by Jason Norris, CFA

Executive Vice President of Research

While the U.S. consumer remains resilient, CEO confidence has been deteriorating as economic uncertainty has been increasing. This has been affecting capital spending, as well as other uses of cash.

Source: FactSet

With respect to heightened ambiguity, Goldman Sachs expects overall business cash spending to fall 6 percent in 2019 and increase only 2 percent in 2020. This comes off a record 25 percent growth in 2018 driven by the tax cuts. Slowing earnings growth and trade tensions are resulting in heightened conservatisms for corporations. The decline in 2019 is primarily driven by a slowdown in cash acquisitions and stock buybacks. Stock buybacks are expected to decline by 15 percent, or $120 billion.

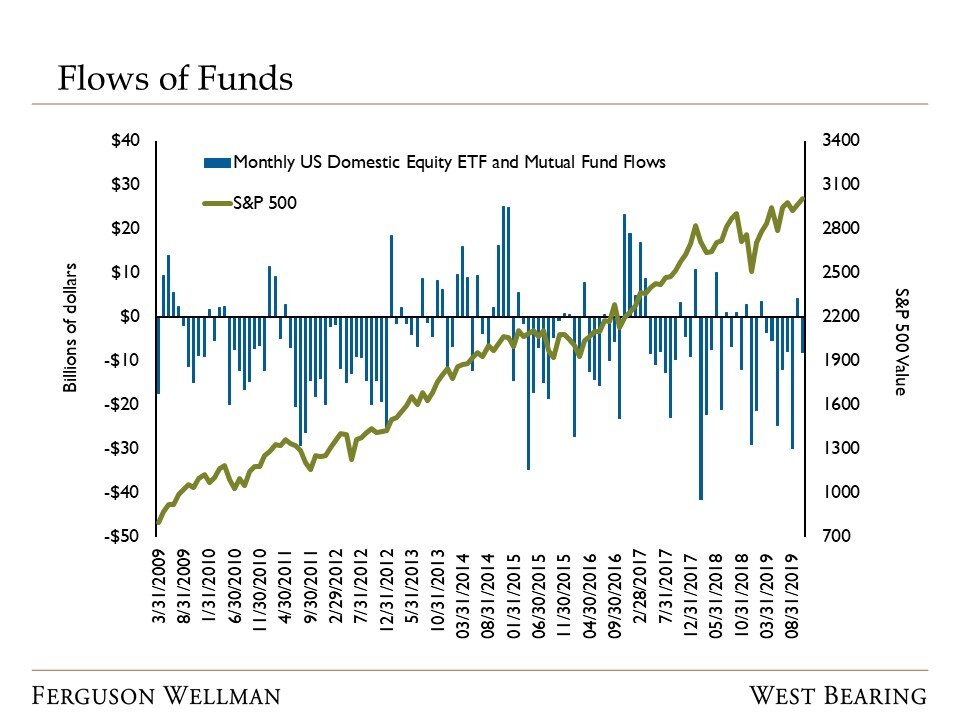

Corporate stock buybacks have been a nice support for the U.S. equity markets. The chart below highlights how share buybacks have more than offset the liquidation of U.S. equities from mutual funds and Exchange Traded Funds (ETFs).

Source: ICI and Goldman Sachs

While buybacks are forecasted to remain above historic averages, they will be meaningfully below the 2018 peak.

The chart also highlights how individual investors have been net sellers of U.S. equities the last 10 years. The years 2013 and 2014 were the only positive years for inflows into domestic mutual funds and ETFs. Over this time period, the S&P 500 returned over 300 percent.

Sources: ICI and FactSet

Takeaways for the Week:

We’ve stated this before, but with stocks near all-time highs and investors reluctance to buy/own U.S. equities, this has been the “Rodney Dangerfield” of bull markets