by Alex Harding, CFA

Vice President, Equity Research

Shifting Demand

As new parents, my wife and I have been experiencing the ongoing formula shortage firsthand as we prepare for our little one to start daycare in June. The search for formula reminds me of the early days of the pandemic when life turned into a competitive “treasure hunt” due to supply constraints and a drastic change in consumer demand. Fortunately, while not immediate, it looks like the situation is improving as the Abbott plant in Michigan works to restart production and shipments arrive from abroad.

Retail Earnings Season

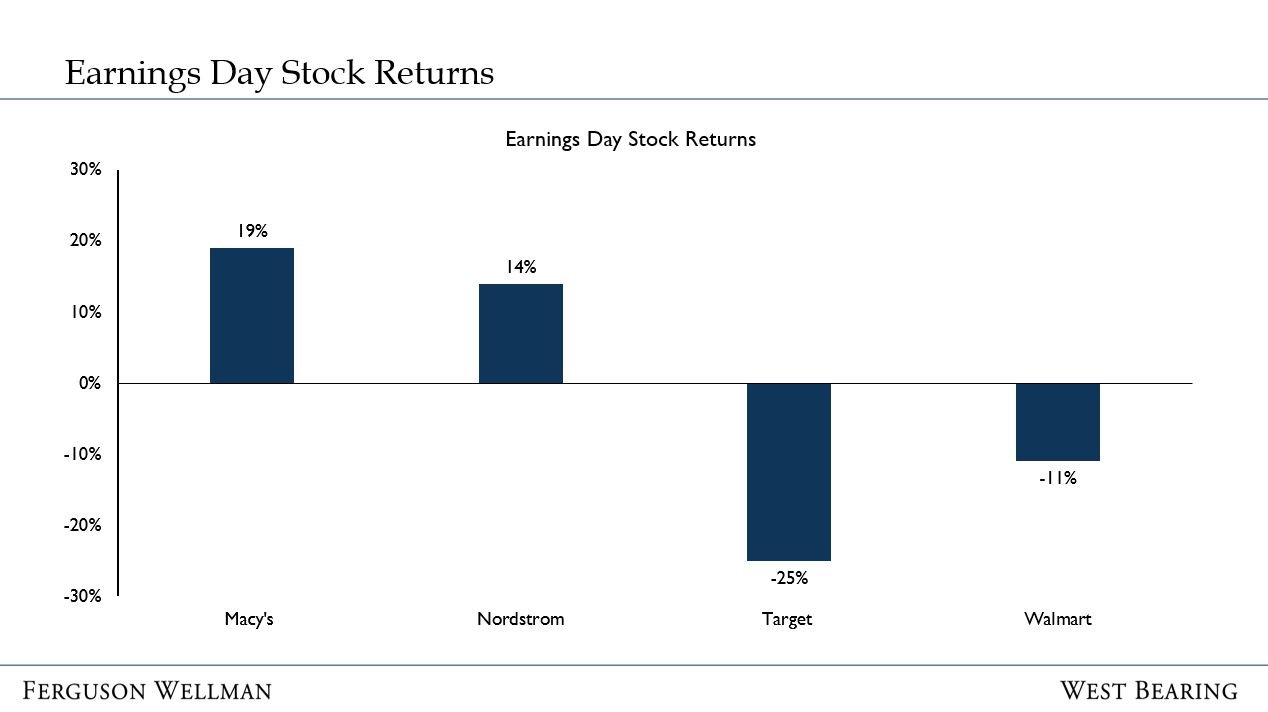

As rapid as the increase in goods spending was early in the pandemic, retail companies are witnessing the opposite unfold as consumers return to more normal behavior. Recently, companies such as Macy’s, Nordstrom, Target and Walmart, reported first quarter earnings results with notable differences in their profit outlooks. While all four retailers posted higher revenues, Target and Walmart were caught off-guard by the pace at which consumers shifted their spending away from items such as furniture and TVs to groceries and consumables. This led to excess inventory, higher markdowns and lower profitability. In contrast, retailers, Macy’s and Nordstrom, that serve higher-income demographics, raised earnings projections for the year as both are benefitting from increased spending on occasion-based apparel.

Quotes from the CEOs of Target and Nordstrom as well as the chart depicting investors’ reaction to the earnings release further explain the bifurcation between retail companies this quarter.

“While we anticipated a post-stimulus slowdown in these categories and we expect the consumer to continue refocusing their spending away from goods and into services, we didn't anticipate the magnitude of that shift.” – Target Charmain and CEO, Brian Cornell

“This quarter, we saw customers shopping for long anticipated in-person occasions such as social events, travel and return to office. Beyond occasions, customers also reevaluated and refreshed their wardrobes. We are encouraged by this opportunity because it favors the core categories of our business and the core capabilities of our service model.” – Nordstrom CEO and Director Erik Nordstrom

Source: Refinitiv

While the shift between goods and services tells a part of the story, inflation acting as a regressive tax on lower-income earners also plays a role as the demographic comprises a larger percentage of the Walmart and Target customer base. Households in the bottom quintile of income have seen their “real” wage decline, as stimulus check savings runs off and higher food and gas prices crowd out other spending. Acutely aware of the financial stress posed by inflation, the Federal Reserve acknowledged the elevated state of inflation in their May meeting minutes while committing the central bank to restoring price stability. In support of its mission, Friday’s release of the personal consumption expenditure report revealed the Fed’s preferred inflation measure declined for the first time since late 2020, from 6.6% to 6.3%.

Takeaways for the week

After eight straight weeks of declines, the Dow Jones Industrial Average rallied 6% this week

Retailer earnings show the disproportionate burden inflation has on lower-income households

We wish our blog readers a fun and safe Memorial Day Weekend