by Peter Jones, CFA

Senior Vice President

The geopolitical situation between Russia and Ukraine remained atop the headlines this week and without a doubt have had a material impact on the capital markets. However, market fears were manifesting well before the reality of a Russian invasion. Namely, the market has been concerned this year about the necessary pivot in Fed policy to mitigate currently high levels of inflation. In other words, how much will the economy slow as the Fed tightens policy and removes the extraordinary levels of accommodation enjoyed in 2020 and 2021?

We acknowledge the negative growth impact of tightening Fed policy and certainly understand the market’s reaction to Russia’s aggression in Ukraine. However, at this juncture a normalization of monetary policy and an exogenous political shock are not enough to alter our outlook or warrant a change in asset allocation or portfolio strategy. We believe the economy is on strong enough footing to withstand both a tightening of policy and the geopolitical environment.

To summarize our thoughts:

The economic impact of the current geopolitical environment beyond Russian and Ukraine should be quite limited.

The most significant (economic) consequence is heightened inflationary pressures via higher energy prices and supply chain constraints. This increases the level of difficulty of the tightrope that the Federal Reserve will have to walk between raising rates enough to tame inflation without choking economic growth. In fact, most central bankers around the world will be confronted with the same challenge as the inflationary fallout of the invasion of Ukraine will be even more acute in Europe than in the United States.

While no one knows how this will ultimately play out, this situation didn’t sneak up on the market as it had been well telegraphed for weeks…and therefore, likely already discounted over the past month as the market (S&P 500) was down 8.6% on the year before Putin’s proclamation on Monday.

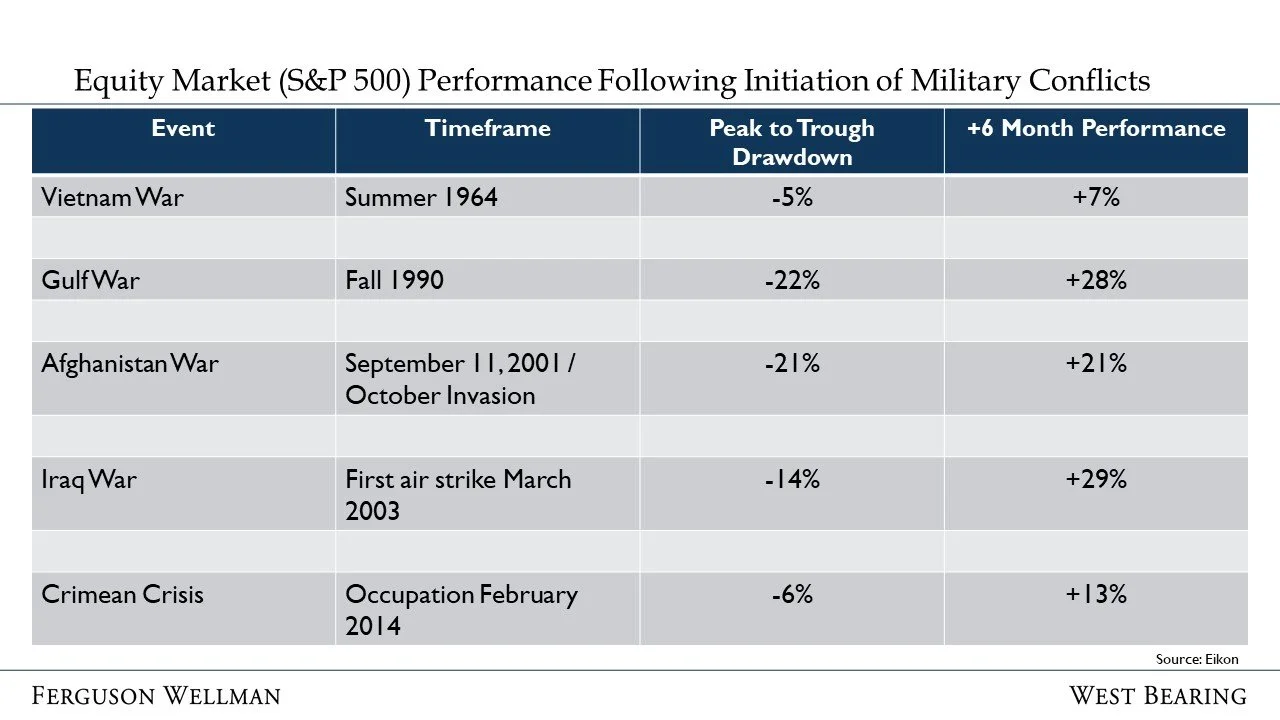

Furthermore, we looked at past instances of military conflict and market performance. Unequivocally, the market reacts negatively at the outset but the correction typically proves to be a buying opportunity. As can be seen from the table below, while sudden market selloffs related to exogenous shocks are unsettling, short-term emotional moves are ultimately overwhelmed by the underlying economic fundamentals that drive the market in the long-term.

Takeaways for the Week

The current market correction is a function of a) inflation concerns b) imminent tightening in federal reserve policy and c) the conflict between Russia and Ukraine

Despite the current market headwinds, the US economy remains on strong footing

Past instances of military conflict have typically proven to be buying opportunities