Annual presentation from Ferguson Wellman sharing our views for the year regarding the global economy and capital markets, as well as a planning update from our wealth management team.

Outlook 2025

We present our Outlook 2025 publication titled “Lessons Learned,” in which we discuss the resilience of the U.S. economy in 2024, highlighting the significant contributions of major technology companies to profit growth and providing insights on asset allocation strategies for 2025. Additionally, our team of analysts provide a look-back on each of the firm’s strategies and a primer on the environment for each in the year ahead.

Investment Strategy Video Fourth Quarter 2024

Chief Investment Officer George Hosfield, CFA, presents the firm's quarterly Investment Strategy titled, "Awaiting the Score." In the video, he discusses how the Fed is shifting its focus to the labor market.

Market Letter Fourth Quarter 2024

We present the fourth quarter 2024 Market Letter publication titled, “Awaiting the Score,” in which Chief Investment Officer George Hosfield, CFA, outlines the positive impact of receding inflation, renewed profit growth and the Fed’s monetary policy on investors. Krystal Daibes Higgins, CFA, discusses the skepticism and evolving debate around the ROI of artificial intelligence (AI). Lastly, Brad Houle, CFA, asks the question, “How Far, How Fast?” when it comes to the Fed’s rate cuts.

Investment Strategy Video Third Quarter 2024

Chief Investment Officer George Hosfield, CFA, presents the firm's quarterly Investment Strategy titled, "We’ve Landed."

Market Letter Third Quarter 2024

We present the third quarter 2024 Market Letter publication titled, “We’ve Landed,” featuring articles written by George Hosfield, CFA, Dean Dordevic and Joe Herrle, CFA.

Quarterly Publication Focus: So Far, So Good

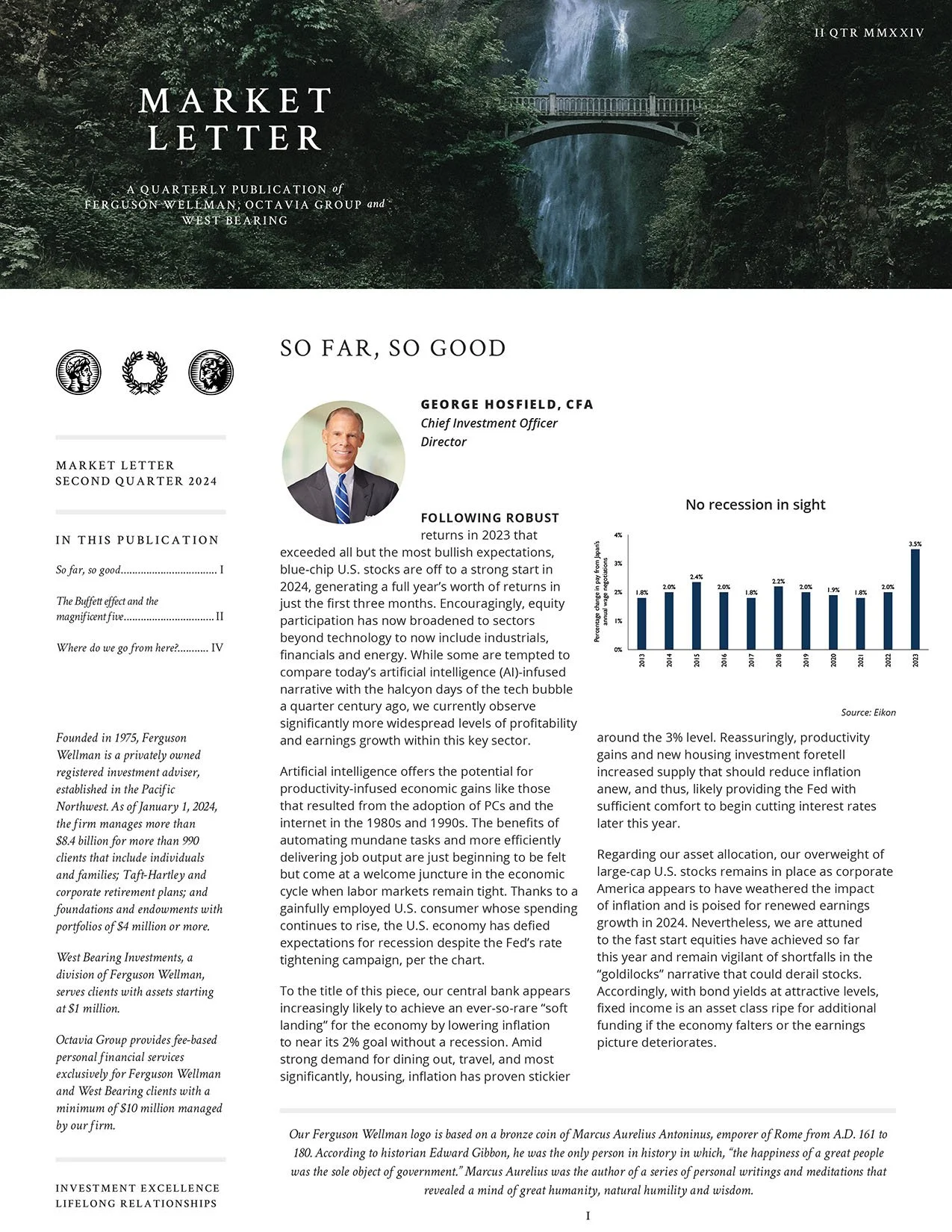

In the cover page of our quarterly Market Letter publication, George Hosfield, CFA, provides an update to our investment strategy titled, “So Far, So Good.” In the piece, George discusses the Fed’s progress in fighting inflation and delivering a soft economic landing, plus an update on the dominant theme of artificial intelligence across equity markets.

Second Quarter 2024 Investment Strategy Video: So Far, So Good

Head of Fixed Income and Principal Brad Houle, CFA, presents the firm's quarterly Investment Strategy titled, "So Far, So Good." In the video he discusses how the Fed's fight on inflation is faring, our belief that commercial real estate is not similar to residential real estate circa 2008 and investors' expectations for earnings for the remainder of the year.

Market Letter Second Quarter 2024: So Far, So Good

We present Market Letter publication for the second quarter 2024 titled “So Far, So Good” in which Chief Investment Officer George Hosfield, CFA, outlines our belief the Fed remains on course to deliver an ever-so-rare soft landing to this inflationary cycle. Dean Dordevic writes about the Japanese economy and Warren Buffett’s investment there in recent years since the introduction of the “Corporate Governance Code” and Jason Norris, CFA, provides an update on equity market valuations and how investors expect the market to grow for the remainder of the year.

Investment Outlook 2024 Video: Sticking the Landing

Annual presentation from Ferguson Wellman sharing our views for the year regarding the global economy and capital markets, as well as a planning update from our wealth management team.

2024 Investment Outlook Webinar Video: Sticking the Landing

Annual presentation from Ferguson Wellman sharing our views for the year regarding the global economy and capital markets, as well as a planning update from our wealth management team.

2024 Outlook Publication: Sticking the Landing

Investment Strategy Video: Inflation's Flame Flickers

George Hosfield, CFA, discusses Ferguson Wellman's quarterly strategy titled, "Inflation's Flame Flickers," which addresses the narrow market leadership, the impact of higher interest rates on inflation and how assets are priced at this stage of the economic cycle.

Fourth Quarter 2023 Market Letter: Inflation's Flame Flickers

Presenting our fourth quarter 2023 publication of Market Letter titled, “Inflation’s Flame Flickers.”

Third Quarter 2023 Investment Strategy Video: Standing Eight Count

Third Quarter 2023 Market Letter: Standing Eight Count

2023 Mid-Year Update Video

In spring 2023, members of our team have hosted events throughout the Pacific and Inland Northwest. Following our “tour,” we created a video of our presentation for clients who missed an event or don’t reside in the Northwest.

Market Letter: Stalemate

Investment Strategy Video: Stalemate

George Hosfield, CFA, discusses the firm's quarterly strategy titled "Stalemate," which highlights the Fed's ongoing battle to tame inflation along with our views on the health of the banking industry and capital market expectations for the balance of the year.

2023 Investment Outlook Video

Annual presentation from Ferguson Wellman investment team discussing the major themes facing capital markets in 2023 and how they will affect client portfolios.