by Peter Jones, CFA

Vice President of Equity Research and Portfolio Management

At Home and Online

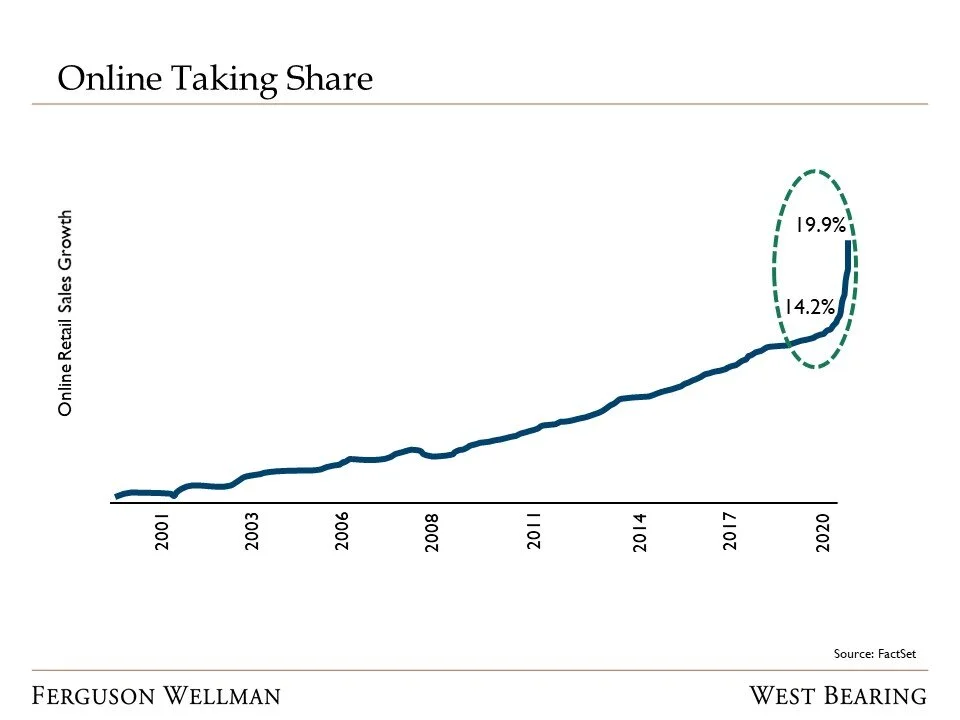

Without question, 2020 has brought about not only a steep, yet short-lived, recession, but also a material change in consumer preferences and behavior. We have seen several trends that were present before the pandemic accelerate as a result. Of course, the central theme has been the shift from physical retail locations to e-commerce. In fact, online’s share of total retail has moved from 14 percent to 19 percent in a matter of months. Prior to this year, online was taking share at a clip of 1 percent per year.

Although the pandemic has accelerated structural change, it has also caused a new trend to emerge -a housing boom. The decade following the housing crisis in 2008 brought about a relatively sluggish recovery in housing volumes. For one, consumers still scarred from the pain of 2008 were wary of taking on too much debt. In addition, the millennial generation has been very slow to buy homes, opting instead to rent in dense, urban areas or continue living at home with their parents.

However, as we emerge from this most recent crisis there are clear signposts that this trend is coming to an end. The last six months has made us all consider the utility of the home. When people were free to go out and about to bars, restaurants, gyms and other shared spaces there was little concern about living in a studio apartment when there were countless things to do within a couple of blocks. Now, after some six months of quarantine, that sentiment has certainly changed. The importance of satisfaction of the living space has skyrocketed as a result. This has led to a surge in first-time homeowners. The combination of a global pandemic, social unrest and protests in certain urban centers of the country has diminished the attractiveness of city living. Lastly, the work-from-home experiment has by-and-large been a success. This proof of concept has enabled dozens of multi-national corporations, especially big technology, to consider permanent or part-time work-from-home solutions. Of course, this would translate to further distance in proximity to the office and allow workers to live in the suburbs or country, or in some cases, other cities.

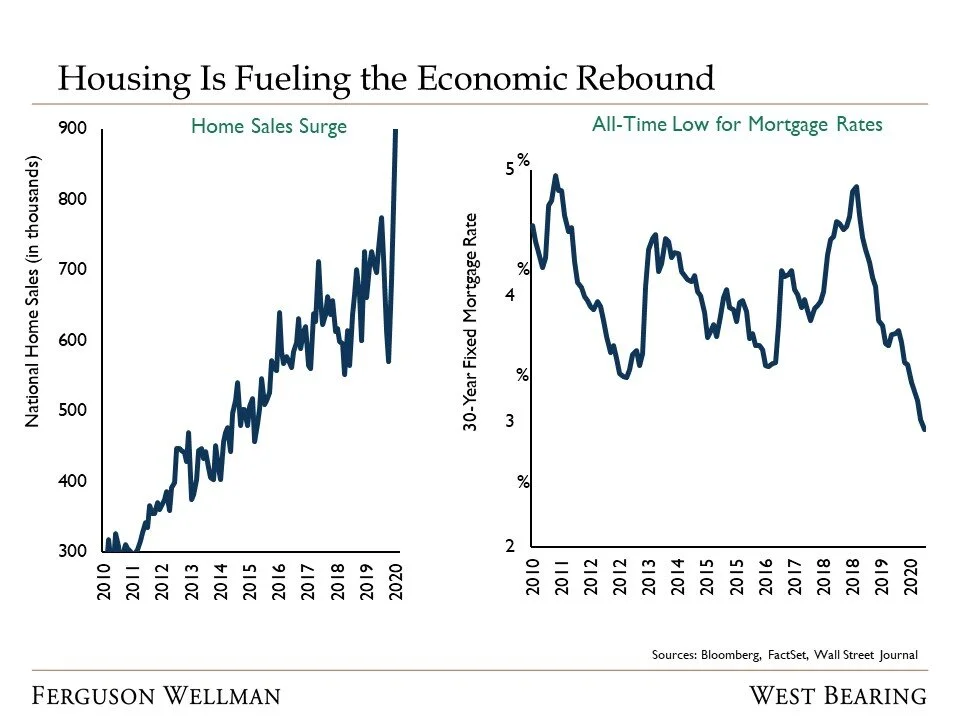

The confluence of several factors unique to 2020 has led to what some are characterizing as “the golden age of housing.” A change in sentiment is all well and good, but consumers need to have the financial means to go from renting to buying. The recent short-lived recession forced the Federal Reserve and other central banks to ease policy by cutting interest rates to zero and initiating quantitative easing, a method of lowering long-term interest rates and increasing money supply. These policy actions have pressured mortgage rates to record lows, allowing prospective home-buyers attractive financing options. As can be seen in the chart below, home sales have spiked and at the same time mortgage rates have fallen to new lows.

In summary, 2020 has been an incredibly challenging year with a global pandemic forcing consumers to stay at home, a recession that has left millions without a job and social unrest that has caused a necessary reevaluation of equality in our country. And all of this before wildfires devastated our beloved Pacific Northwest. As investment professionals, our job is to be objective in our assessment of how these unprecedented developments will impact the economy and shape consumer behavior. We have seen trends, such as e-commerce, accelerate sharply but at the same time we are seeing new trends emerge, most prominently a structural de-urbanization and housing boom that we believe will continue for years to come.

Week in Review and Our Takeaways:

Trends already in place, such as e-commerce, have accelerated as a result of the pandemic

Record low interest rates, increasing utility of the residence and diminishing attractiveness of urban living is resulting in a housing boom