by Peter Jones, CFA

Vice President of Equity Research and Analysis

By all measures, this new reality is unprecedented. To start, this is not a typical recession whereby the economy runs “too hot,” such as when a major industry collapses like the banking system during the mortgage crisis or the technology sector of the early 2000s. Going into this downturn, the economy was incredibly healthy. Instead, this is a public health crisis that has unfolded into economic repression. The government has shut down the economy in order to slow the spread of the virus and the speed at which the economy has come to a halt has happened faster than any time in our history.

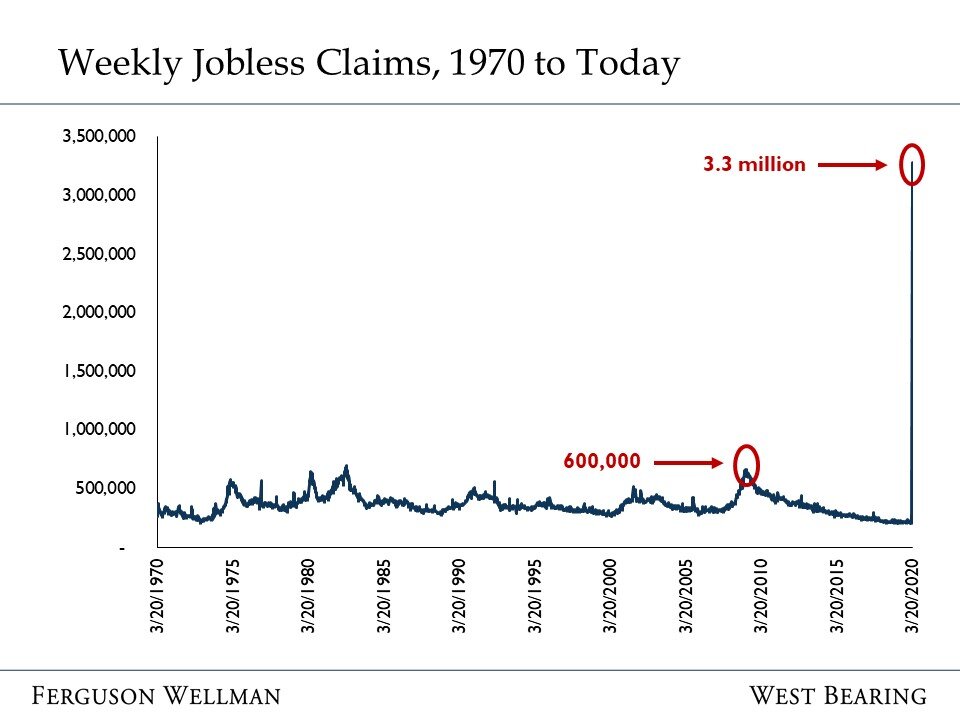

The bad news is obvious. More than 3 million people filed for unemployment in the last week. The previous record was 600,000. Second quarter GDP is set to decline more than 10 percent compared to the first quarter and the stock market, at its worst point, declined 34 percent from the February 19 high, the fastest decline of this magnitude in history. While it is very challenging to find a silver lining in this situation, we would like to point out a few reasons to be optimistic. Through a mandatory shutdown of the economy, the unemployment cycle that is typically a drawn out and painful process, generally occurring for more than a year, has been crunched into just a few weeks. Historical precedent for recessions is that we witness at least a year of continual deterioration in joblessness, economic declines and with it the stock market. This has been compressed. The near-term economic data will be more severe than past downturns but will also be less persistent.

Source: Factset

In addition, the size and scope of fiscal and monetary stimulus that will flood the system is unprecedented. The government recognizes that it needs to bail out consumers, corporations and the financial system for complying with the shutdown. It is providing enhanced unemployment benefits and encouraging companies to furlough employees instead of permanent termination. This effectively transfers the cost of labor from corporations and their shareholders to the government. This will eventually be passed on to taxpayers and owners of U.S. Treasury bonds but that is an issue for another time, perhaps decades from now.

While it is difficult to draw comparisons to the current situation, it is informative to look at past recessions and the ensuing size of stimulus provided to the economy. In 2003, after the tech bubble collapsed, the Bush tax cuts created a windfall of $1.3 trillion to consumers. This was approximately 12 percent of GDP. One year after the announcement of the cuts, the economy was back in expansion and the stock market had risen by 20 percent. In February 2009, the Obama administration enacted $800 billion of fiscal stimulus to bring the economy out of the financial crisis. This amounted to about 5 percent of GDP. One year after the announcement of stimulus, the market had risen again by more than 40 percent. The $2 trillion of stimulus that was passed today equates to 10 percent of GDP. This is an enormous figure: twice the size of the stimulus that fought off the financial crisis. This situation is unlike both the early 2000s and the financial crisis, but past instances of large-scale fiscal stimulus have brought the economy back to its feet.

The speed of government action is similarly unprecedented. The stock market peaked in 2000 and declined through 2002. It wasn’t until 2003 that the Bush administration enacted tax cuts. The market again peaked in 2007 and declined until early 2009 when the government finally injected stimulus. Currently, the government is providing stimulus just one month after the peak in the market and before the economy falls into a technical recession, which is defined as two consecutive quarters of negative GDP growth.

Source: Barclays Aggregate, Committee for a Responsible Budget

As detailed above, the current crisis has been truncated into what will likely be months, as opposed to the historical measurement of years. At this time, it is our belief that the recovery will be similarly hasty and forceful. However, this will not occur until it becomes clear that the extreme containment measures have been effective in flattening the curve of the virus.

At Ferguson Wellman and West Bearing, our transition to working from home has gone seamlessly with no disruption of client service. All everyday activities such as cash transfers, client interactions and more have all occurred as if we were sitting in our office in downtown Portland. We would like to thank our clients for their understanding and cooperation during this extraordinary situation. We look forward to seeing you soon.

Our Takeaways from the Week

This is not a typical recession; this is a public health crisis. As a result, the speed of the downturn and recovery will be accelerated

The size of fiscal and monetary stimulus is unprecedented

For the first time in several weeks, the S&P gained ground, up about 10 percent