Our Director and CEO Emeritus Jim Rudd, has long been a fan of the Wayne Gretzky quote, “don’t skate to where the puck is, skate to where it is going.” While it important to keep an eye on current data, it is more important to understand current data in the context of where you think the puck, or the economy in this case, is going. Let’s look at what is currently going on in Washington and the economy, and where we expect they are going later this year and into 2022.

Third Quarter 2021 Investment Strategy Video: Coming in Hot

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Panic Attack

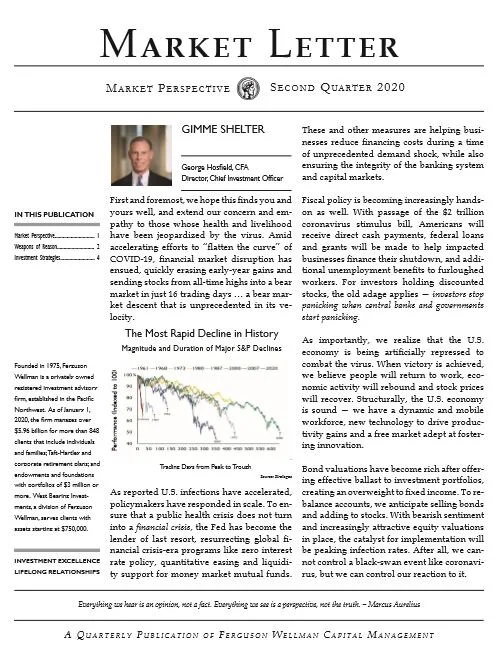

Twelve months ago, investors were in a state of sheer panic as they were witnessing stocks freefall by over 30 percent.

COVID Economy

We have been closely monitoring the recent uptick in COVID-19 infections across the country and in Europe. The path of the virus is the most important factor in the economic recovery and the thing that we know the least about.

Q4 2020 Mid-Quarter Investment Strategy Update

On October 20, our firm hosted a mid-quarter Investment Strategy Update webinar presented by Chief Investment Officer, George Hosfield, CFA, and Head of Fixed Income, Brad Houle, CFA.

Making Sense of the (Un)Employment Picture

Each week our Investment Policy Committee meets to review asset allocation and our outlook for the economy and global markets. We have a standard book of economic charts that we review to determine the health of the economy and what is transpiring around the world and many of these indicators go back decades.

At Home and Online

Without question, 2020 has brought about not only a steep, yet short-lived, recession, but also a material change in consumer preferences and behavior.

Update: Required Minimum Distributions Are Waived for 2020

The Coronavirus Aid Relief and Economic Security (CARES) Act waives required minimum distributions (RMDs) from retirement accounts for 2020.

Down in a Hole

Thursday’s unemployment claims continued to paint a dismal picture in the jobs market, where roughly 2.1 million people filed for initial claims last week, which brings the total over the last two months to roughly 40 million.

Opening for Business

Following a stimulus-induced surge from March lows, blue-chip stocks that had mounted over a 30-percent advance have consolidated gains so far in May.

"The Bad News Won't Stop but the Markets Keep Rising"

“The Bad News Won’t Stop, but Markets Keep Rising,” read the headline of the business section of the NY Times this week. I have received many questions from many clients and friends over the past couple of weeks regarding this notion.

Chart-side Chats

Last week marked the semi-sesquicentennial anniversary of Franklin Delano Roosevelt’s death which sparked many to compare our current financial markets to the Great Depression. As the stock market continues its rapid ascent for a second week and pundits start talking about the shape of the recovery, there is one lesson some overlook from the Depression era — the value of FDR’s fireside chats. During these chats, the president used simple, direct language to convey very difficult news; a format we are keeping in mind.

From Bad to Better

As the world’s battle against coronavirus rages on, we offer our best regards to those on the front lines battling the pandemic and express our sympathies to those whose health and welfare are being directly impacted.

2020 Q2 Market Letter: Gimme Shelter

Important 2020 Tax Season Reminders

Federal and states governments are working hard to provide support and relief to taxpayers during the COVID-19 global pandemic. One element that will ease the burden on taxpayer cashflow is the delay in due dates for filing and paying your 2019 taxes.

High Anxiety

Staying in touch with clients is critical during such extreme market volatility. Admittedly these are highly stressful and uncertain times for everyone. It is paramount that we stay safe, remain calm and strive to make decisions that are aligned with our long-term goals … not current headlines.

March Sadness

First and foremost, we want to extend our concern and empathy to those whose health has been directly impacted by the virus, as well to those in the travel, entertainment and restaurant industries whose jobs are increasingly at risk.

Cole and Lago Quoted in Portland Tribune

White Knuckles

The rollercoaster ride continued this week as stocks moved at least 2 percent every day; however, with all of that volatility the S&P 500 was up 1 percent.

Fear Is Only as Deep as the Mind Allows

Kingda Ka at Six Flags in New Jersey is the tallest and fastest roller coaster in the United States. Imagine being on that coaster.