by Charissa Anderson, CFP®, CDFA®

Portfolio and Wealth Management

Over the next decade, millennials will inherit over $68 trillion to become the richest generation in American history, according to a 2019 Coldwell Banker study. If this prediction comes true, in 2030 millennials will have five times the wealth they have today.

No matter your generation, there is a chance you will receive an inheritance at some point in your life. This bittersweet transfer of wealth could substantially change your financial picture. When the time comes, to make well-informed decisions you’ll need to understand:

The type of assets you are inheriting

How they affect your taxes and existing financial situation

Where you can turn for help managing your inheritance

First things first

Here’s the good news: Inheritance is generally income-tax free. However, depending on the total value of the decedent’s assets and lifetime giving, there could be federal and/or state level estate tax and possibly a generation skipping transfer tax. Estate taxes are generally the liability of the estate, but many plans allocate the responsibility for these taxes among the beneficiaries. Also, a few states impose an inheritance tax, payable by the beneficiaries. It is a good idea not to spend your windfall until you understand if tax liabilities have been fully met.

Some asset types have greater tax implications than others. In general, you could be required to pay taxes on assets that create income, like interest and dividends. Retirement accounts may be taxable when withdrawn, and you may pay capital gains taxes on nonretirement assets when you sell them.

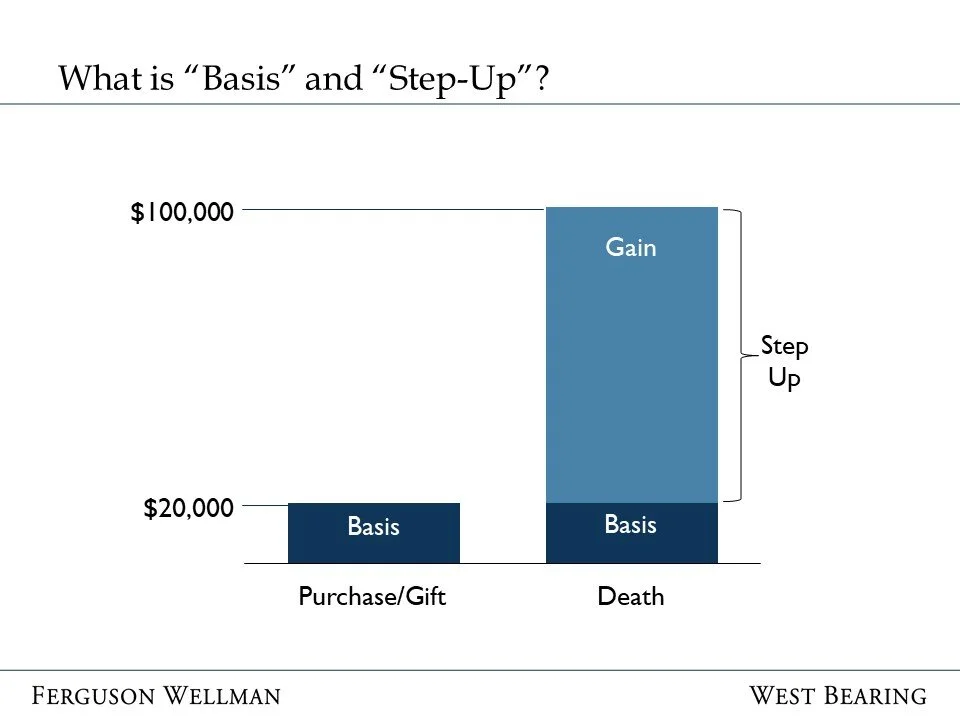

Nonretirement assets may receive a “step-up in cost basis” at death. This means the cost basis is “stepped up” to the fair market value on the date of death and any capital gains tax that was due is eliminated. When you later sell the inherited asset, you would pay capital gains tax only on the profit that has occurred since then—the difference between the current market value and the stepped-up cost basis. Assets received from a living individual do not receive this same benefit.

For example, the stock your aunt bought for $20,000 decades ago has appreciated to $100,000 by the end of her life. The cost basis was originally $20,000; however, due to the step-up in basis, you inherit the stock with a new cost basis of $100,000. If you sell the stock immediately you have no capital gain. If it appreciates another $5,000 to $105,000 by the time you sell, you will have $5,000 of taxable capital gain. Whereas, if your aunt gifted the stock to you during your life, your cost basis would also be $20,000 and selling the asset would trigger capital gains tax on the appreciation.

Understanding what you are inheriting

There are many different types of assets you may inherit; here are a few of the most common:

Cash, such as savings and checking accounts, generally doesn’t trigger income tax. You simply receive the asset.

Real estate is a different story. While inheriting a property will not generally trigger income taxes, what you decide to do with the property — move in, rent it, or sell it — could affect property taxes, capital gains taxes or other expenses. If real property, or any other assets, are held inside of a limited liability company (LLC), there may be additional actions required to receive any available step-up in basis.

Retirement accounts, such as traditional IRAs and 401(k)s are some of the most income tax-sensitive assets you could inherit. These accounts are typically funded with pre-tax dollars, so you will likely pay income tax on the distributions. Also, there are requirements related to the amount and timing of distributions. The timeline for most beneficiaries to complete distributions from retirement accounts was significantly shortened by the SECURE Act, which became effective in 2020. There can be steep penalties (50 percent) for failing to take distributions at the appropriate time, so be sure to review these closely.

Roth IRA and Roth 401(k)s, are slightly different. Unlike traditional IRAs and 401(k)s, Roth accounts are funded with after-tax dollars. These accounts have the same rules around required distributions, but the withdrawals are income tax-free, making these very attractive assets to inherit.

Life insurance proceeds you receive as a beneficiary are not subject to income tax in most cases and proper planning can often eliminate estate taxes.

Investment accounts and individual stocks, bonds and mutual funds move into your name when inherited. You may choose to sell them immediately or keep them, allowing them to continue to grow. Work with your portfolio manager and the trustee/executor of the decedent to confirm if the assets are eligible for a stepped-up cost basis which could eliminate or reduce any capital gains taxes if the assets are sold quickly. However, future dividends, interest or capital gains are generally taxable.

Trusts are another way that assets are distributed beyond inheriting them directly. If you are a beneficiary, the trust documents will specify how and when these assets are to be distributed. The provisions and tax implications of a trust are unique to each situation, so communication with the trustee and your legal and tax professionals is important.

What next?

The implications of receiving an inheritance overlap many areas of expertise and this is only an overview of the possibilities. If you have received or are expecting to receive an inheritance, you may have many more questions about your newfound wealth. It is a good time to create or revisit your financial plan and prioritize your goals. Your Ferguson Wellman and West Bearing team, in collaboration with your tax and legal counsel, can help you navigate the present and form an appropriate plan for your future.

Ferguson Wellman and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.