by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Demand for commercial real estate from investors has been robust for the past few years. In a world of low interest rates, the relative yield advantage of owning commercial real estate is attractive to investors. In addition, trophy commercial properties in gateway cities like New York and San Francisco are seen as a “store-of-value” to foreign investors. When international investors are faced with a volatile home currency or an unstable government, the thought of owning a landmark building in an American city is a relatively prudent investment. As a result, real estate transactions in coastal cities have occurred at price levels that imply a very meager return for the buyer.

While most categories of commercial real estate have performed well, one of the most robust has been apartment buildings. Home prices have rebounded sharply since the Great Recession, particularly in the “cool” cities that millennials prefer to call home. One would think that the millennial generation is the demographic driving new household formation and should be in their prime first-time home buying years. However, a cultural shift has taken place whereby millennials are waiting longer to get married, start families and often prefer to rent for a number of reasons.

According to the U.S. Census Bureau, home ownership as a percentage of households has declined nationally from nearly 70 percent in 2004 and 2005 to 63.8 percent in 2015. A one-percentage-point change in home ownership rates equates to 1.3 million households, according to Bloomberg data. Lending requirements for first-time home building have been tightened dramatically since the financial crisis and the 20-percent down payment requirement disqualifies many millennial prospective homebuyers.

Home Ownership as a Percentage of Total Households

According to Bloomberg, apartment construction nationally has been rising since 2009. Apartment construction permits, a leading indicator of multifamily construction, was at an all-time high of 557,000 units in May. Permits last approached this level in June 2008.

Broadly speaking, real estate development moves in cycles. Whether it’s the unsold condos following the 2009 financial crisis or the now ubiquitous “selfie stick,” we have seen firsthand that whatever the hot trend happens to be is, it has the potential to … cool down.

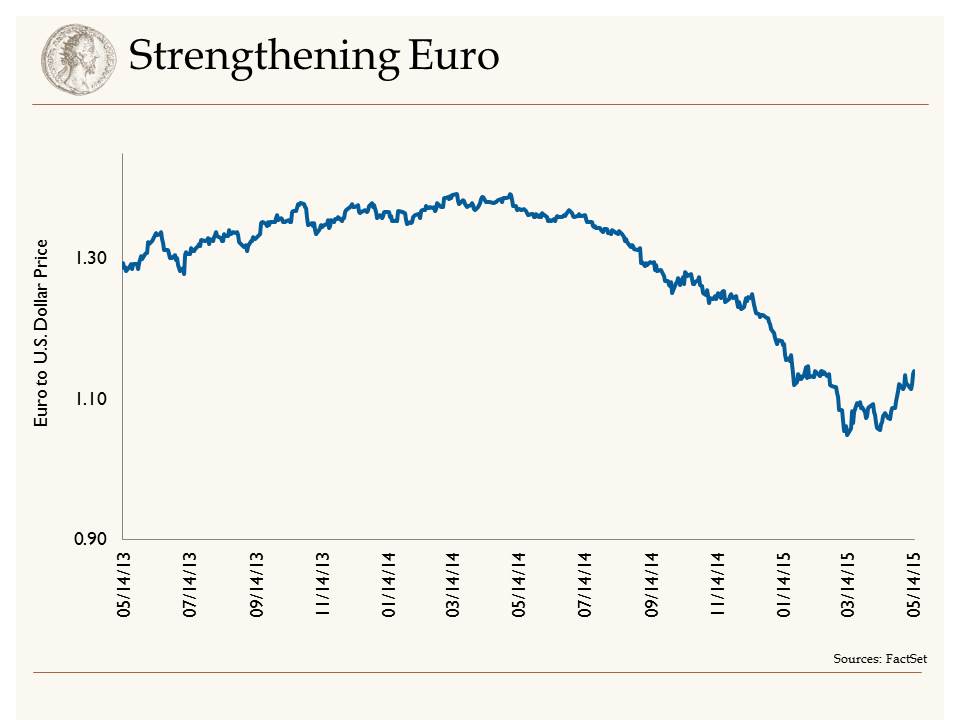

Greekspeak

This week there continued to be directionless news flow regarding the continued debt crisis in Greece. While it is impossible to determine what the outcome may be, one thing is certain: The market has a high level of Greece fatigue. Investors are weary of the issue and it appears that even the correspondents on CNBC are tired of reporting on it. We are closely monitoring the debt of neighboring southern European nations for any sign of contagion and thus far, the crisis does not seem to be spreading. July 20 is now viewed as a critical day, according to Bloomberg, as Greece owes the European Central Bank (ECB) 3.5 billion euros on that day. If there is a failure to pay, this would put Greece on the way to getting the boot by the EU. Interestingly, Greece will possibly delay payment to the International Monetary Fund (IMF) this month with no real consequences as liquidity will not be cut off to Greek banks. Evidently, not paying back the IMF is something akin to not paying back your in-laws with the only consequence being an awkward Thanksgiving dinner. The impact of not paying back the ECB is similar to not paying back the guy you borrowed money from at the racetrack.

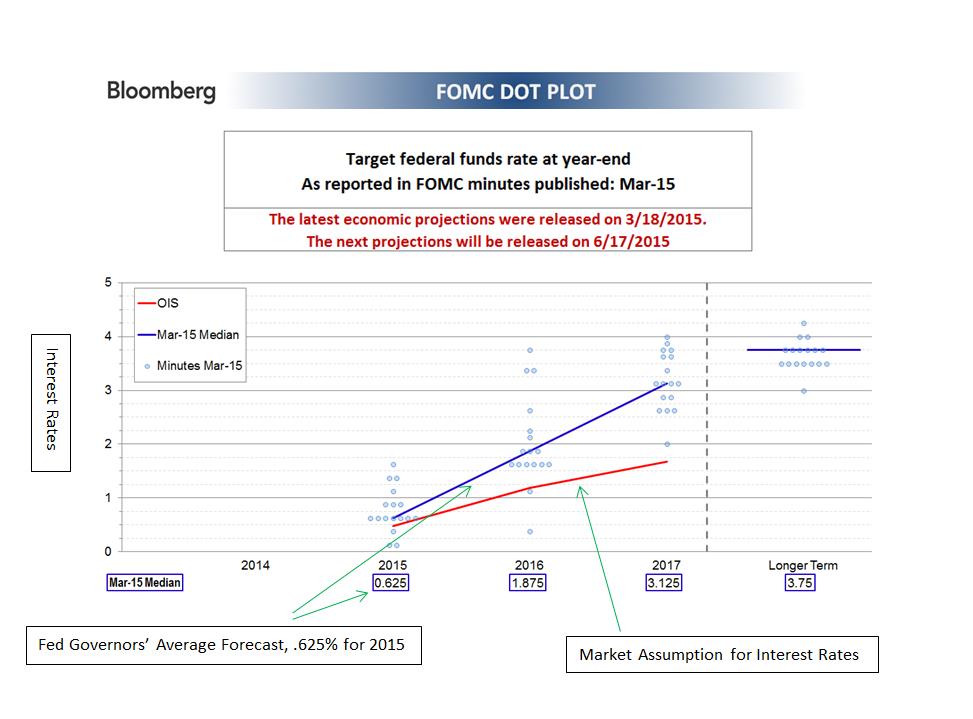

In addition, the Federal Open Market Committee minutes were released this week. Parsing every word of the Fed minutes revealed that interest rates may rise in September and December of this year. This quote possibly has been the most over-analyzed and highly anticipated Fed rate hike of all time. Ultimately, this is good news: The Fed thinks the economy is robust enough that they need to tap the brakes to keep it from getting overheated.

Our Takeaways for the Week

- Expect interest rates to make small movements upward in the fall

- The multifamily housing market is robust and is likely to peak this year