Market Letter publication for third quarter 2021 titled, “Coming in Hot.”

Third Quarter 2021 Investment Strategy Video: Coming in Hot

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Sign of the Times

Earlier this week, my family and I were out to dinner when we saw a sign on the front door of the restaurant that read: “Being short staffed is the new pandemic… Thank you for your patience with us.” While we are familiar with the standard “help wanted” signs, specifically in the service sectors industry, you may have noticed a recent addition to these signs: signing bonuses.

New Payroll Tax for Washington Residents

Washington State has created the nation’s first public state-operated insurance program for long-term care insurance funded by a new payroll tax of 0.58% paid by employees (not employers) starting January 1, 2022.

Summertime Blues

The Dog Days of Summer are here! In addition to the record heat waves expected to bombard the West Coast this weekend, we also await what typically occurs around this same time: equity market volatility and below average returns.

Exit Strategy

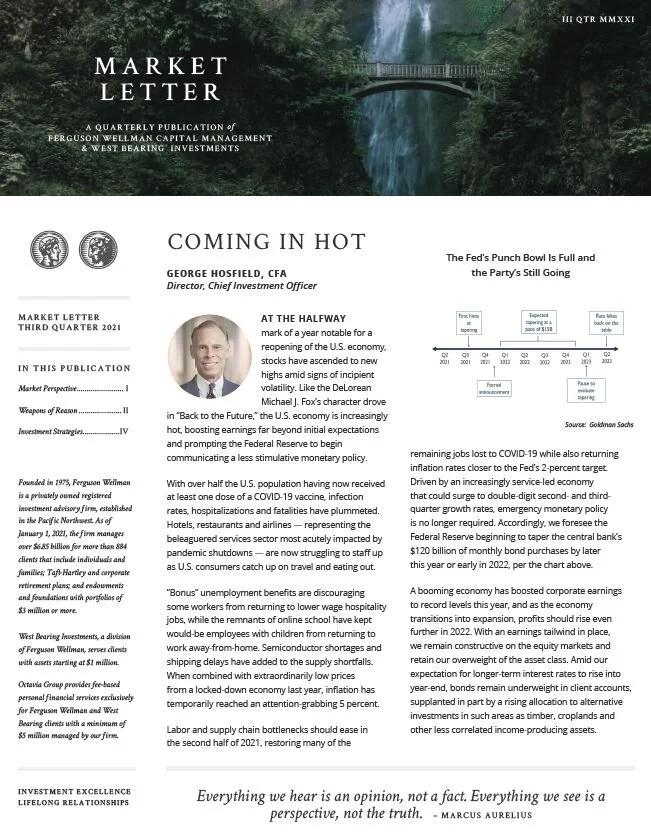

A year ago, Federal Reserve Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” At this week’s Federal Open Market Committee (FOMC) meeting the Fed took its first tangible steps to lay the groundwork for a gradual removal of the stimulus measures enacted last year.

What to Do with Excess 529 Plan Funds?

While reaching your college savings goal is worth celebrating, it’s important to know your options should you have excess funds.

Lifelong Excellence Speaker Series: Common Threads

On Thursday, June 10, we hosted a conversation on clothing and the relationship we have with our wardrobes in a post-pandemic world. The discussion was hosted by Kirstin Havnaer of Ferguson Wellman and featured Scarlet Chamberlain, stylist and jewelry designer, Lily Sheehan, associate professor at Oregon State University and Betsy Warren, clothing curator and owner of the Bliss House Museum.

To view a recording of this virtual event, please click on the button below.

Hot Off The Press

Inflation, fast becoming the most dominant market and economic theme of 2021, has media and market commentators fixated on the topic, this blog included. In fact, this will be our fourth entry covering inflation in the past five weeks. While we apologize for “beating a dead horse,” we would be remiss if we did not provide our readers with further clarification on the subject.

Signs!

“Signs, Signs everywhere there are [help wanted] Signs,” is how the song goes. It’s the first Friday of the month, and that means the monthly payroll report is released by the Bureau of Labor & Statistics.

Ferguson Wellman Recognized as One of Portland's Largest Money Managers

Ferguson Wellman Capital Management and West Bearing Investments were recently named by Portland Business Journal to their Oregon and S.W. Washington Money Management Firms list, ranked at fifth out of 44 companies.

Easing Into Summer

A quiet week on Wall Street feels like just what the doctor ordered ahead of the long Memorial Day weekend. Stocks remain well bid and within striking distance of new highs ahead of what will be a busier week of economic data.

Oregon Business Magazine Names Firm to Financial Planner List

How to Choose a 529 Plan

In honor of National 529 Day, we’ve highlighted several criteria to explore when it comes to choosing the best plan for your college savings and wealth planning needs.

An Inflation Fixation

Both the financial and popular press have been inundated with headlines on inflation. Last week’s higher than expected Consumer Price Index (CPI) report added fuel to this fire. Given the elevated inflation measures reported the last two months, two questions rise to the fore: 1) Is the inflation we are all seeing temporary or long-lasting, and 2) How and over what timeframe will the Federal Reserve address it.

It Finally Happened...

Last year, when our economy began to emerge from the recession and to reopen, so too did concerns of inflation, even though it was below the Federal Reserve’s target interest rate of 2 percent.

The Writing on the Wall

“Tell me where earnings are going, and I’ll tell you where the markets are going” is common phrase you’ve heard from us over the years.

A Focus on 529 Plans in May

College tuition costs have increased more quickly than any household expense in decades. Although there are many education funding options, there is one that often rises to the top – the 529 plan.

Inflection Points

Earlier this month in an interview with 60 Minutes, Federal Reserve Chair Jerome Powell indicated he believed the U.S. economy “seems to be at an inflection point” due to widespread vaccinations and previously enacted stimulus measures. He added his expectation that the economy would begin to grow “much more quickly” and that the pace of job creation would accelerate.

Error of the Estimates

First quarter earnings season shifted into high gear this week, transitioning from the big banks to blue chip companies ranging from Procter & Gamble and Johnson & Johnson to Intel and AT&T.