If you are feeling anxious about possible changes to estate taxes, expect to have a taxable estate, and want to take action – it may be worth learning a little bit about irrevocable trusts.

Second Quarter 2021 Investment Strategy Webinar

On April 20, our firm hosted an Investment Strategy Update webinar presented by Chief Investment Officer, George Hosfield, CFA, and Head of Fixed Income, Brad Houle, CFA.

A recording of the presentation can be viewed below and the slides can be found through this link.

Inflation Bonds

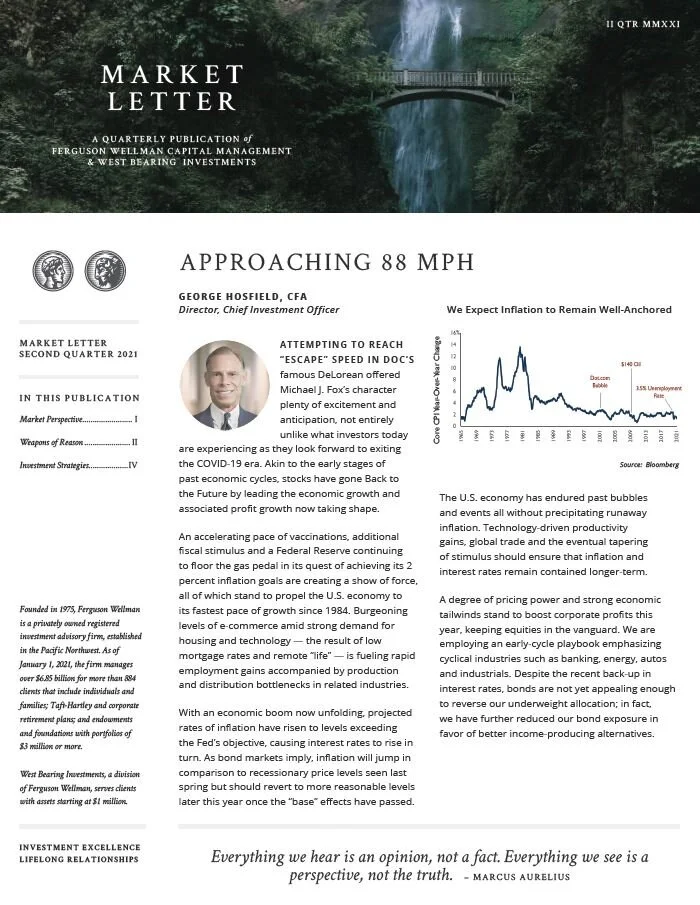

On Tuesday this week, inflation data as measured by the consumer price index (CPI) for the month of March was reported at 2.6 percent. This year-over-year inflation reading was significantly higher than it had been trending over the past few months.

Second Quarter 2021 Wealth Management Insights Video

Mary Lago, CFP®, CTFA, chair of Ferguson Wellman and West Bearing's wealth management committee, discusses strategies to create a legacy for future generations of your family.

Second Quarter 2021 Investment Strategy Video: Approaching 88 MPH

Q2 2021 Investment Strategy Video with Brad Houle, CFA, head of fixed income at Ferguson Wellman and West Bearing Investments.

Knowing the Rules

Treasury Secretary Janet Yellen called for a global minimum tax in a speech this week coinciding with the Biden administration’s call for a corporate tax increase. Just like the rules of recess football, it’s not the rate that’s important, it’s the certainty in the rules itself that matter.

Wealth Management Insights: Preparing Future Generations for a Legacy of Success

Our Wealth Management Insights publication for second quarter 2021 titled, “Preparing Future Generations for a Legacy of Success.”

Market Letter Second Quarter 2021: Approaching 88 MPH

Quarterly publication discussing our investment strategies and the capital markets for the second quarter of 2021 titled, “Approaching 88 MPH.”

The "Yeah, but..." Recovery

Maybe it’s human nature, news coverage or it’s just a self-preservation mechanism, but I’ve decided to start calling this the “yeah, but….” recovery. “The global economy is going to boom in the second half of the year,” say the economists. And then comes, “Yeah, but…’

New Leadership and The Vaccine Pivot

Last November, Pfizer announced a 95 percent efficacy of their COVID-19 vaccine. Since that time, there has been a notable shift in leadership within the stock market.

Inheritance: Navigating the Bittersweet Windfall

No matter your generation, there is a chance you will receive an inheritance at some point in your life. This bittersweet transfer of wealth could substantially change your financial picture.

Panic Attack

Twelve months ago, investors were in a state of sheer panic as they were witnessing stocks freefall by over 30 percent.

The COVID Pandemic Turns One

This week marks the one-year anniversary of the World Health Organization declaring the COVID-19 virus a pandemic. Since then, we have seen the largest economy in the world locked down, a massive spike in unemployment and the shortest economic recession on record, quickly followed by double-digit GDP growth.

2020 Annual Report

Statement of Confidence

Federal Reserve Chairman Jerome Powell in testimony to Congress last week said that the increase in Treasury bond yields is a "statement of confidence" in a robust economic outlook.

Wealth Management Insights Forum: Planning for the Future

Our Wealth Managment Insights Forum recording can be accessed here. Topics covered included financial spring cleaning, potential new tax policies, strategic savings and spending priorities and steps toward establishing a wealth plan.

Changing of the Guard

Federal Reserve Chairman Jay Powell briefed lawmakers this week on the state of monetary policy, assuring members of Congress that the central bank has no intention of raising interest rates anytime soon.

Inflation and the Recovery

Inflation expectations are rising. Next month, we begin to lap the extraordinarily low inflation measured last year when the pandemic triggered a dramatic reduction of demand for both goods and services globally. Upcoming reports may be elevated when compared to last year’s weak results and we may see 3 to 4 percent increases in inflation this spring.

2021 Annual Limits for Tax and Wealth Planning

The College for Financial Planning has released its 2021 Annual Guide that is a great resource for tax planning, charitable giving and other important topics.