by Krystal Daibes Higgins, CFA

Vice President, Equity Research

Demand-Driven Disruption

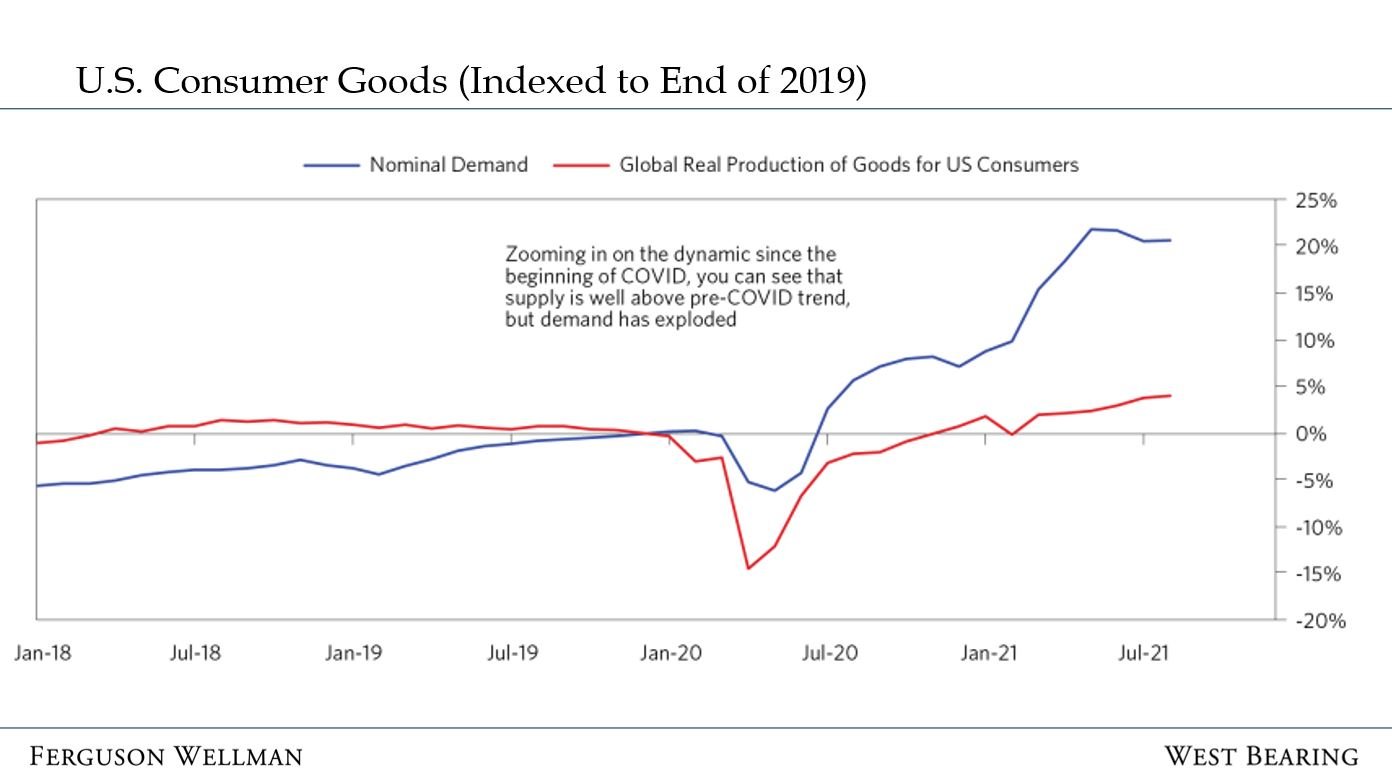

Americans are buying more than ever before. Despite supply actually surpassing above pre-COVID levels and dockworkers unloading ships as fast they can, the supply chain is unable to keep up with record consumer demand. Furthermore, the supply-demand gap may worsen as we head into the peak of holiday shopping season. As a result, we’re seeing inflation metrics remain elevated. However, we believe robust consumer demand should also sustain strong macroeconomic and business fundamentals.

Demand Shock

Even as production facilities and ports increase operational capacity, pent-up consumer demand has far outpaced supply. In fact, U.S. ports are on track to manage 26 million TEU (twenty-foot container or equivalent units) in 2021, an 18% increase over 2020’s record of 22 million TEU.

Source: NRF/Hackett Associates Global Port Tracker

Source: Bridgewater Associates

Despite the record level of shipments, we continue to see supply shortages across several product categories. Simply put, there are just not enough production components and workers in place to fulfill demand. Encouragingly, yesterday the Job Opening and Labor Turnover Survey (JOLTS) October report indicated that job opening growth is leveling while quit rates are declining. We could be finally turning the corner on labor disequilibrium but given limited historical data we are in terra incognita.

The current heightened demand is largely the effect of loose monetary policy and fiscal stimulus that more than offset lost income during the shutdown. However, we have a few reasons to believe that demand could be sustained:

Bigger bank accounts: The infusion of government cash has allowed many to pay down debt and helped to fuel the rise of asset values, therefore improving overall consumers net worth. While we expect the savings rate to decline over time, it’s still well above pre-COVID levels.

Low yields: While interest rates are expected to climb modestly as the Fed begins tapering, we are likely to remain in an historically low-rate environment, which should continue supporting business and consumer investment and spending. In addition, it is unlikely that the Fed will raise rates until the second half of next year.

More fiscal stimulus is on the way: Some states are cutting taxes as state balance sheets are significantly improved and healthier than they were before the pandemic.

Strong Demand Should Sustain Strong Business Fundamentals

As we have noted in previous blogs, consumers are the engine of the U.S. economy—making up 70% of gross domestic product (GDP). If the consumer component is healthy, so too will be the economy. Though the current demand environment is unsustainable, overall consumers are on much better footing than they were a few years ago. We also have several indications of solid economic fundamentals, including higher trending GDP levels, near-low unemployment levels and consumers and businesses appearing to absorb and navigate inflation. We don’t expect companies to generate the same growth we saw in 2021, but we do expect to see continued growth off of what was already a solid year for businesses and consumers alike.

Our Takeaways for the Week:

Consumer demand has far outpaced the supply recovery, due to the enormous amount of federal funding and loose monetary policy

A healthy consumer backdrop should allow for continued solid economic and business fundamentals