Shawn Narancich, CFA, shares our thoughts on the issues of oil supply and demand and our outlook for the energy sector.

Patience Pays Off

Our initial U.S. economic outlook has generally played out as expected this year: continued (albeit slower) economic growth, persistent inflation, interest rate hikes and increased market volatility. However, Russia’s invasion of Ukraine was an unexpected significant development that further elevated market volatility and dampened the global economic outlook.

What Really Matters

With an eventful first quarter now in the history books, we can safely say that the elevated levels of volatility that we predicted for 2022 are now in play.

Under Pressure

Our 2022 Investment Outlook features the Superman and Clark Kent theme, a metaphor referencing past extraordinary economic stimulus provided by the Federal Reserve and the U.S. government during the COVID-19 pandemic, as well as the supercharged earnings growth that served as a key tailwind for stocks last year.

Navigating a Geopolitical Crisis

The geopolitical situation between Russia and Ukraine remained atop the headlines this week and without a doubt have had a material impact on the capital markets.

The Great Disconnect

There has been a decade's worth of world events in the last three months. An oil price war between Russia and Saudi Arabia, growing tension and trade disputes with China, a global pandemic and this week the worst domestic civil unrest in a generation.

The Return of $1 Gas?

On Monday, for the first time ever, the price of oil contracts for future delivery fell below $0 to -$37.63 per barrel. While financial markets have adapted to the unfortunate reality of negative interest rates, a negative price for a physical commodity is another issue.

Slow Ride

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Slow Ride

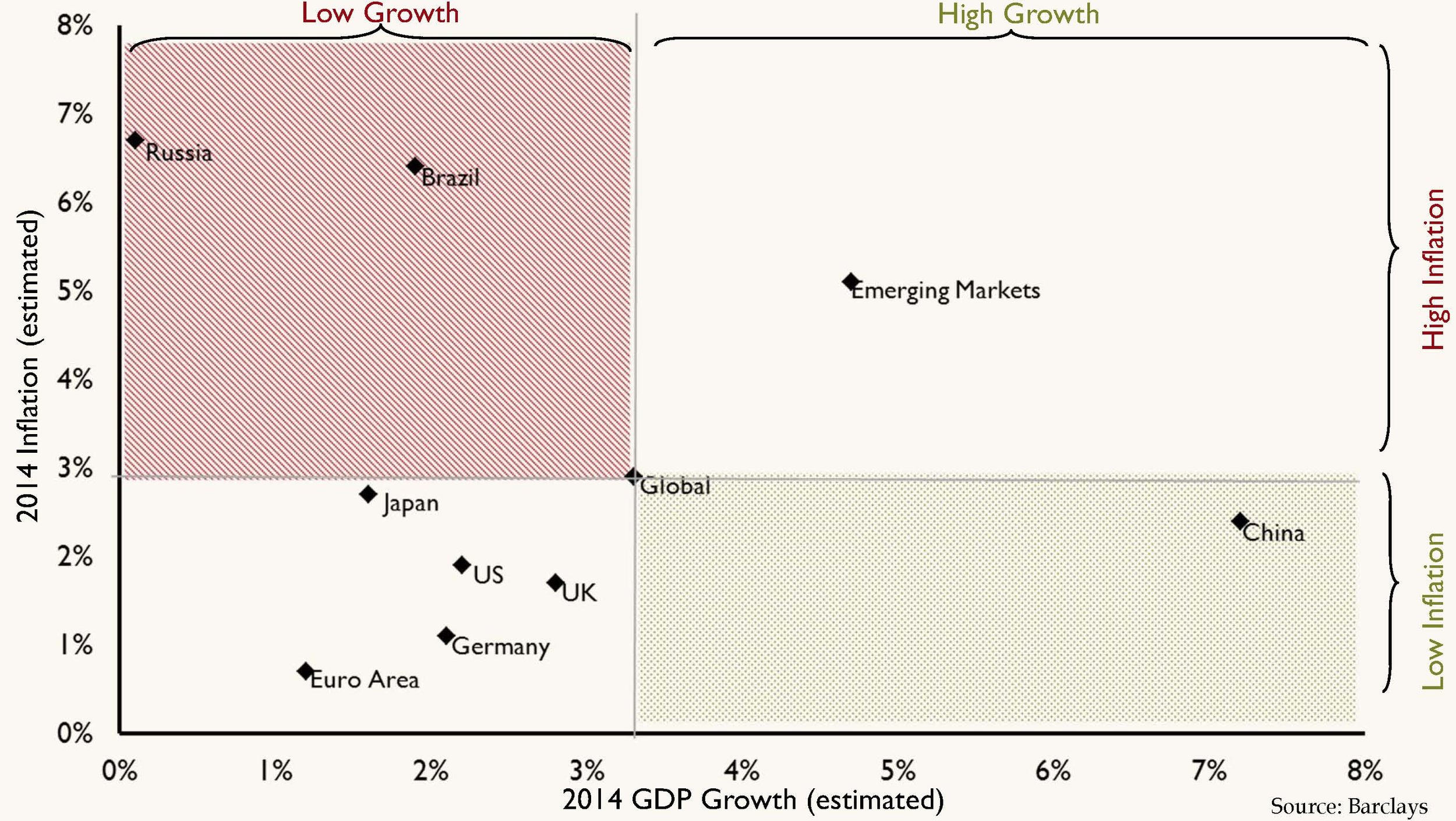

This week, the World Bank lowered their global GDP assumptions for 2014 to 2.8 percent from 3.2 percent. The bank cited the BRICs (Brazil, Russia, India and China) as well as the U.S. as culprits for the lowered estimates. We believe the slowdown in the U.S. is solely a first quarter event due to weather, and we expect to see acceleration throughout the year. China’s growth, though slowing, is still relatively robust and inflation remains under control. Regrettably, Brazil and Russia have not fared as well. As the chart below highlights, Brazil and Russia are stuck in a slowing growth, high inflation environment that is difficult to overcome. With high inflation, there is pressure to raise interest rates, but that leads to increased headwind for growth.

Unfortunately for Brazil, the build up for the World Cup has not provided the added stimulus that was hoped for. Corruption and cronyism have proved to be rampant and the economy has not seen the desired lift. There was the expectation that the employment opportunities would bring about an economic boost for their citizens. However, this hasn’t happened and there remains strong sense of frustration among the public.

London Calling

Earlier this week, there were protests centered in London (with minor demonstrations in Paris and other European cities) due to the growth of the online transportation company, Uber. This company is disrupting the “old” taxi cab model by allowing customers to access drivers of vehicles for hire through a mobile app. This disruption allows consumers to by-pass the classic taxi for a private hire, which in many instances, may be cheaper and more convenient. The company started in San Francisco and is expanding globally.

The protests may have had an unintended counter effect. A lot of the general public, especially in Europe, have not heard of Uber, thus these actions just put the start-up on the front pages. Competition for the general public is usually a good thing in pushing prices down and improving service. However, as a CNBC reporter stated, the French public are in favor of the protests, but that doesn’t come as a surprise “in a country where competition is not really a key word and where a strike is probably some sort of national sport.” On a final note, Uber recently completed a round of financing which valued the company at close to $18 billion.

The Mob Rules

While stocks hit new highs at the beginning of the week, geopolitical issues in the Middle East have tempered those gains. With militants gaining control of key cities in Iraq, the supply of oil has now come into question. This has resulted in a run up in the price of crude. We are of the belief that the price of oil will remain stable as the U.S. continues to increase its supply over the long term. However, we will continue to experience short term volatility due to global tensions and we remain overweight the energy sector based on our thesis that the global economy remains in expansion mode. This recent spike has resulted in the sector being the best performer this last week.

Takeaways for the Week

- Key emerging markets are struggling with flagging growth and high inflation and investors have to be selective

- In aggregate, global growth is still healthy and the U.S. should lead the developed world

- The U.S. will make it out of the first round of the World Cup and Germany will win it all

Spring Break Movies

by Tim Carkin, CAIA, CMT

Senior Vice President

by Tim Carkin, CAIA, CMT

Senior Vice President

Divergent

This week the market is showing some interesting divergence. The S&P 500 performance is paltry, nearly flat on the year. Technology, biotech and consumer discretionary sectors, which are more heavily weighted in the NASDAQ, started selling off heavily last week leaving the NASDAQ down more than seven percent year to date. This week small cap stocks, which had been performing admirably, sold off more than four percent and are now negative on the year. Citigroup, Morgan Stanley and other large financials also sold off heavily after the Fed’s latest stress test results. On the plus side, emerging market stocks rallied significantly this week in hopes of new Chinese stimulus.

Need for Speed

A few good economic readings came out this week. Last month’s Q4 GDP number was revised up to an annualized 2.6 percent from 2.4 percent. This came as consumer spending in February rose by the most in three years and jobless claims declined last week to the lowest level in four months. Personal consumption expenditures (PCE), a favorite economic indicator of past Fed Chairman Bernanke ticked up 0.1 percent in February. Lower jobless claims and a low inflation rate give the Fed a little cushion to work with when considering stimulus and rate increases.

Rise of an Empire?

The constant media attention of developments in the standoff between Ukraine and Russian is weighing on the market. We did get good news on that front in an announcement from the IMF of $14-18 billion in aid. In addition, our Senate approved $1 billion in loan guarantees and the EU promised more than 10 billion euros in the next few years. On the other hand, Yulia Tymoshenko, former Prime Minister of Ukraine, announced her candidacy for president. This ensures the standoff will remain in the news through the Ukrainian elections on May 25th.

Takeaways for the Week

- Geopolitics is a major overhang to the momentum in the U.S. economy