by Ralph Cole, CFA

Director, Equity Strategy and Portfolio Management

Maybe it’s human nature, news coverage or it’s just a self-preservation mechanism, but I’ve decided to start calling this the “yeah, but….” recovery.

“The global economy is going to boom in the second half of the year,” say the economists. And then comes, “Yeah, but…

COVID-19 cases are rising again here in the US.”

vaccinations aren’t going very well in Europe.”

inflation is going to be terrible.”

government debt is too large.”

interest rates are moving higher.”

taxes are going up.”

The surprise over the past 12 months has been how strong the economy and markets have been, yet we are still in lockdown, and unemployment is over 6 percent. There were so many reasons to be pessimistic, yet it was exactly the wrong posture as an investor. We understand that the issues above are real, but what we are saying is that they will not be significant enough to derail the global expansion. That being said, the points made above will make the recovery uneven country to country and will slow growth in future years.

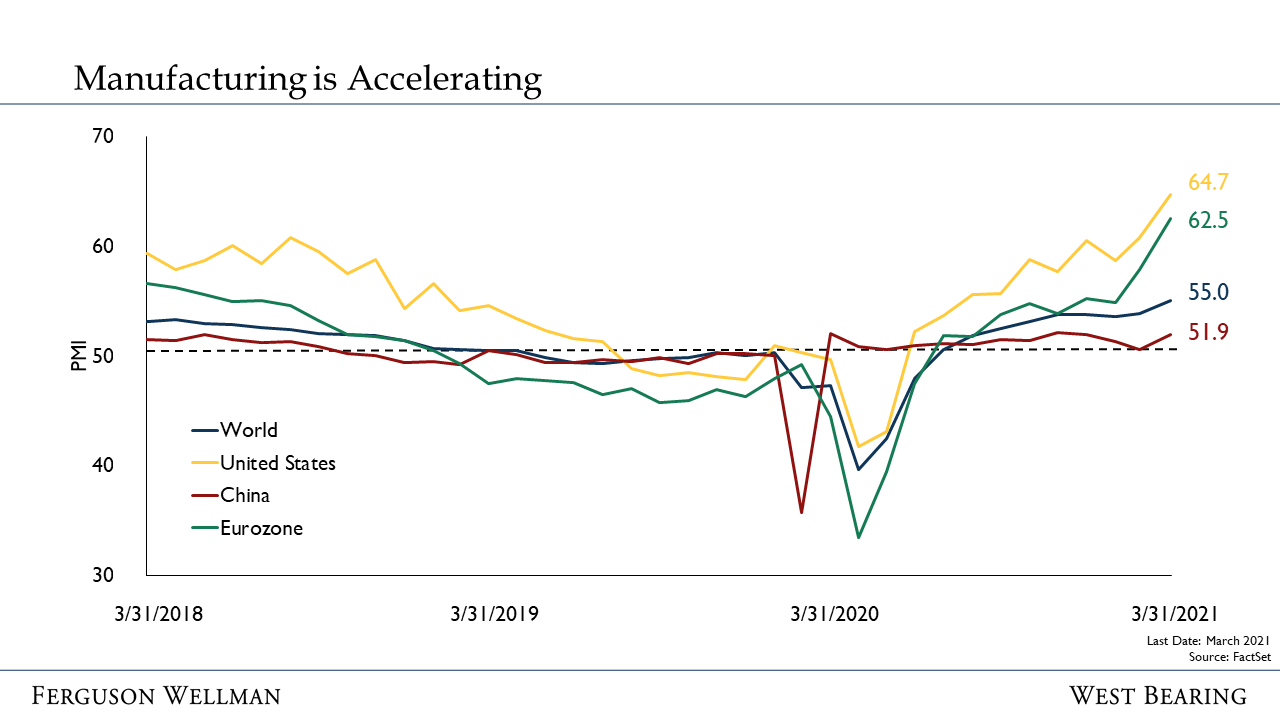

One of our favorite economic indicators is the Purchasing Managers Index (PMI). The PMI measures whether purchasing managers think market conditions in their industry are expanding, contracting, or staying the same. The midpoint of the measurement is a score of 50. Anything higher than 50 is considered expansionary, anything less than 50 signals contraction.

Source: FactSet

Purchasing managers around the world, and across industries, think things in manufacturing are getting better at a rapid pace. This makes sense to us as we saw factories shut down during the pandemic in conjunction with a great deal of pent-up demand across businesses.

The International Monetary Fund raised global growth estimates for 2021 in January. They announced this week that they will be raising those estimates again next Tuesday. It is our expectation that they will have to revise them higher as we move throughout the year. Current estimates are below:

Source: International Monetary Fund

The top economist on Wall Street, Ed Hyman, is calling for 8.5 percent GDP growth in 2021 for the U.S. This is notable as the last time the U.S. economy grew 8.5 percent in a year was 1950.

Week in Review and Our Takeaways:

As always, there are risks. We believe the risks can be managed especially with the backdrop of economic strength not seen in 70 years

Don’t let the “yeah, but…” crowd bring you down. After a horrific 2020, we’ve all earned a little bit of fun in 2021