by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Spinning Wheel

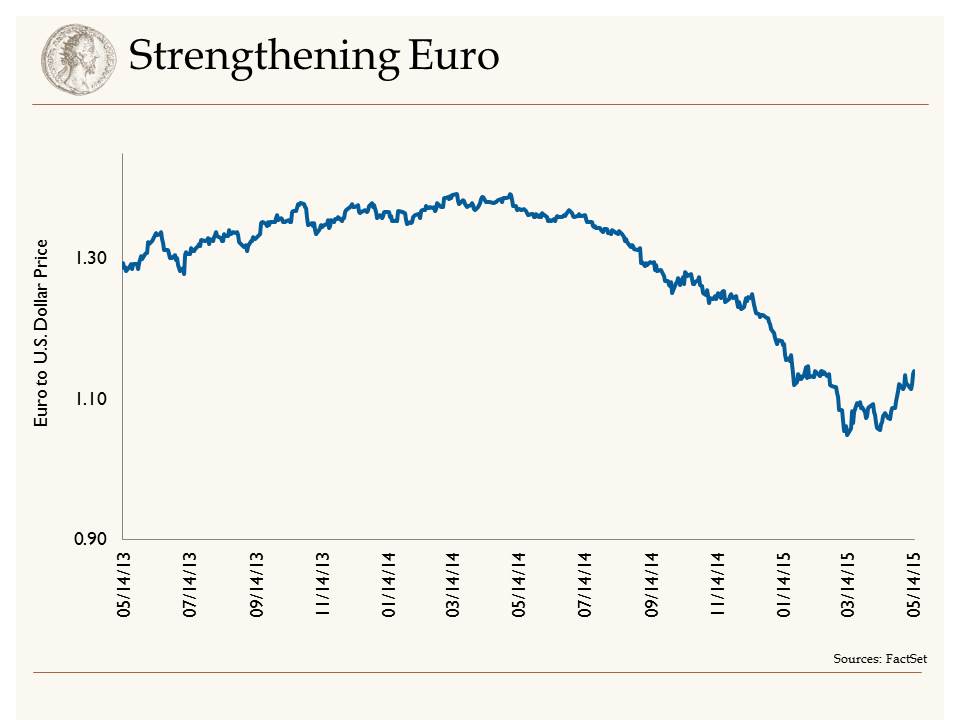

The strong dollar has been a headwind for S&P earnings so far this year. However, that headwind appears to be dissipating. Having traded at $1.40 less than a year ago, by last month the Euro had plunged to $1.05. The Euro's 25 percent devaluation has been a positive development for European economies. Paired with quantitative easing, this has led to a rally in European equity markets.

As confidence has started to build in the Eurozone, we have seen economic growth starting to accelerate. In fact, first quarter GDP in the Eurozone was 1.6 percent, which compares favorably to the meager .2 percent reported in the U.S. for the first quarter. This change at the margin, with Euro growth outpacing U.S. growth, has led to a strengthening of the Euro relative to the U.S. dollar. As Shawn Narancich stated in our March 13 blog, "the dollar was due for a break after such a parabolic run." Since mid-March, the Euro has strengthened 8.5 percent relative to its U.S. counterpart. We view this moderation in dollar strength as a positive for U.S. multi-national companies, and we also see it as a healthy indicator for the capital markets. We still believe that the dollar will strengthen against the Euro as the year moves along, but it will be gradual.

Finally

Along with a rally in the Euro, we have seen a rally in interest rates since the end of January. The U.S. 10-year bond yield bottomed at 1.64 percent in January; today it stands at 2.23 percent. Not only have U.S. bond yields risen over that time period, but so have yields in Europe. After bottoming at .08 percent, the German 10-year bund now stands at a .70 percent yield. We have long maintained that higher global yields would result in higher rates here in the U.S. and we believe yields are finally starting to discount expectations of stronger global growth in coming quarters.

Takeaways for the week:

- The dollar has taken a pause against the Euro, and we view this as healthy for the global economy

- Higher yields are reflecting higher growth prospects in the second half of 2015