by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Slow Ride

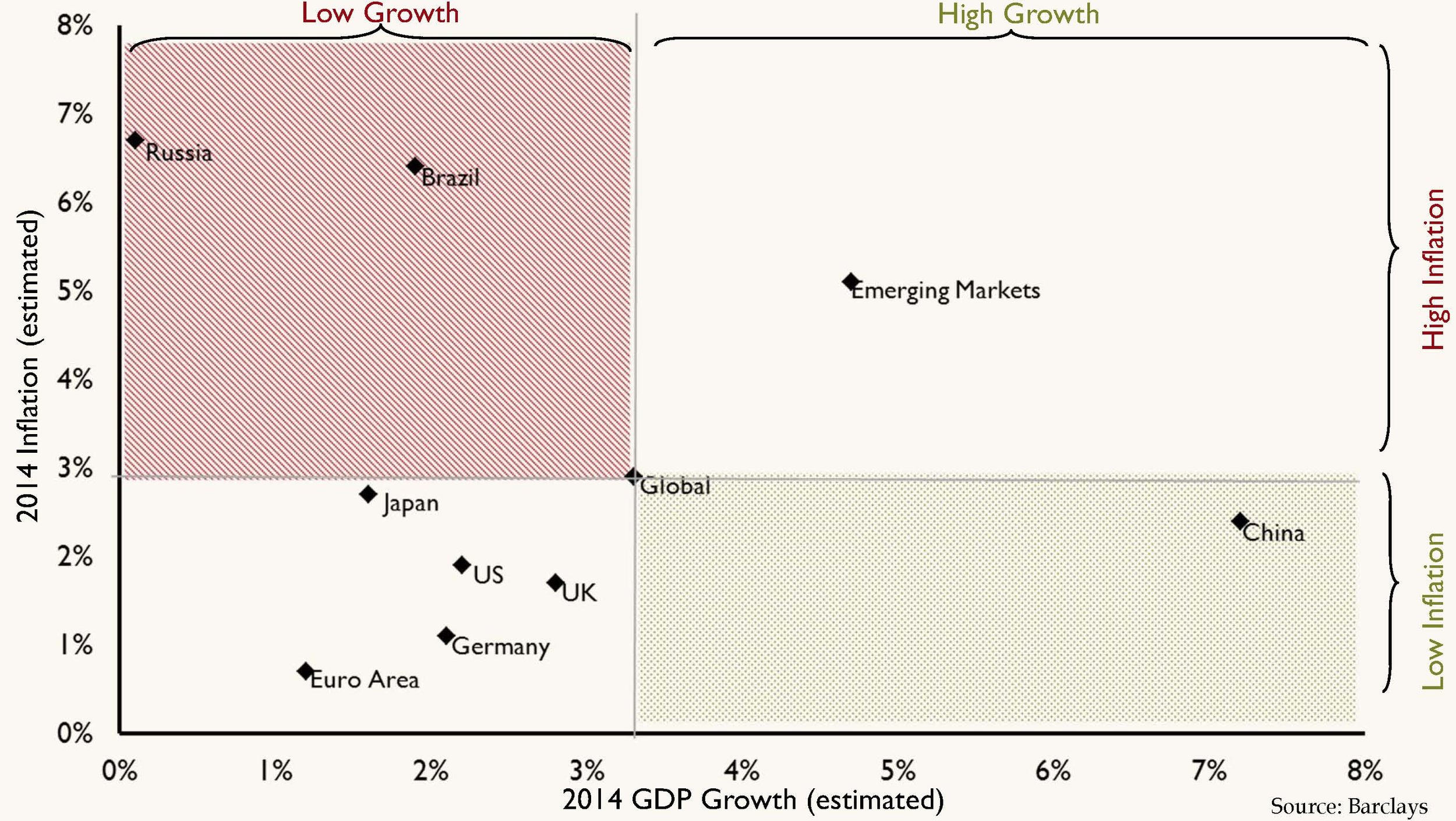

This week, the World Bank lowered their global GDP assumptions for 2014 to 2.8 percent from 3.2 percent. The bank cited the BRICs (Brazil, Russia, India and China) as well as the U.S. as culprits for the lowered estimates. We believe the slowdown in the U.S. is solely a first quarter event due to weather, and we expect to see acceleration throughout the year. China’s growth, though slowing, is still relatively robust and inflation remains under control. Regrettably, Brazil and Russia have not fared as well. As the chart below highlights, Brazil and Russia are stuck in a slowing growth, high inflation environment that is difficult to overcome. With high inflation, there is pressure to raise interest rates, but that leads to increased headwind for growth.

Unfortunately for Brazil, the build up for the World Cup has not provided the added stimulus that was hoped for. Corruption and cronyism have proved to be rampant and the economy has not seen the desired lift. There was the expectation that the employment opportunities would bring about an economic boost for their citizens. However, this hasn’t happened and there remains strong sense of frustration among the public.

London Calling

Earlier this week, there were protests centered in London (with minor demonstrations in Paris and other European cities) due to the growth of the online transportation company, Uber. This company is disrupting the “old” taxi cab model by allowing customers to access drivers of vehicles for hire through a mobile app. This disruption allows consumers to by-pass the classic taxi for a private hire, which in many instances, may be cheaper and more convenient. The company started in San Francisco and is expanding globally.

The protests may have had an unintended counter effect. A lot of the general public, especially in Europe, have not heard of Uber, thus these actions just put the start-up on the front pages. Competition for the general public is usually a good thing in pushing prices down and improving service. However, as a CNBC reporter stated, the French public are in favor of the protests, but that doesn’t come as a surprise “in a country where competition is not really a key word and where a strike is probably some sort of national sport.” On a final note, Uber recently completed a round of financing which valued the company at close to $18 billion.

The Mob Rules

While stocks hit new highs at the beginning of the week, geopolitical issues in the Middle East have tempered those gains. With militants gaining control of key cities in Iraq, the supply of oil has now come into question. This has resulted in a run up in the price of crude. We are of the belief that the price of oil will remain stable as the U.S. continues to increase its supply over the long term. However, we will continue to experience short term volatility due to global tensions and we remain overweight the energy sector based on our thesis that the global economy remains in expansion mode. This recent spike has resulted in the sector being the best performer this last week.

Takeaways for the Week

- Key emerging markets are struggling with flagging growth and high inflation and investors have to be selective

- In aggregate, global growth is still healthy and the U.S. should lead the developed world

- The U.S. will make it out of the first round of the World Cup and Germany will win it all