by Shawn Narancich, CFA

Executive Vice President, Equity Research and Portfolio Management

High and Right

First quarter earnings season shifted into high gear this week, transitioning from the big banks to blue chip companies ranging from Procter & Gamble and Johnson & Johnson to Intel and AT&T. So far, so good. With 25 percent of the S&P 500 having now reported, estimated first quarter earnings growth has risen from 24 percent to 34 percent, this as companies increasingly benefit from accelerating economic activity the result of vaccination success and unprecedented levels of stimulus. Thus far, over 90 percent of companies are beating investor expectations for earnings, and by the largest margin since 2008. While investors are now laser focused on earnings, economic data continues to impress in several key areas, both of which are supporting stock prices that remain biased to the upside.

Gaining Steam

As median house prices are now being reported up a staggering +17 percent year-over-year, monthly new home sales for March rebounded 20 percent compared to weather-impacted February levels, to an annualized rate that stands at its highest level since 2006. With fewer existing houses on the market than available realtors to sell them, the onus for alleviating a shortage of housing continues to fall on the homebuilders, with the likes of industry leader D.R. Horton doing its part as evidenced by its robust new home sales and earnings reported this week. The housing market, combined most notably with the travel and leisure industries, is absorbing a shrinking pool of available labor, helping reduce the latest weekly unemployment claims to their lowest level since the pandemic began. Relatedly, we are encouraged by continuing improvement in manufacturing and service sector data reported today that reinforce our view of an improving labor market.

Maintaining Resolve

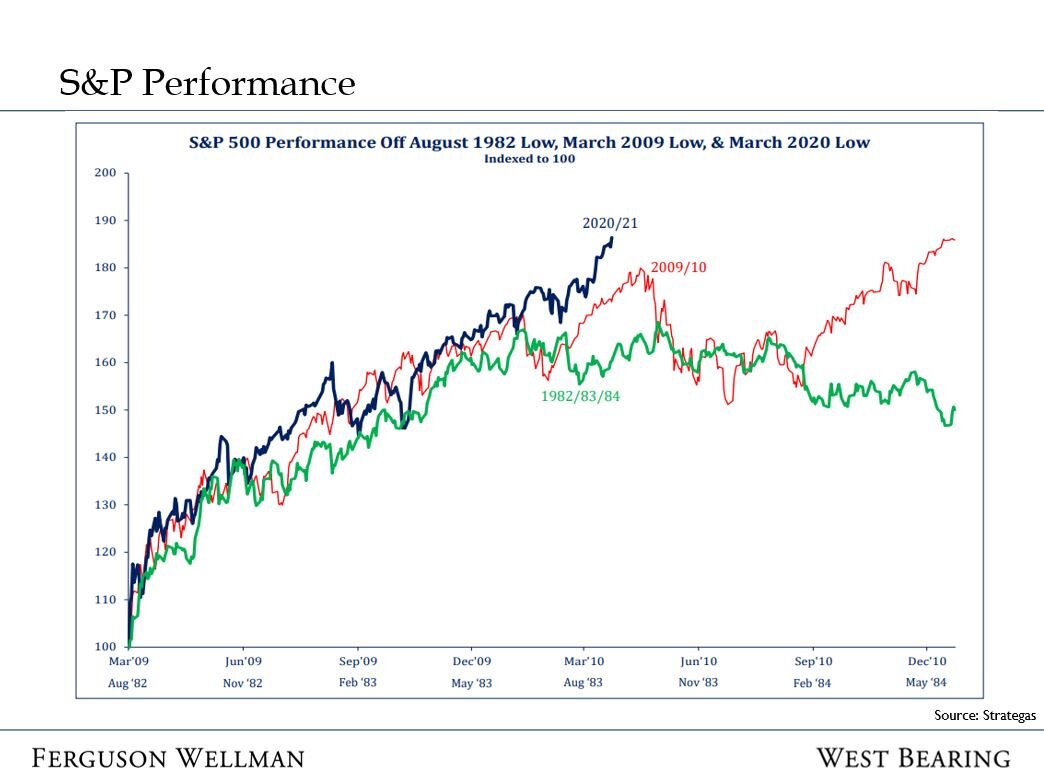

By now, a lot of the low hanging fruit has already been picked from the stock market at large. As shown in the accompanying chart, stocks are up over 80 percent from last year’s March lows, having anticipated the robust economic data investors are now experiencing. The chart compares the current bull market with ones that began in 1982 and 2009, and is instructional not so much for any predictive ability about where stock prices are headed, but rather the tendency for further returns to be less directional and more volatile in the near-term. We continue to overweight equities on the value side of the investing spectrum, but recognize that a host of “known-unknowns” like future headline inflation readings and geopolitical risk could cause stock prices to correct at some point this year. Corrections are inevitable, but early in a new economic cycle with robust stimulus and economic re-opening driving exceptional earnings growth, we continue to advise clients to stay the course with equities.

Inside Scoop

In addition to robust earnings being reported tangential to the hot housing market, what stands out to us so far this earnings season is that companies overall appear to be successfully managing through higher input costs — rising commodity prices and freight costs to name a couple — with a mix of pricing and internal efficiencies that could end up producing surprisingly strong post-COVID productivity gains.

Banks are benefitting from efficiency gains as well, but have been a notable exception to the positive stock price narrative so far this earnings season. Investors expected them to benefit from improving credit quality tied to a rebounding economy, but what has disappointed bank investors is a lack of loan growth and still declining net interest margins for the group overall. While higher rates on the long-end of the interest rate curve take longer to be reflected in income statements, we continue to like banks for their sturdier balance sheets, improving capital returns and operating sensitivity to an improving economy that we believe will be born out through better loan growth in the quarters to come.

Week in Review and Our Takeaways for the Week

Stocks battled back to near unchanged levels for the week as earnings and economic data remain supportive of equities

Although stock market corrections are inevitable, we continue to see equities outperforming longer-term