Oregon Business Magazine Spreading the Wealth

February 25, 2014

By Paige Parker

A high bar to clear. Until last year, investors seeking the expertise of Portland firm Ferguson Wellman Capital Management needed to bring at least $2 million along with them. The 39-year-old wealth management firm lavishes personal attention on its clients. Some families have trusted Ferguson Wellman with their money through three generations. And its employees are far from fickle: Not a single investment professional hired in the last 25 years has left Ferguson Wellman for another job, says CEO James Rudd. The firm closed out 2012 with just shy of 600 individual and institutional clients and $2.91 billion in assets under management. “We’re not a hot-dot manager,” Rudd says.

Creating growth, controlling growth. Market research told the employee-owned firm that the time had come to pursue less wealthy investors. Assuming it would attract younger investors, Ferguson Wellman this summer added two employees and launched West Bearing Investments, a division for Oregon, Washington and California clients with at least $750,000 to invest. West Bearing clients have access to the same investments as Ferguson Wellman clients, as well as direct access to the analysts who create those investments.

The rich get richer. On January 1, the firm raised its minimum for entry into the established Ferguson Wellman division to $3 million. The move doesn’t affect current clients. “I’ve been here 31 years, and this is the fourth time we’ve increased our minimum,” Rudd says. Ferguson Wellman first established a minimum, then $1 million, in 1989. The higher minimum “allows us to continue to be very client centered in what we do and very entrepreneurial,” Rudd says. “Clients are the greatest resource that we have. Believe me, it takes years to form a trusting relationship with a client.”

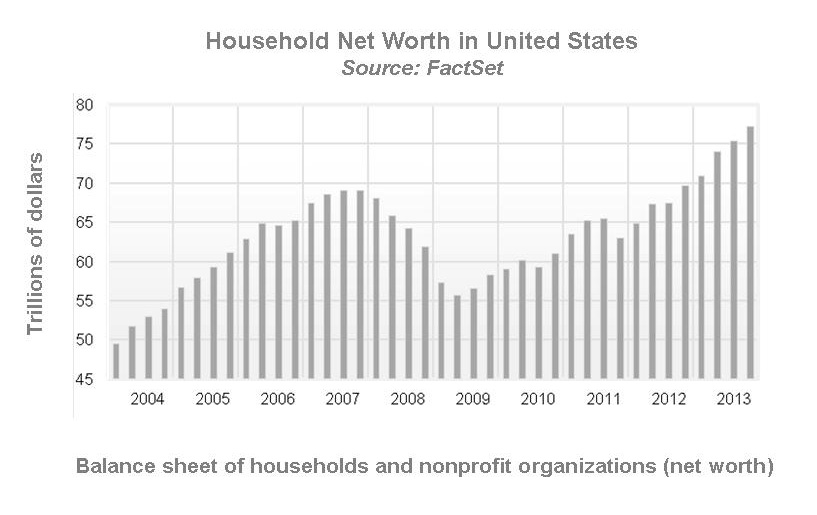

Surprising results. The 43-employee company ended 2013 with $3.8 billion in assets under management, largely because of the strong performance of the stock market. But it also brought in 52 new clients. Twenty-eight came from the West Bearing division, which hit its goal of $25 million in assets under management.

So has the double-digit growth in Oregon’s software sector brought young, flush investors into the Ferguson Wellman fold? Not yet. The new clients aren’t of the high-tech hoodie set, but rather business owners, entrepreneurs, doctors and those who’ve inherited money. “When it came down to it, in the Northwest — anywhere, for that matter — $750,000 is a great amount of money to be putting into a retirement,” says Mary Faulkner, senior vice president for branding and communications. “Our demographics at West Bearing compared to Ferguson Wellman, they’re essentially the same. It was an exciting discovery for us — how wealth manifests itself in the Northwest.”