by Jason Norris, CFA

Director

Equity Research and Portfolio Management

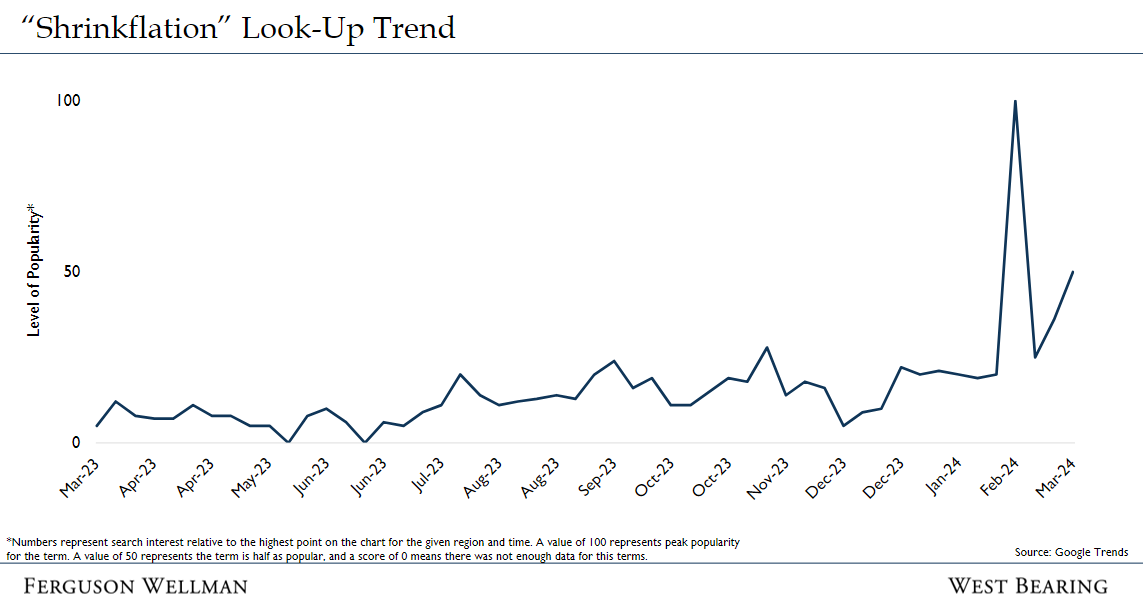

Over the last month, the term Shrinkflation has become more popular in the media. The term was broached by President Biden during a Super Bowl interview earlier this year, but has been gaining traction more recently (see chart below on Google search trends) due to a proposed bill in Congress, as well as Sesame Street’s Cookie Monster complaining on X (formerly Twitter).

What is Shrinkflation? It’s when companies reduce the quantity in a package and keep the price the same. For example, in 2022 a bag of oranges might have come with 10 oranges and sold for $6.00. Now, that bag may have 8 oranges but still costs $6.00. Companies will argue that their overall costs are increasing, thus rather than raising prices, they reduce quantities sold to maintain a certain price point for customers. Either way, consumers will want to be a bit more conscious of rising cost per units. Consumers are also spending a larger portion of their income on food. However, this is driven by going out to eat. The chart below looks at the percentage of income spent on food at home versus food away. Notice that the rate of money spent on food at home has been relatively flat, whereas food away has steadily increased.

Ultimately, higher food prices and lower quantities are starting to weigh on consumers. Thus, while the economy continues to remain healthy and the labor market strong, consumer sentiment remains very low as inflationary pressures, especially in food/commodities, remain strong.

Mr. Powell Goes to Congress

Fed Chair Powell was visiting Congress this week and based on the questions, it seems congress members, as well as their constituents, are frustrated by higher interest rates. Unfortunately, due to the strengthening of the economy, as well as lingering inflation, the Fed doesn’t have a reason to lower rates in the near term. Investors are handicapping a .75% reduction of the Fed Funds rate by the end of 2024, and we believe that is appropriate. The economy remains healthy and should be able to withstand higher rates for longer as inflation rates fall back to target. Even when the Fed starts to lower rates, it doesn’t necessarily mean mortgage and other rates will fall as well. The Fed controls short term rates, while the market controls longer term rates, which are impacted by inflation, economic growth and supply/demand of government bonds. As we’ve written before (refer to our January 12th blog) , our view isn’t that rates are at extreme levels and “need” to come down. Rather, we believe that rates have moved back to normal, pre global financial crisis, levels; and these levels can accommodate economic growth.

Takeaways from the Week

Stocks hit a record high this week as economic data continued to support a healthy economy.

The labor market remains strong with the unemployment rate below 4%, unemployment claims at historic lows and job openings still out numbering those looking.