Today the employment data for the month of June was released and was stronger than analysts’ expectations. Nonfarm payrolls increased 372,000 in the month of June, well above the estimate of 265,000. In addition, average hourly earnings growth moderated on a month-to-month basis, which should help the inflationary pressures in the economy.

Raising Rates for the Right Reason

During our collective years in investment management, we’ve come to use several phrases over and over. Our long-time clients may begin to roll their eyes as we repeat an oft-used phrase, “The Fed is raising rates for the right reason.”

The Fed Is Raising Rates … Now What?

The Federal Reserve has maintained near-zero interest rates for nearly two years, and by now, it is clear this extraordinary policy is no longer needed. Over the last several months, continued elevated inflation readings, coupled with a tightening labor market, have led the Fed to suggest rate hikes are coming both sooner and faster than previously expected.

Demand-Driven Disruption

Americans are buying more than ever before. Despite supply actually surpassing above pre-COVID levels and dockworkers unloading ships as fast they can, the supply chain is unable to keep up with record consumer demand. Furthermore, the supply-demand gap may worsen as we head into the peak of holiday shopping season.

Fourth Quarter 2021 Investment Strategy Video

Skating to Where the Puck Is Going

Our Director and CEO Emeritus Jim Rudd, has long been a fan of the Wayne Gretzky quote, “don’t skate to where the puck is, skate to where it is going.” While it important to keep an eye on current data, it is more important to understand current data in the context of where you think the puck, or the economy in this case, is going. Let’s look at what is currently going on in Washington and the economy, and where we expect they are going later this year and into 2022.

Respect

Rolling Stone magazine released its top 500 songs of all time this week. While some may argue that the top ten is missing several classics, they did rank Aretha Franklin’s “Respect” as the best of all time. We feel this song is also timely as we believe the U.S. consumer deserves “a little respect”.

The Song Remains the Same

Recent uncertainty due to the COVID Delta variant as well as concerns over the Federal Reserve tapering has resulted in a “risk off” market.

The Writing on the Wall

“Tell me where earnings are going, and I’ll tell you where the markets are going” is common phrase you’ve heard from us over the years.

Yield On, Yield Off

When the Federal Reserve cut their overnight policy rate by a total of 2.0 percent to the zero bound in the fourth quarter of 2008, few investors would have anticipated it would be another seven years before the Fed felt economic conditions warranted raising that policy rate by even one-quarter percent.

"The Bad News Won't Stop but the Markets Keep Rising"

“The Bad News Won’t Stop, but Markets Keep Rising,” read the headline of the business section of the NY Times this week. I have received many questions from many clients and friends over the past couple of weeks regarding this notion.

Chart-side Chats

Last week marked the semi-sesquicentennial anniversary of Franklin Delano Roosevelt’s death which sparked many to compare our current financial markets to the Great Depression. As the stock market continues its rapid ascent for a second week and pundits start talking about the shape of the recovery, there is one lesson some overlook from the Depression era — the value of FDR’s fireside chats. During these chats, the president used simple, direct language to convey very difficult news; a format we are keeping in mind.

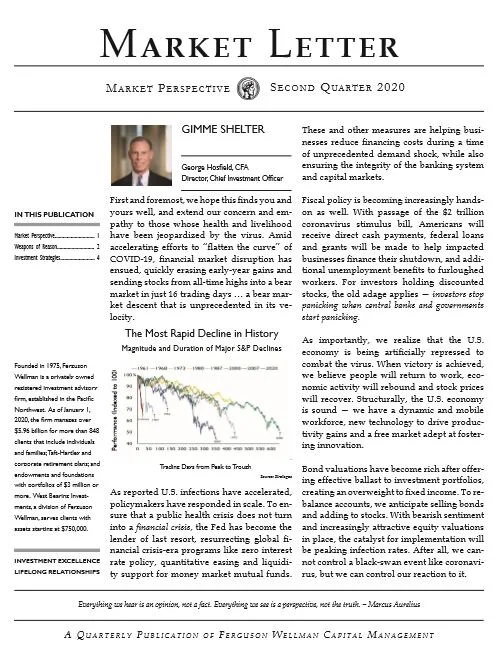

2020 Q2 Market Letter: Gimme Shelter

Cole and Lago Quoted in Portland Tribune

Investment Outlook Video Q1 2020: Age Is Just a Number

George Hosfield, CFA, chief investment officer for Ferguson Wellman and West Bearing Investments, shares the firm’s outlook for 2020.

The Fear Index Fades

Negative interest rates have been in the news this year and have been the source of questions from clients. Negative Interest rates are an extraordinarily unusual phenomenon where an investor pays for the “privilege” of loaning a country money.

Investment Strategy Video Fourth Quarter 2019: Holding Pattern

A Cycle Within a Cycle

The U.S. economy has been expanding for over 10 years, the longest economic expansion in U.S. history. When looking back, the bull run in stocks and the economic expansion may seem “easy” but there have been multiple periods of angst as we flirted with slow growth.

Whistleblower Markets

With the impeachment inquiry being announced this week, clients have been asking, “What does this mean for my investments?” The short answer: markets trade on economic fundamentals, not political headlines.

Long Live the U.S. Consumer

This morning the Bureau of Economic Analysis released the second quarter GDP estimate and, while growth was down 3.1 percent from the first quarter, it was still a healthy 2.1 percent with consumer and government spending that was strong.