by Jason Norris, CFA

Executive Vice President of Research

“What a long, strange trip it’s been.” – The Grateful Dead

Who knew that in 1970, the chorus line of the classic song, “Truckin” by the Grateful Dead would clearly define today’s stock market environment? We experienced a 12 percent rally in equities in a shortened holiday week as investors greeted government stimulus and less bad news on COVID-19 with enthusiasm.

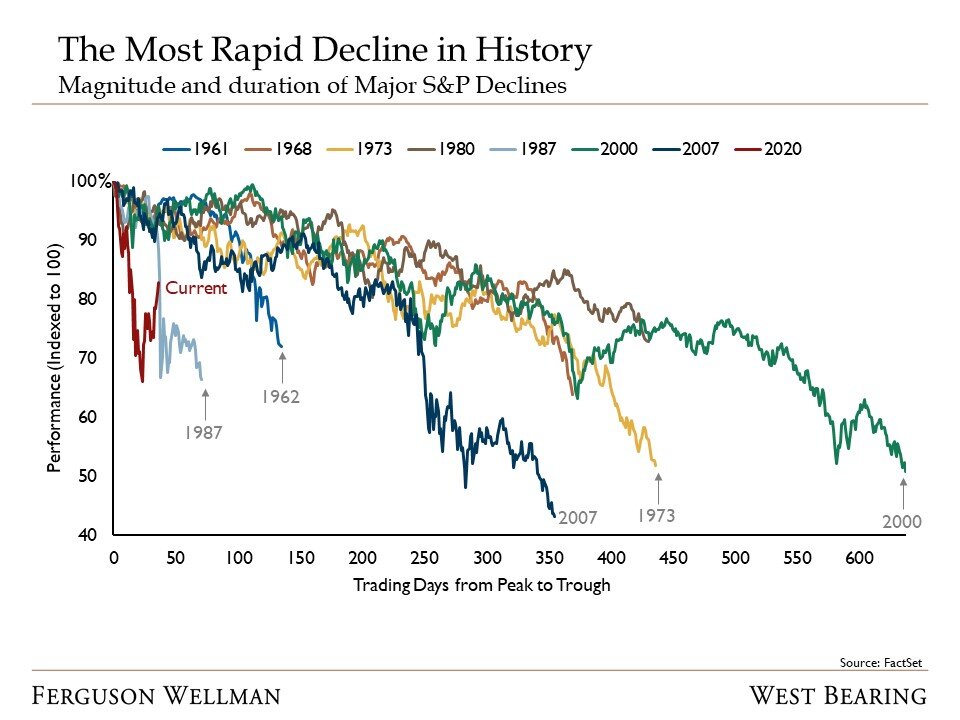

Investors also went through an unprecedented selloff in March, resulting in a 34 percent decline in the S&P 500 from February 19 to March 23. While the speed and magnitude were a surprise, so has been the bounce back, which has been 25 percent in 14 days. The chart below highlights previous bear markets, and what is noticeable is the velocity of the decline as well as the recovery.

Source: FactSet

When looking at volatility of the previous two months, investors need to take a step back and check their emotions. As we have seen recently, equity market moves are far more dramatic than any time in history. Getting emotionally caught up in that volatility can lead to unwise decisions.

“V-Bottoms are rare, but thankfully so are pandemics and 35 percent monthly declines in the S&P. “There is no playbook … Stay Nimble, Stay Home.” -Rich Ross, Evercore ISI

For long-term investors, the focus should be on corporate fundamentals and profitability. Since there is so much short-term uncertainty in 2020, we are focused on our expectations for the recovery in 2021. When looking at economic data, and most notably, highlighted by today’s initial jobless claims of 6.6 million, we know the next several months are going to be bad. However, we know the U.S. Federal Reserve monetary stimulus, coupled with fiscal stimulus out of DC, is going to be unprecedented with respect to the amount of dollars that will be injected into the economy. Therefore, while we aren’t discounting current company and economic reports, we are putting them into perspective.

Sound Decisions

We have slowly been putting money to work in equities during the current market weakness and anticipate continuing to do so as conditions last.

We believe that negative sentiment peaked in March. The data on COVID-19 infections seems to be improving. And while valuations are not cheap, they aren’t expensive when looking at 2021 earnings. Therefore, gradually adding to equities makes sense to us.

Ferguson Wellman hopes you all stay safe and healthy. We hope you enjoy the holiday weekend and remember to “keep truckin’.”

Week in Review and Our Takeaways:

We anticipate equity volatility to continue as investors assess the economic impact of the pandemic

The fiscal stimulus coming out of Washington should be more effective then the 2008 stimulus as it targets workers and consumers