future and ultimately long-term earnings.

Opening for Business

Following a stimulus-induced surge from March lows, blue-chip stocks that had mounted over a 30-percent advance have consolidated gains so far in May.

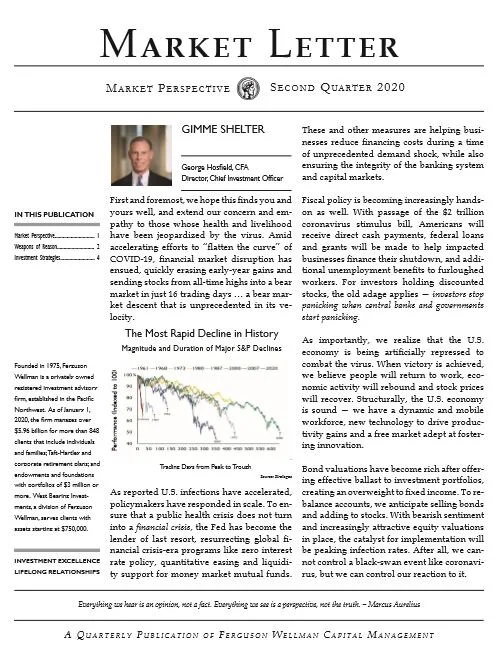

2020 Q2 Market Letter: Gimme Shelter

Fear Is Only as Deep as the Mind Allows

Kingda Ka at Six Flags in New Jersey is the tallest and fastest roller coaster in the United States. Imagine being on that coaster.

Too Much to Overcome in the Near Term

As investors, we know that near-term sentiment can get ahead of fundamentals, and we felt that was the case early in the year. What would cause the market to pull back was not as easy to determine, but it appears earnings and the Coronavirus are the current catalysts for selling stocks. Now seems like an appropriate time to remind investors how we manage through turbulent times, and how we view market corrections versus bear markets.

Back to the Basics

With stocks, only two things matter: earnings and what investors are willing to pay for a dollar of earnings.

Glass Half Full

With some 90 percent of the S&P 500 having now reported third quarter earnings, investors have responded favorably to a plurality of companies delivering better than expected numbers.

Show Me the Money

While the U.S. consumer remains resilient, CEO confidence has been deteriorating as economic uncertainty has been increasing.

Long Live the U.S. Consumer

This morning the Bureau of Economic Analysis released the second quarter GDP estimate and, while growth was down 3.1 percent from the first quarter, it was still a healthy 2.1 percent with consumer and government spending that was strong.