April Fools?

With an eventful first quarter now in the history books, we can safely say that the elevated levels of volatility that we predicted for 2022 are now in play. Amid 40-year highs in inflation and a war in Eastern Europe that few foresaw in the waning days of 2021, investors have been whipsawed by stocks that have corrected for the first time in two years. Blue-chip stocks have recovered half of their double-digit percentage losses of several weeks ago, but as this week’s payroll report highlights, the cross-currents of economic data and a new direction for monetary policy likely indicate more volatility ahead.

Batting .500

A U.S. economy still rebounding from COVID-19 produced a robust gain in net new jobs of 431,000 in March. While undershooting estimates for a gain of nearly 500,000, today’s payroll report and the accompanying drop in unemployment to a 3.6% rate highlight the strength of our domestic labor market. Not surprisingly, the largest job gains occurred in leisure and hospitality, this as Americans are traveling and eating out more. With U.S. payrolls now totaling 151 million, the U.S. economy is within about a million jobs of the pre-COVID employment peak. For the Federal Reserve, today’s jobs report helps confirm that one of its two overriding goals – full employment – has now been achieved.

A New Fed Focus

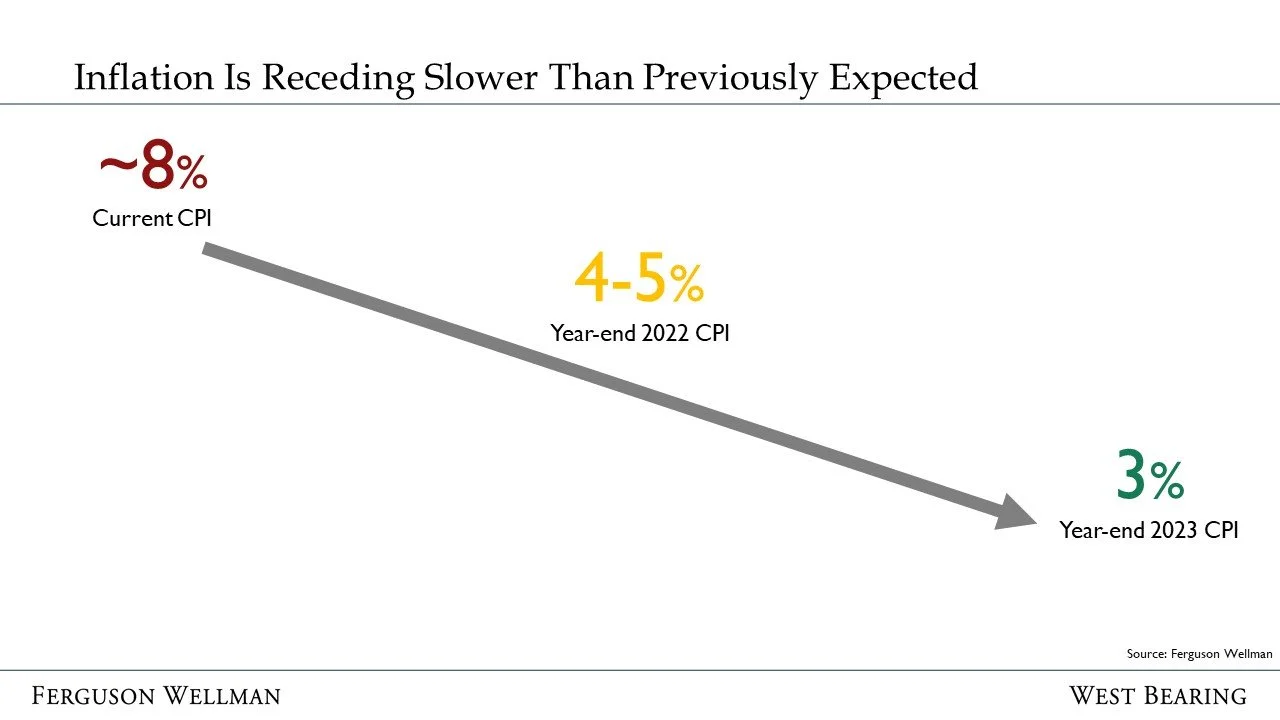

In the initial stages of our central bank’s rate-hiking campaign, the Federal Funds futures market is now discounting rate hikes at each of the Fed’s next six meetings this year. Acknowledging 40-year inflation highs and evidence that pricing power has spread to labor markets and less volatile elements of consumer prices like rent, the Federal Funds futures market is now discounting an elevated half a percentage point hike in rates when the Fed next meets in early May. With “base effects” comping last year’s rising rates of inflation likely to help moderate year-over-year increases, our bet is that the highs for inflation this cycle are now being realized. As labor force participation rates inch up as evidenced again in today’s jobs report, and supply chain issues like COVID lockdowns slowly fade, inflationary pressures from the supply side should ease. And with interest rates on credit cards and mortgages now rising, consumer demand for big ticket purchases should moderate. Accordingly, while we acknowledge that recent commodity price spikes are resulting in inflation being higher for longer and peaking at rates that could exceed 8% in March, we continue to expect inflation to moderate, as per the following chart.

Evidence of moderating inflation would reassure the Fed that it can achieve a soft landing for the economy without resorting to a shock-and-awe campaign of rate hikes that could create a recession. Fears of such received airtime this week as 2-year Treasury rates briefly traded above benchmark 10-year Treasury rates, producing what is known as a yield curve inversion. While all modern era recessions have been proceeded by yield curve inversions, we are prone to observe that yield curve inversions do not always foretell recession; they are much more predictive of recession when the yield curve inversion endures.

Stocks > Bonds

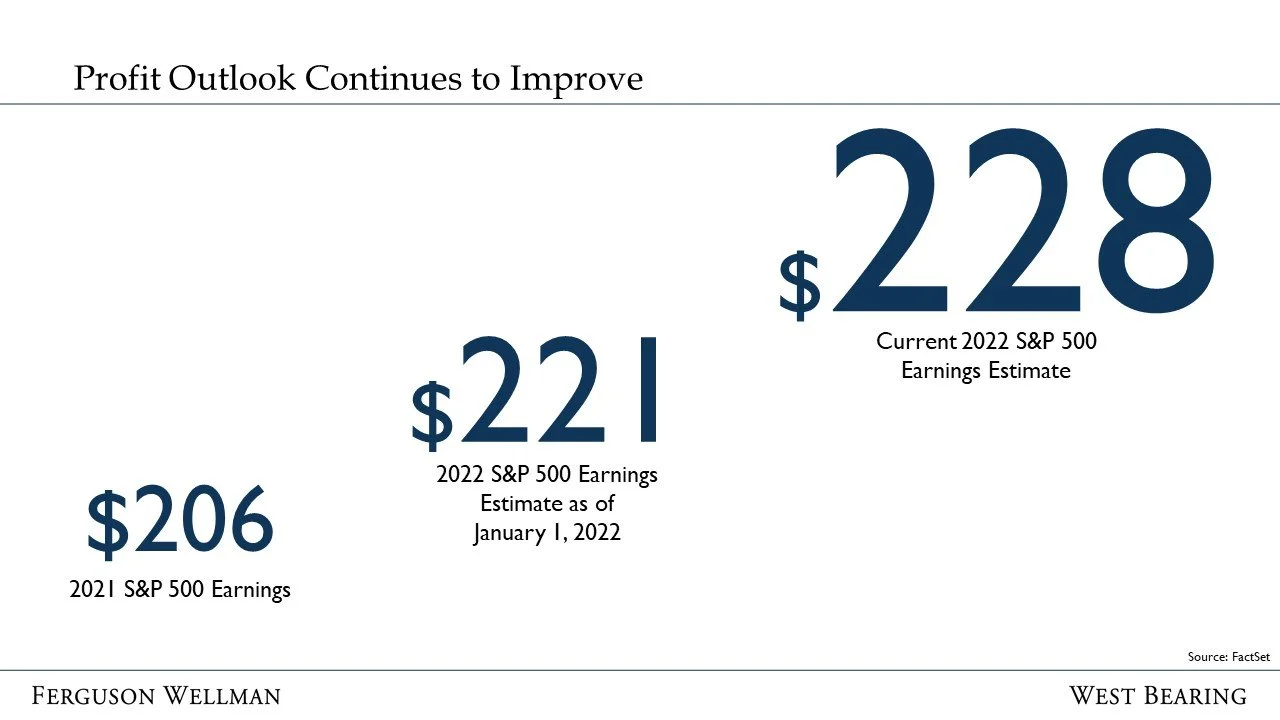

Despite a challenging backdrop of geopolitical conflict and inflation, we continue to expect stocks to outperform bonds. As it always is, this outlook is grounded in earnings. The chart below portrays expected growth in 2022 profits that has improved from beginning of the year levels amid strong pricing power being realized by America’s leading companies.

Our Takeaways for the Week

Stocks closed out a volatile first quarter, with the S&P 500 down 6%

Expected growth in corporate profits supports our continued overweight of U.S. equities