by Timothy D. Carkin

Senior Vice President

Chart-side Chat

Last week marked the semi-sesquicentennial anniversary of Franklin Delano Roosevelt’s death which sparked many to compare our current financial markets to the Great Depression. As the stock market continues its rapid ascent for a second week and pundits start talking about the shape of the recovery, there is one lesson some overlook from the Depression era — the value of FDR’s fireside chats. During these chats, the president used simple, direct language to convey very difficult news; a format we are keeping in mind.

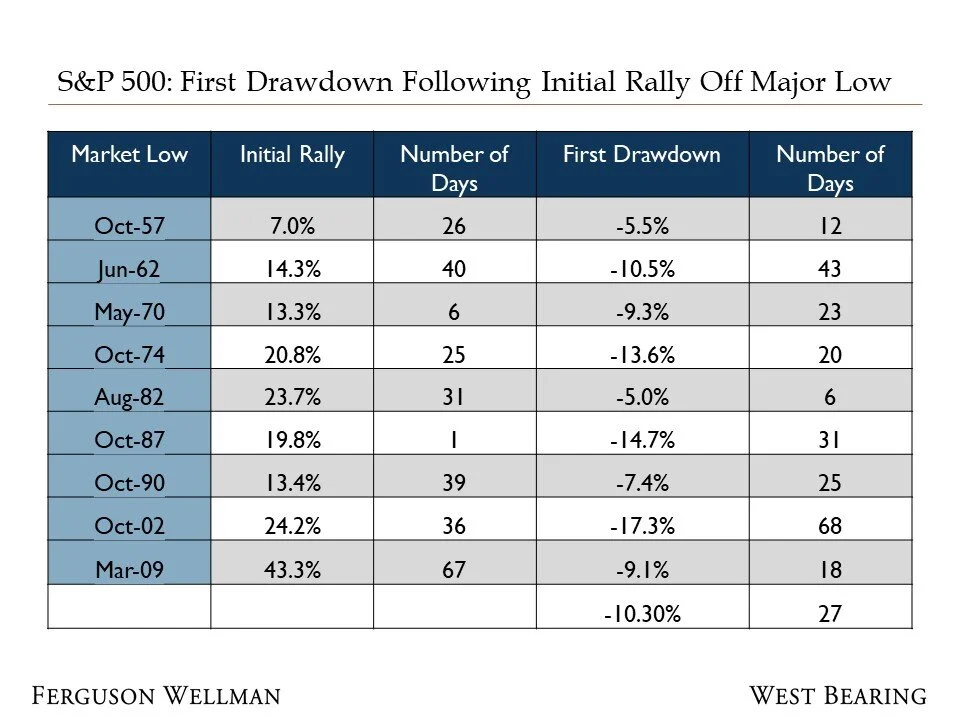

My friends, there is a good chance the equity markets will soon retrace some of their recent gains. The S&P 500 has rallied nearly 28 percent since setting a low last month. The last few weeks the market has had a tailwind from positive COVID-19 statistics, colossal amounts of monetary fiscal stimulus and now possible developments on the medical front. However, historically markets draw down much of their gains after a rally off lows. All the good news probably means we won’t retest the absolute lows, but as evident in the chart below, the S&P 500 has typically pulled back an average of 10 percent after its initial rally. My friends, this is healthy and normal for the market.

Source: Strategas Research

Fortitude and Good Temper

In one of the first fireside chats, FDR thanked Americans for their fortitude and good temper during the government’s shutdown of banks. When they reopened, there wasn’t a run on the banks which would cause the system to collapse. We believe Americans have exhibited great fortitude and good temper through this pandemic, but we still don’t know how much damage has been done to the economy and how quickly it will respond. This week, 5.2 million Americans filed for unemployment, raising the jobless claims to 22 million, recording the steepest monthly drop in employment since the Commerce Department started keeping record. In a communication we sent earlier this week, we touched on the shape of the market recovery. One key factor in that shape is how many and how swiftly those who are now unemployed can get back to work. We know that 70 percent of the economy is the consumer, so the sooner they begin working, the faster the recovery.

Week in Review and Our Takeaways

A second straight week of gains in equities marks a 14-percent rally in two weeks

The recent market rally is climbing a wall of worry. Pullbacks in this environment should be expected