With the COVID-19 pandemic creating slight confusion on what day it is, much less what month we are in, some of us may not have seen National 529 Day on our calendars.

Baby Steps

All 50 states have now taken steps to re-open according to the Wall Street Journal. While still devastating in magnitude, many high-frequency and leading economic indicators may be past their “worst-ever” levels, showing slight improvement from their recent and historic lows.

Simple, Powerful Steps to Take Before Your Estate Planning Meeting

With the onset of the COVID-19 pandemic, there seems to be a rush on clients seeking estate planning advice. There is certainly no replacement for personal advice from qualified counsel, but there are a few things you can do in the interim.

Webinar Video: Q3 Mid-Quarter Strategy Update

Opening for Business

Following a stimulus-induced surge from March lows, blue-chip stocks that had mounted over a 30-percent advance have consolidated gains so far in May.

A Lost Decade

This morning, the U.S. Bureau of Labor Statistics released unemployment statistics capturing the full effects of shelter-in-place mandates: in April, over 20 million jobs were lost, the highest monthly loss on record. This resulted in an unemployment rate of 14.7 percent, the highest since the Great Depression when unemployment was above 25 percent.

"The Bad News Won't Stop but the Markets Keep Rising"

“The Bad News Won’t Stop, but Markets Keep Rising,” read the headline of the business section of the NY Times this week. I have received many questions from many clients and friends over the past couple of weeks regarding this notion.

The Return of $1 Gas?

On Monday, for the first time ever, the price of oil contracts for future delivery fell below $0 to -$37.63 per barrel. While financial markets have adapted to the unfortunate reality of negative interest rates, a negative price for a physical commodity is another issue.

A New Outlook on Earth Day

Wednesday, April 22, is the 50th anniversary of Earth Day. In 1970, U.S. Senator Gaylord Nelson and activist Denis Hayes launched a nationwide environmental “teach-in” that later became Earth Day. Although the pandemic may have disrupted plans for this milestone anniversary, if Senator Nelson were alive today, he would find emerging business practices of interest.

Chart-side Chats

Last week marked the semi-sesquicentennial anniversary of Franklin Delano Roosevelt’s death which sparked many to compare our current financial markets to the Great Depression. As the stock market continues its rapid ascent for a second week and pundits start talking about the shape of the recovery, there is one lesson some overlook from the Depression era — the value of FDR’s fireside chats. During these chats, the president used simple, direct language to convey very difficult news; a format we are keeping in mind.

What a Long, Strange Trip It's Been

Who knew that in 1970, the chorus line of the classic song, “Truckin” by the Grateful Dead would clearly define today’s stock market environment?

Norris Interviewed on Boise State Public Radio

Jason Norris, CFA, recently spoke with Gemma Gaudette, Daily Show Host for Boise State Public Radio’s “Idaho Matters” news program.

From Bad to Better

As the world’s battle against coronavirus rages on, we offer our best regards to those on the front lines battling the pandemic and express our sympathies to those whose health and welfare are being directly impacted.

2020 Q2 Market Letter: Gimme Shelter

Wealth Management Strategies for Now and Later

Executive Vice President, Mary Lago, CFP, CTFA, discusses strategies clients can employ for their long-term financial health.

Second Quarter 2020 Investment Strategy Video: Gimme Shelter

We are pleased to present our Investment Strategy Video for the second quarter of 2020 titled, “Gimme Shelter.”

Roth IRA Conversion Considerations

Roth IRAs are after-tax retirement accounts. While not tax deductible when they are funded, they grow tax free and withdrawals are income tax free provided they are withdrawn after age 59 ½. Additionally, most Roth IRAs are not subject to required minimum distributions.

Important 2020 Tax Season Reminders

Federal and states governments are working hard to provide support and relief to taxpayers during the COVID-19 global pandemic. One element that will ease the burden on taxpayer cashflow is the delay in due dates for filing and paying your 2019 taxes.

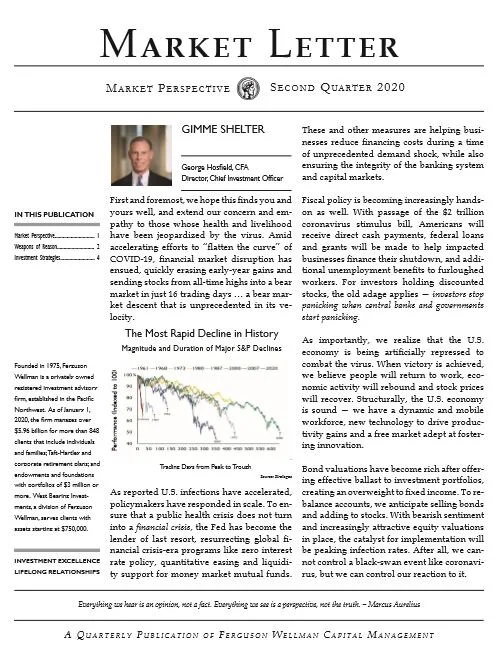

Unprecedented ... By All Measures

By all measures, this new reality is unprecedented. To start, this is not a typical recession whereby the economy runs “too hot,” such as when a major industry collapses like the banking system during the mortgage crisis or the technology sector of the early 2000s.

High Anxiety

Staying in touch with clients is critical during such extreme market volatility. Admittedly these are highly stressful and uncertain times for everyone. It is paramount that we stay safe, remain calm and strive to make decisions that are aligned with our long-term goals … not current headlines.