In the cover page of our quarterly Market Letter publication, George Hosfield, CFA, provides an update to our investment strategy titled, “So Far, So Good.” In the piece, George discusses the Fed’s progress in fighting inflation and delivering a soft economic landing, plus an update on the dominant theme of artificial intelligence across equity markets.

Planning for Our Children's Future

Samantha Pahlow, CTFA, AWMA®, provides an overview of important issues to consider when making legacy plans with children and grandchildren in mind.

Mega-Cap Earnings in Focus

The U.S. stock market saw a rebound the last couple of weeks, breaking the prior three-week losing streak. The S&P 500 gains were driven by mega-cap names due in large part to their recent earnings results which exceeded investors’ expectations.

Why Does Everything Feel So Expensive?

Last weekend, as my kids played in the park, a fellow dad struck up a conversation. During our talk, he sighed and asked, "Everything feels so expensive these days, doesn't it?" I’ve heard this sentiment frequently, from friends, family and clients who have expressed curiosity about the rising costs of everyday goods and services. While many individuals are feeling the strain on their finances, inflation measures, such as the Consumer Price Index (CPI), appear to be trending downward, showing a rosier economic picture. So why are people feeling the pinch?

2024 Required Minimum Distributions for IRA Beneficiaries Waived Again by IRS

Tyler Conroy, CFP®, writes about the IRS waiving required minimum distributions in 2024 and shares a resource for individuals for whom this may apply.

Two Steps Forward, One Step Back

The first three weeks of the second quarter have been tough for both equity and bond investors. After a great start to the year, there hasn't been any place for investors to hide in April. The chart below highlights that the three major equity classes, as well as bonds, have all posted negative returns, with Small Caps now down close to 4% for the year.

Houle on KOIN Wallet Wednesday

Is 3% the New 2%?

The Consumer Price Index (CPI) is a measure of goods and services prices across the economy, and a popular gauge of inflation. The headline CPI rose 3.5% in March from a year earlier, which was higher than economists had forecast and an increase from February’s 3.2% reading. The Core CPI, which excludes the volatile food and energy components, also rose more than expected, with medical care and auto insurance boosting the non-housing service prices.

Second Quarter 2024 Investment Strategy Video: So Far, So Good

Head of Fixed Income and Principal Brad Houle, CFA, presents the firm's quarterly Investment Strategy titled, "So Far, So Good." In the video he discusses how the Fed's fight on inflation is faring, our belief that commercial real estate is not similar to residential real estate circa 2008 and investors' expectations for earnings for the remainder of the year.

Helping the Next Generation with Buying a Home

The current residential real estate market continues to apply pressure on potential home buyers, with many feeling the constraints of high housing prices and relatively high interest rates for mortgages.

Market Letter Second Quarter 2024: So Far, So Good

We present Market Letter publication for the second quarter 2024 titled “So Far, So Good” in which Chief Investment Officer George Hosfield, CFA, outlines our belief the Fed remains on course to deliver an ever-so-rare soft landing to this inflationary cycle. Dean Dordevic writes about the Japanese economy and Warren Buffett’s investment there in recent years since the introduction of the “Corporate Governance Code” and Jason Norris, CFA, provides an update on equity market valuations and how investors expect the market to grow for the remainder of the year.

Wealth Management Insights Second Quarter 2024: Planning for Our Children's Future

We present our second quarter 2024 issue of Wealth Management Insights titled “Planning for our Children’s Future.” In it, Samantha Pahlow, CTFA, AWMA®, discusses the crucial aspects to consider when planning for the distribution of assets for minor children. Scott Christianson, CFP®, writes about planning ahead for unanticipated outcomes in our estate plans and what we can do with estate planning to avoid major pitfalls and Charissa Anderson, CFP®, CDFA®, provides a considerations when saving for education and utilizing a 529 account.

Commercial is not 2008 Residential

As we move further into 2024, the commercial real estate (CRE) market continues to attract investors’ attention. Often, when the Federal Reserve increases short-term interest rates rapidly, as in this cycle, some aspect of the capital markets or asset class breaks. CRE is the primary suspect for a crisis in this cycle.

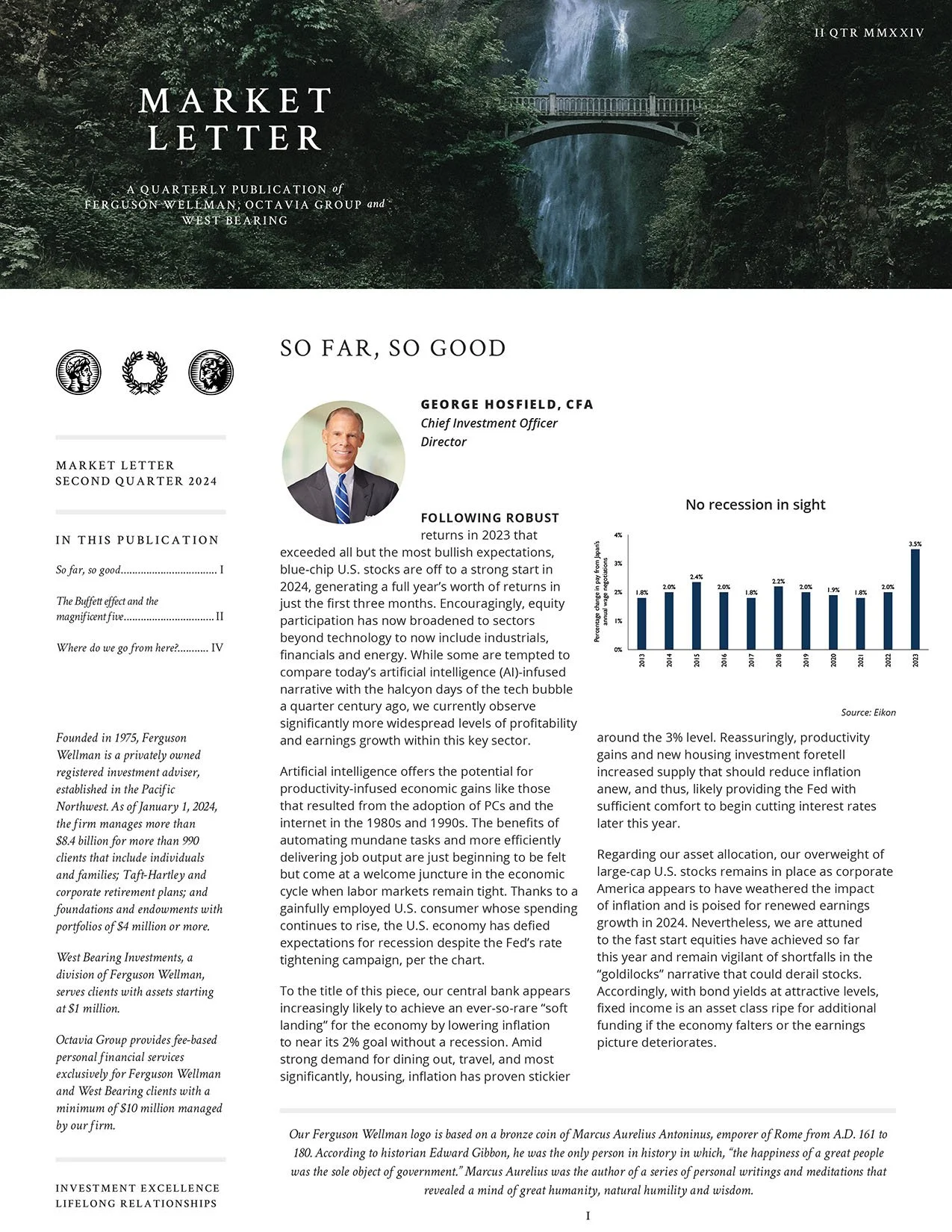

A Good Year In a Few Months: The U.S. Stock Market's Remarkable Rally

During the decade I spent in San Francisco, I had the pleasure of working with a great economist and investor from 2015 to 2019. Those years proved formative for my investing career, and I learned much from my time there. Recently, I have been reminded of an adage of his. After a short period of strong performance, he would exclaim, “We had a good year this month!”, meaning the portfolio returned what we considered a good year's worth of returns in a fraction of the time. Given the robust performance of the stock market over the last several months, I have been reminded of this saying more than a few times.

The End of an Era

Would you have believed us if we had told you on January 1 that the S&P 500 would be up nearly 10% year-to-date after last year’s 25% jump?

What Goes Up, Must Come Down ... Eventually

This week investors shrugged off hotter-than-expected inflation data, one of the most important data inputs for the Fed in deciding its next policy moves. The impact of the Fed aggressively raising rates over the past year has brought inflation down from a whopping 9% in June 2022 to 3% by the end of 2023. The Fed’s ultimate target is 2%. Much like updating a computer, the last bit sometimes takes the longest.

Things to Know Around Tax Time

As April 15 draws closer, individuals across the country are filing their tax returns, some of whom are anxiously awaiting the results.

S is for Shrinkflation

Over the last month, the term Shrinkflation has become more popular in the media. The term was broached by President Biden during a Super Bowl interview earlier this year, but has been gaining traction more recently (see chart below on Google search trends) due to a proposed bill in Congress, as well as Sesame Street’s Cookie Monster complaining on X (formerly Twitter).

2023 Annual Report

Productivity = Prosperity

By March, our feelings of excitement for a new year have generally worn off and we have settled into our winter routines. The hope of an early spring and longer days are normally what carries us through the season, but this year, more excitement is brewing.