by Casia Chappell, CFP®, CPWA®

Vice President of Wealth Planning

Washington State has created the nation’s first public state-operated insurance program for long-term care insurance funded by a new payroll tax of 0.58 percent paid by employees (not employers) starting January 1, 2022. Employees can request a permanent exemption from the tax if they have their own long-term care policy, or put one in place, prior to the November 1, 2021, deadline. Self-employed individuals may opt-in to participate in the program. Unlike some payroll taxes this tax will apply to all compensation, including bonuses and stock-based compensation, with no income cap.

Washington residents who pay into the program, named WA Cares Fund, will become eligible for its benefits starting in 2025. The benefits outlined in the program include up to $100 per day to cover a range of long-term care costs with a lifetime maximum of $36,500. More information regarding the benefits of the plan, qualifications, and contribution requirements, can be found on the WA Cares Fund website.

The impetus behind the new program included concerns about an aging population and the increasing cost of care. According to the Genworth Cost of Care Survey, seven out of 10 people will require some form of long-term care in their lifetime. Long-term care is a broad term that covers a range of services provided to those who need professional or personal assistance due to a medical condition. Examples include assistance with dressing or feeding, or more advanced medical assistance such as physical therapy after a stroke. Some long-term-care policies also cover needs such as care coordination and home-modifications. These services may be provided by family members or trained professionals and may be provided in-home or at a treatment facility.

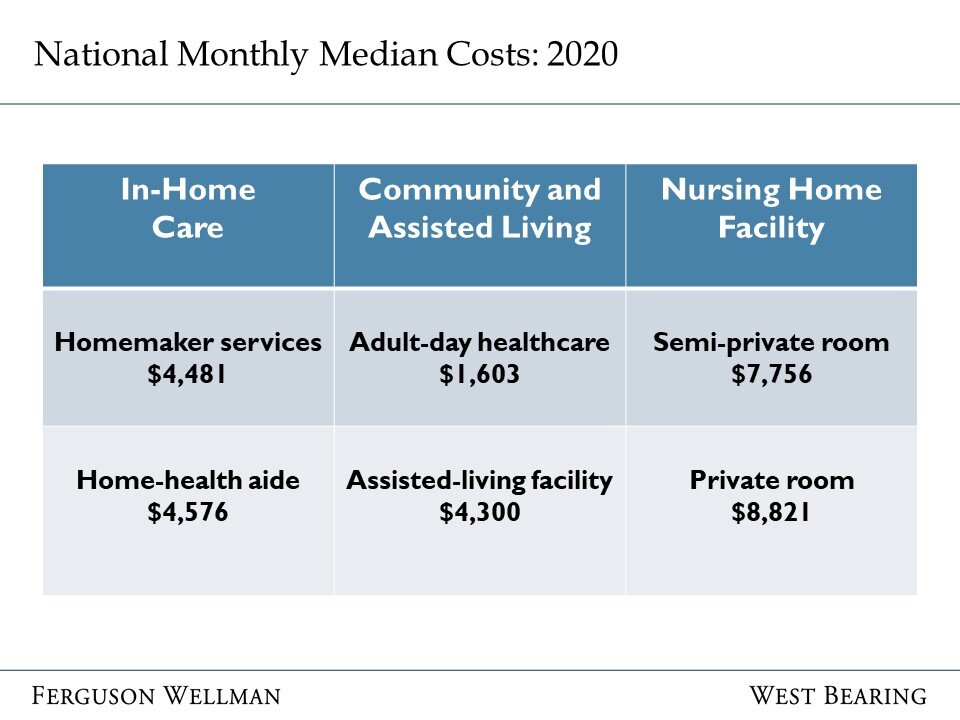

The 2020 national average cost of care ranges from $74 per day for adult day health care to $290 per day for private room in a nursing home facility. State-specific costs in Washington are above-average.

Source: Genworth

Long-term care insurance helps cover the costs of these services and can mitigate the risk to an individual’s assets should they experience an event requiring expensive care. Long-term care policies are most often purchased by individuals aged 55-to-65 while they are healthy enough to qualify, and who do not anticipate having sufficient assets to self-insure or who want to preserve their assets for their heirs. Many factors are included when determining whether you can self-insure, so it’s crucial to have a detailed financial plan to better understand how long-term care costs may impact your ability to meet your goals.

Source: American Association for Long-Term Care Insurance

Annual premiums can vary drastically based on several factors including your age, health and the specific benefits of the policy. As a comparison, a Washington resident earning $300,000 in total compensation will pay $1,740 annually in new taxes under the program which is roughly equal to the average annual premium of a long-term care policy for a 55-year-old male as seen in the table above.

There are several financial, medical and personal considerations when reviewing long-term care options. Many private policies will offer more benefits and flexibility than the WA Cares Fund. One common concern, particularly as premiums continue to rise, is what happens if you purchase a policy but never use it? One way to mitigate that risk is to consider a hybrid life insurance/long-term care insurance policy. These types of policies, while more expensive, function as long-term care policies that provide a death benefit to the insured’s heirs if benefits were never used or life insurance policies that allow the insured to access the death benefit early if care is needed. These may be a solution for younger Washington residents with high earnings who are seeking exemptions to the payroll tax.

This new tax should prompt high earners, even those in their 30s and 40s, to consult their financial professionals for analysis regarding the impact the tax will have on their earnings, the cost of a private long-term care policy and their projected future asset base. Those who believe they will retire outside Washington State may also want to consider private coverage as the benefits of the WA Cares Fund will not apply to costs incurred in other states. Keep in mind that it can take anywhere from a couple weeks to a few months to get through the application and underwriting process for long-term care insurance. For additional guidance and references to licensed and qualified insurance agents, please reach out to your portfolio manager.

This topic is of particular interest to clients who are:

Washington residents

Employed and earning over $150,000 in total compensation

Total future earnings of approximately $6.3 million will result in taxes paid equal to the lifetime benefit of $36,500

Age 65 or under

Unsure if they can, or want, to self-insure

Seeking long-term care coverage with more flexibility and benefits than WA Cares Fund

Ferguson Wellman and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.