by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Stronger The U.S. economy was indeed stronger than first reported in the second quarter as estimates were revised higher this week when the commerce department reported that the U.S. economy grew 4.2 percent during the quarter. This pace fits with our narrative that the U.S. economy is truly getting healthier, particularly in the aftermath of a very harsh winter.

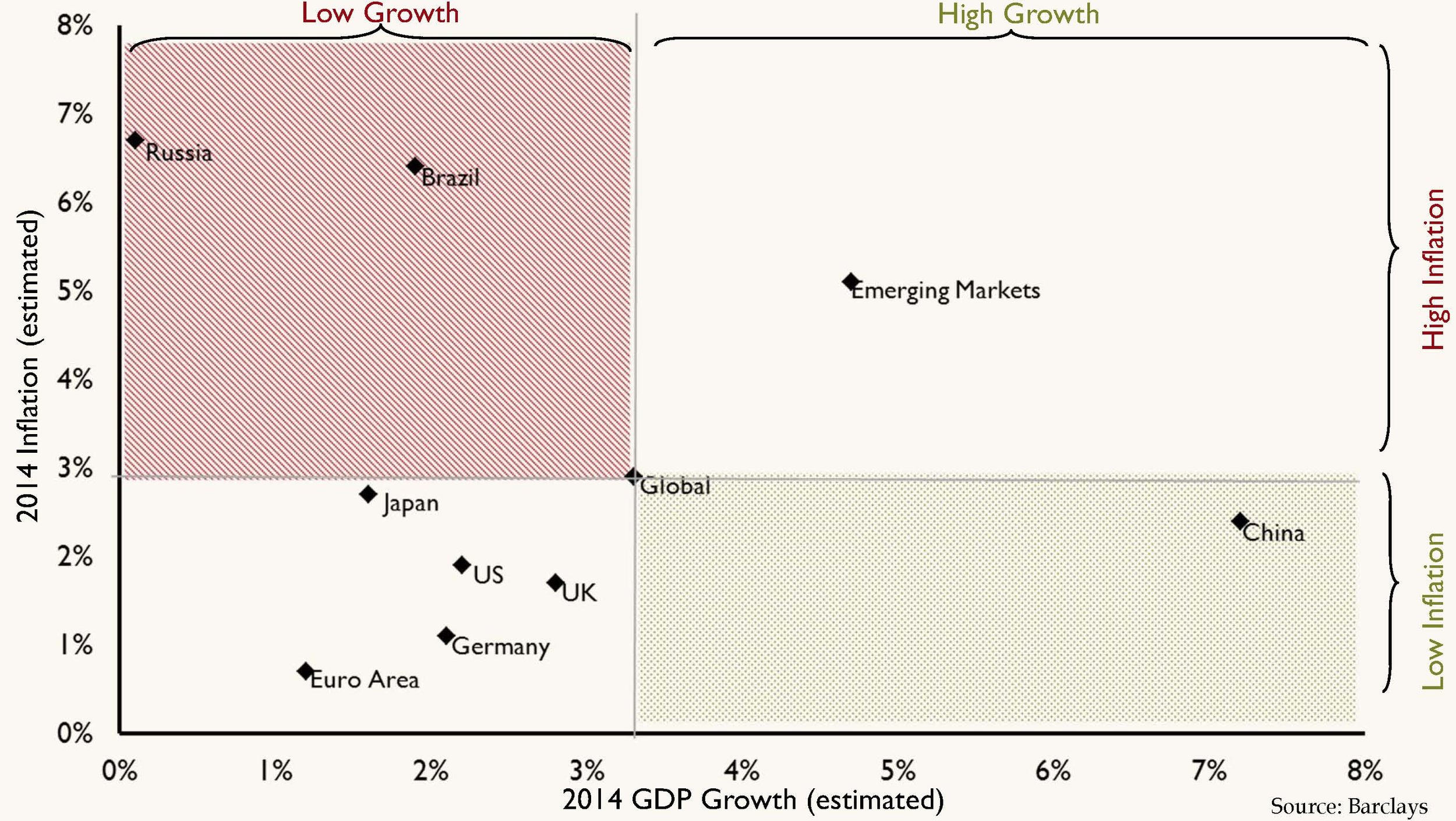

In fact, there was a lot to like about most of the economic reports this week. For example, durable goods orders grew 22 percent, led by airplanes; unemployment claims came in again under the 300,000 mark - yet another example of vitality in the labor markets; auto sales for the month of July were robust at over a 16 million annual rate of sales. In summary, current economic statistics suggest a sustainable expansion with moderate inflation.

Witchcraft Black magic may be the only explanation for ultra-low interest rates in the face of sound economic numbers. Our industry heuristic states that strong economic growth ultimately must translate into higher interest rates. Not so fast my friend. While the U.S. economy is growing quite nicely, Europe is suffering from falling growth rates, and plunging inflation which has contributed to record lows in interest rates throughout the Eurozone. For example, Germany’s 10-year bund fell to a .88 percent yield while 10-year debt yields touched 1.24 percent in France and hit a 2.22 percent in Italy. With European Central Bank chief Mario Draghi’s most recent speech in Jackson Hole last week, he essentially took perceived credit risk off the table for the Eurozone. With a compelling endorsement of U.S. style quantitative easing on the horizon, investors clearly are (for the time being) comfortable holding European debt.

Lower rates throughout the Eurozone have effectively put a bid under U.S. bonds. In the global market for debt, savers view U.S. debt as a good deal at these levels and continue to buy. Studies estimate that the downward pressure on U.S. rates from lower European rates is anywhere from 20–30 basis points. As you can see from the chart below, U.S. 10-year yields are at their outer-bounds relative to the yield on the 10-year German bund.

Our Takeaways for the Week

- The U.S. economic expansion has taken hold, and looks to be sustainable throughout the second half of 2014

- Lower interest rates around the world and continued quantitative easing by the Fed has kept a lid on interest rates … for now

- The end of summer brings the anticipation of football season, and the end to QE infinity