by Krystal Daibes Higgins, CFA

Vice President, Equity Research

Our initial U.S. economic outlook has generally played out as expected this year: continued (albeit slower) economic growth, persistent inflation, interest rate hikes and increased market volatility. However, Russia’s invasion of Ukraine was an unexpected significant development that further elevated market volatility and dampened the global economic outlook. In the U.S., we continue to see positive economic signals— strong job growth, steadily declining unemployment and consumer resilience, to name a few.

That is not to say we are ignoring potential recession risks that have been prominently featured in headlines. An inverted yield curve and oil price spike that is driving the highest inflation in four decades can certainly have an impact on the capital markets and economy, but neither indicates that a recession is imminent. Additionally, as companies begin reporting earnings, we continue to see strong consumer and business activity with the reopening of the global economy, lifting travel restrictions and returning office workers.

Despite the positive economic signals, the stock market is reacting as if a recession is looming. Since the beginning of this year, the S&P 500 has declined more than 7% and has been accompanied by endless negative headlines. While no one can be certain about whether economic growth or a recession will take place this year, we can find comfort that over longer investment time horizons, a patient investor has a remarkably high likelihood of generating positive returns. It is this reason that we emphasize that during heightened market volatility investors refocus on longer-term fundamentals and investment results.

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

Warren Buffett’s quote holds true for owning equities in general. Timing the market has proven to be a losing—and costly—battle for even the most experienced and sophisticated investors, yet many still react to short-term market movements by either chasing returns or moving to cash during market turmoil. Unless an investor can accurately predict the best and/or worst days of the stock market (or even the best or worst quarters or years), investment returns can be easily and significantly eroded if investors do not stay invested. In fact, if an investor missed just the 10 best days of the stock market in the last 40 years, investment returns decrease by a staggering amount. Furthermore, the best stock market days occurred during volatile market environments or shortly after one of the worst days—making it very tricky to accurately time the market.

History has shown that the chances of producing a positive return increase significantly the longer the investment time horizon. It just takes patience.

Since 1950, the probability of realizing a positive return in any given year is approximately 80%. That probability, however, increases as the time horizon lengthens:

There were only two 10-year periods that generated negative results. Both were approximately a 1% decline and occurred during the “lost decade” between 2000 and 2010, where the U.S. stock market endured the tech and housing bubbles, 9/11 attacks, Iraq war and hurricanes Katrina and Rita.

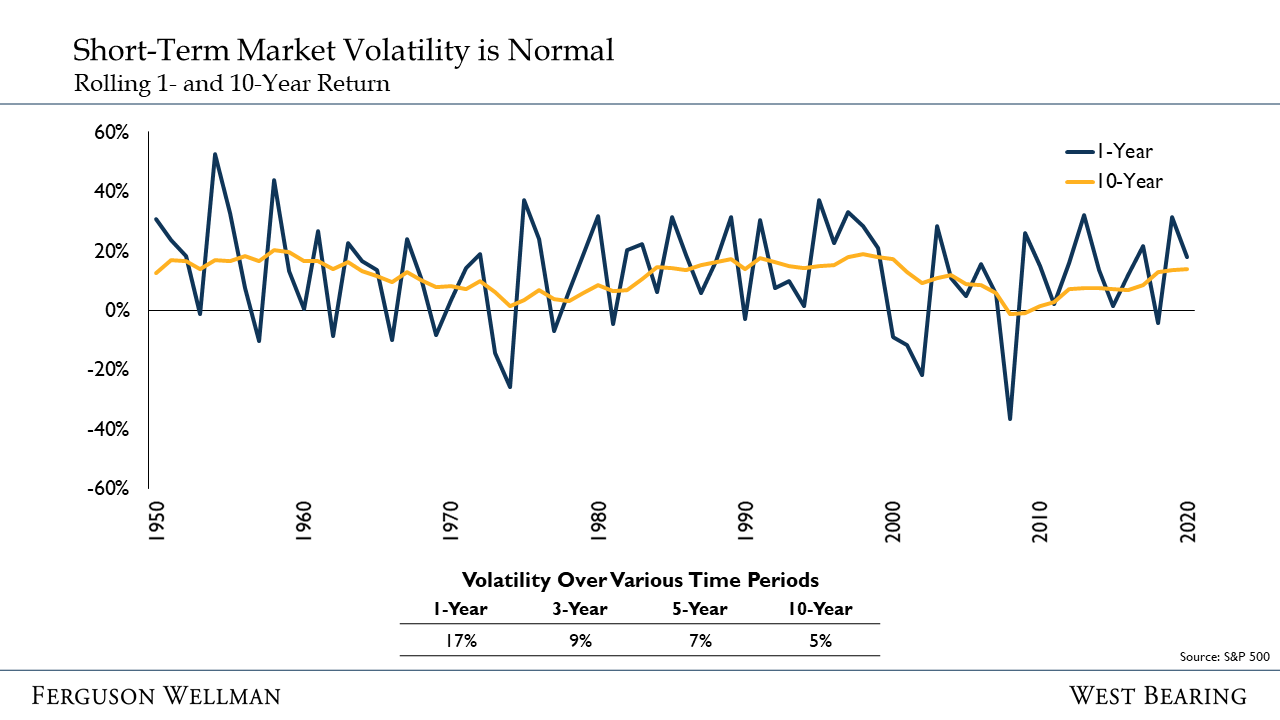

In addition to an increased likelihood of positive long-term returns, volatility decreases significantly as the time horizon increases—i.e., there is far less fluctuation in the 10-year return numbers than the 1-, 3-, and 5-year return numbers. Over the course of one year, the market return (as measured by the S&P 500) fluctuated by 17% in either direction compared to only 5% over 10 years.

Source: S&P 500

It can certainly be difficult to stay patient during a volatile market environment, but it is critical to not let market whims take over a long-term investment strategy. The market will continue to fluctuate—wildly from time to time—but as long as investors can remain patient, there is a stronger chance that investment results will be better than timing the unpredictable stock market.

Week in Review and our Takeaways:

Despite the solid economic fundamentals, the S&P 500 has declined more than 7% this year due to the confluence of rising rate expectations, the Russia-Ukraine conflict, inflation fears and, as always, the accompanying barrage of negative headlines

Stay patient and focus on long-term investment results. There is a significantly greater chance that an investor will realize positive returns the longer the investment horizon