As the calendar turned to the final quarter of 2024, there was plenty of economic and geopolitical news for investors to digest.

Inflation Redux

The last time I wrote the blog was April 14 and inflation data was the topic du jour. Serendipitously, the July inflation announcement was the major market event this week. So, to keep me honest, let us revisit some items from the April post.

Milestones

This week, investors recognized the 8-year anniversary of a bull market that is now second only in length to the tech-fueled run of the 1990s. In March, blue chip stocks consolidated a small portion of recent gains, but nevertheless, the S&P 500 has now returned over 250 percent since the bear market lows in March of 2009.

Seasons of Change

After an unusually long spell of low volatility, stocks and bonds sold off in tandem to end a week that was previously on the quiet side following the Labor Day holiday. Coming into Friday, stocks had essentially earned out the high single-digit returns we foresaw for 2016. Low levels of economic growth globally should renew profit growth in future quarters, but neither stocks nor bonds are cheap at this point.

Perception and Reality

U.S. unemployment claims at a 43-year low, manufacturing PMI’s back in positive territory, and a five percent unemployment rate are key reasons why recent recession fears have receded. Against this backdrop, stocks are above water for the year. While retail sales, including this week’s print, have been lackluster, four

Rescue Me

That’s the message we heard loud and clear from the markets this week. As economies and markets around the world wobble to start the new year, they were looking to central banks to bail them out. Mario Draghi gave markets around the world some solace with his dovish news conference yesterday.

Cole and Houle Quoted in Bend Bulletin

For investors, this year started with more than a passing resemblance to 2015, according to executives at Portland-based investment firm Ferguson Wellman Capital Management.

At the firm’s annual investment outlook Wednesday at Deschutes Brewery, in Bend, two Ferguson Wellman vice presidents advised cautious optimism. They took their theme from the

Light at the End of the Tunnel

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Retailing Blues

Earnings season has all but wrapped up for another quarter, but department store retailers are adding a problematic book-end to a quarter that has generally come in ahead of expectations. Flat third quarter earnings were weighed down by widespread losses in energy and dampened again by the stronger dollar, factors that many investors thought would spare U.S. centric retailers. Following Wal-Mart’s surprisingly weak earnings outlook in October, both Macy’s and Nordstrom came to the earnings confessional this week to report weaker than expected sales and substantially reduced profit forecasts. For Macy’s, its red star seems to be falling, as elevated inventories are forecast to weigh on margins for the company’s most important holiday sales quarter. Despite recent evidence of elevated merchandise levels in traditional retail channels, the subsequent 15-20 percent declines in both retailers’ share prices speak to the traffic challenges afflicting both Nordstrom and Macy’s. Investors long retailing stocks will hope for better news from home improvement, off-price, and specialty retailers next week.

Sales Falling Flat?

Amid increasing concerns about U.S. retailing, news that October retail sales barely budged cast a further shadow on the industry. In our opinion, weakness for select retailers reporting quarterly numbers speaks more to their distribution strategies and product mix than to any deeper concerns about the health of U.S. consumers. Shoppers are buying more of what they want and need online at Amazon.com, disadvantaging traditional bricks-and-mortar retailers that lack the cars, footwear, and food that consumers still want to see and trial firsthand before they buy. Also at work are the weather and the dollar. A mild fall has hurt department store retailers’ apparel sales and the strong dollar has deterred foreign visitors from taking American shopping sprees. Notwithstanding company specific retailing challenges, we continue to believe that a healthy job market, low gas prices, and low interest rates support domestic consumption and will be a tailwind for the U.S. economy.

Oil -- Down but not Out

In addition to the hit that retailers took this week, energy stocks again took it on the chin as oil prices retest August lows. Refineries are going through what’s called the turnaround season, a time of reduced product output that coincides with a change in product emphasis from summer gasoline to winter heating oil. Refinery throughput slows and with it, crude demand. As investors fret about recent US inventory builds, we would observe that seasonal factors are at play that obscure the tightening of oil markets – tightening that coincides with falling U.S. production and flattening OPEC production. We don’t expect OPEC to cut production at its December 4 ministerial meeting, but we do believe it will acknowledge that markets are coming back into balance and accede to the cartel’s current level of output. With fuel demand continuing to grow at healthy levels and global supply flattening, the slack in oil markets is disappearing. We are bullish on oil and look forward to higher prices ahead.

Our Takeaways from the Week

- Retailers are book-ending third quarter earnings season, causing consternation for department store investors

- Oil prices are retesting late summer lows ahead of the upcoming OPEC meeting, amid increasing evidence that supply and demand are rebalancing

Upside Down

by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Upside Down

This has been one of the most interesting trading weeks of the year. The seasonal pattern of the stock market is to bottom in October, and rally through the end of the year. While this doesn’t happen every year, so far in October we are following that script. The S&P 500 sold off sharply following the Fed’s decision not to raise interest rates at the September meeting, but found bottom last Friday and has rallied ever since.

Often times the fourth quarter rally is led by names that have performed poorly in the first three quarters of the year. This week was no exception. Through the first nine months of the year energy, materials and the industrial sectors were down 21 percent, 17 percent and 10 percent respectively. Over the last week energy stocks are up 7 percent, the materials sector is up 6.5 percent and industrials are up 6 percent.

Two questions come to mind: First, why did this happen? Secondly, is it sustainable?

Growth stocks were in favor for the first nine months of the year. This is typical during periods of slow global growth as investors are willing to pay handsomely to get the kind of sales growth we have seen in Netflix, Amazon and the healthcare sector. At some point, these names become very expensive. The global slowdown has been led by China, and this past week economic data has been a little better in that country. Probably not enough to signal a huge change in their economy, but enough to spook investors regarding short positions in the more cyclical parts of the market.

As a firm, we believed that oil prices and the energy sector were due to rally because of supply and demand responses in the energy markets. Specifically, low oil prices have caused gasoline demand to rise here in the U.S., while simultaneously causing a drop off in oil production. Historically this combination has always led to higher oil prices and oil rallied nearly 10 percent this week alone.

Whether or not this change in the trend is sustainable remains to be seen. The developed economies of the world remain the engines of growth of the global economy. Demand from the U.S., UK and Europe need to rescue growth in flagging emerging market economies. We believe that this will be the case in the coming months, but doubt that the market will continue its recovery in a straight line. Slow growth accompanied by Fed uncertainty will lead to continued heightened volatility.

Our Takeaways for the Week

- Fourth quarter rallies are common in the stock market, and so far this quarter we are up nearly 5 percent

- We think global growth will accelerate as we move into 2015, supporting the more cyclical sectors of the S&P 500

Good News First

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

Good News First

The jobs market continues to chug along adding 215,000 jobs in the month of July with upward revisions to June and May of 14,000. While this is a solid pace of gains, it hasn’t been strong enough to push wages higher.

Equity markets, on the other hand, have struggled the last several sessions, despite favorable earnings reports. We have seen the major declines in profits in the energy sector; however, the rest of the economy seems to doing well. With just under 90 percent of companies in the S&P 500 reporting second quarter earnings, year-over-year profit growth could very well be negative 1 percent. While nothing to write home about, the main culprit has been the energy sector. Energy earnings are going to be down close to 60 percent year-over-year. If you back out the energy sector, earnings for the rest of the market will be up 5 percent year-over-year. Healthcare, consumer discretionary and financials have led the way higher. We recommend that investors don’t get caught up in the headline numbers, especially now that one sector is having such a major impact on the overall number.

The price of oil won’t necessarily be helping out the energy sector in the third quarter. With WTI at $44, it is close to its March lows. We moved to an overweight in the energy sector six months ago with the belief that as prices fell, demand would increase and supply would decline. What surprised us was the supply side. While rig count has declined by 60 percent domestically, U.S. supply has been somewhat slow to respond to reduced drilling activity. Nevertheless, U.S. supply has peaked and should decline into the second half of the year. We contrast the ex-growth situation domestically with OPEC, where key producers Saudi Arabia and Iraq have combined to boost cartel volumes by 6 percent so far this year. Aside from flattened production domestically and OPEC’s production growth this year, the key to our call for higher oil prices is stronger than commonly perceived demand growth and production from non-U.S., non-OPEC regions around the world. Despite oil prices that reached $140/barrel in 2008, this key source of global supply has failed to deliver any additional production over the past eight years. Our bet is that if additional volumes weren’t forthcoming in more propitious times, this key source of approximately 54 million barrels/day of supply is likely declining at currently depressed prices. Therefore, it will increasingly help to balance the market. We still believe oil will be closer to $70 then $40 at year-end and are focusing on companies with strong balance sheets to weather this near-term storm.

Only a Matter of Time

Recent economic data has not been conducive to a September Fed rate hike. While the unemployment rate at 5.3 percent is a positive sign, coupled with weekly jobless claims at historic lows, there is still a lot of slack in the labor market. There are currently over 5 million jobs that are available, which is an all-time high. While this data signals a tight labor market, the unemployment rate figure does not. Also, wages aren’t increasing at a rate that is a threat to inflation. Earlier this week, the Employment Cost Index showed only a 2 percent increase in labor costs, which comprised 2.1 percent in wages and 1.8 percent in benefits. Today’s jobs report confirmed this with hourly wages rising only 2.1 percent.

We believe a Fed rate hike will happen before the end of the year. Given current data trends, whether it is September or December is a toss-up. We have seen and read about indications that the Fed wants to start the process; however, we believe the data is still signaling uncertainty.

Our Takeaways for the Week

- The Fed will raise rates by the end of 2015

- Stocks continue to be weak, which could be seasonal, but we believe that fundamentals are still attractive

Liquid Courage

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Volatility increased this past week in most asset classes with oil being in focus. In the last two weeks, crude oil is up roughly 20 percent, its best two-week move in 17 years. While the demand picture has not changed, we have seen U.S. oil and gas companies announce major employment cuts and capital expenditure reductions for 2015. We believe that there has been some “short covering” in the market which has led to recent strength. Our belief is that by year-end, oil prices will be between to $60-$70/barrel, due to reduced supply in the U.S. In the face of this, we do believe we see some opportunity in energy stocks. While earnings continue to come down, we think we can find value in select names with strong balance sheets.

All Over the Road

As mentioned earlier, the energy complex was not the only asset class exhibiting volatility. In the first five weeks of 2015, the S&P 500 has been either up or down more than 1 percent 11 times, which is 44 percent of the trading days. To put it in perspective, last year the S&P 500 moved this much only 15 percent of the time. The chart below highlights the last five years.

Days the S&P 500 Was Up or Down More Than 1 Percent

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| Number of Days | 96 | 50 | 38 | 38 | 11 |

| Percent of total trading days | 38% | 20% | 15% | 15% | 44% |

Source: FactSet

This year is setting up to be similar to 2011, a year that saw a lot of uncertainty due to surprisingly poor U.S. GDP growth, a U.S. debt downgrade and the European crisis coming to the forefront. All this uncertainty resulted in a flat market for 2011, but it was a rollercoaster ride. We believe the fundamentals of the U.S. economy and the recent actions of the European Central Bank leave the foundation of the global economy a little firmer. We don’t think the volatility mitigates itself; however, we do believe that equity returns will be better than 2011.

Working for the Weekend

Heading into a wet weekend on the west coast, the monthly jobs report this morning was very strong with the U.S. economy adding 257,000 jobs in January. The unemployment rate ticked up to 5.7 percent due to an increase in people looking for jobs, which is a positive for the economy. This is only a small part of the story. Job gains for December and November were revised higher by 147,000. The third leg of the stool of the January jobs report was an uptick in wages. Wages bounced back after a disappointing December, rising 0.5 percent month-over-month. With a strong labor market and unemployment close to the Fed’s target, we believe this wage growth will persist throughout 2015. This further reinforces our view that 2015 will be a good year for “Main Street.”

Our Takeaways for the Week:

- Main Street will fare better than Wall Street in 2015

- Adding to high quality energy names at this time could pay dividends in 2015

Here Comes Santa Claus

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

The Federal Reserve delivered some early Christmas cheer with a new policy statement on Wednesday, and by Thursday afternoon the Dow average had advanced 700 points. Please excuse us for being frustrated by the constant attention to the Fed and the parsing of every statement they utter. This tends to happen during any Fed tightening cycle. The chart below shows the average S&P 500 performance around the last five Fed tightening cycles. As you can see, about six months before the Fed starts raising rates the market goes through a correction of 5–7 percent and volatility rises.

The U.S. economy continues to hum along, and there is no lack of positive economic indicators. We believe that the Fed will be raising short-term interest rates in the middle of next year and they are doing their best to signal that move to the markets well in advance. The most recent examples last week were jobless claims, which dropped to a six-week low, consumer comfort climbing to a seven-year high, leading economic indicators rising an additional .6 percent and retail sales increasing by the most they have in eight months. In short, there is plenty of good economic news to go around, and enough momentum for the Fed to justify raising rates next year.

Wind of Change

While oil prices fell modestly this week, energy stocks began to rally. Since the peak in oil prices in June, the S&P energy sector fell 25 percent. This week oil prices are down another 2 percent, but oil stocks in the S&P were up 7 percent. We can’t say that we are surprised. Whenever you get such a dramatic drop in prices, it tends to produce bargains. Financial buyers aren’t necessarily brave enough to step into these situations, but strategic buyers are. This week Repsol, a Spanish oil company, made an offer to buy Talisman Energy for $12.9 billion. Talisman’s share price was as low as $3.96 on December 8, and now trades for just over $9.00 per share. We made the case last week that the sell-off in oil was overdone, and it appears others are coming to the same conclusion.

Our Takeaways from the Week

- The stock market will continue to experience increased volatility in the coming months as the Fed communicates its tightening plans

- The sell-off in oil stocks is overdone, and there is value in the sector

- Our warmest wishes for a happy holiday season!

Black Gold?

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Decoupling

With the holiday season in full swing and U.S. investors rejoicing about another year of solid U.S. equity returns, most international investors may be forgiven for feeling like they are getting a lump of coal in their Christmas stocking. In an increasingly decoupled global economy, where China’s growth is slowing and Europe and Japan teeter on the brink of recession, 11 percent returns domestically reflect, in part, the increasingly attractive growth profile of the U.S. economy. What’s surprising is the fact that China’s stock market has risen over 30 percent so far this year, helping buoy emerging market equity returns in a year where stocks have fallen in most foreign markets. Providing better investor access to mainland Chinese equity markets (through linking the Hong Kong and Chinese markets) has helped stimulate investor demand, but the flow of economic data out of the Red Giant remains rather discouraging. Slowing industrial production growth, weaker retail sales, and moribund manufacturing activity all speak to the challenges that Chinese policy makers confront in transitioning the world’s second largest economy from an investment led juggernaut to one better balanced by consumption.

Leading the Way

In contrast, the U.S. economy is moving full speed ahead. The November retail sales growth that came in at the high end of estimates reaffirms our thesis of a healthier U.S. consumer boosted by healthy job gains, rising home prices and the falling price of oil. Healthy retail sales data bely the 11 percent sales decline over the long Thanksgiving Day weekend, indicating that the weak sales numbers were more a function of an earlier start to the holiday selling season. With government spending having apparently bottomed and capital spending on the rise, the error of estimates for Q4 GDP is once again higher.

Crude Thoughts

All of which brings us to the topic that seems to be on everyone’s mind nowadays – oil. Now down 46 percent since June, U.S. black gold is far from it at the moment. Yet we continue to believe that the fundamentals of oil aren’t as bad as the price implies. Developed economy inventories are near five-year averages, global demand continues to grow and, most importantly, because of oil’s correlation with economic growth, GDP globally continues to expand in a world of accommodative monetary policy. Contrast today’s environment with 2008, when oil plummeted over 70 percent in eight months, a washout that coincided with consumer price shocks from $4.40/gallon gas and a global economy on the verge of collapse. The best cure for low oil prices is low oil prices, and at today’s level of around $60/barrel, we expect global petroleum exploration and development spending to fall by 25 percent or more in 2015, sowing the seeds for tighter markets and higher prices.

Indeed, evidence of the supply response to come is already upon us. Lower prices are reducing oil companies’ cash flow, leaving them with less money to reinvest in new wells. We are just beginning to see U.S. shale producers announce their 2015 capital budgets and, so far, the anecdotes support our contention that investment levels will drop dramatically. Indeed, November’s new U.S. well permits number, down 45 percent sequentially, offers investors a taste of the supply response to come. Conoco has announced a 20 percent drop in its capital spending and small independent producer Oasis is cutting its 2015 cap ex budget by 44 percent. Dozens of other independent U.S. producers, those responsible for the domestic energy boom of recent years and which are largely responsible for doubling U.S. production over the past six years, will come to the confessional between now and the end of January.

With less money being expended to replenish reserves from shale wells that deplete up to 50 percent of recoverable reserves in the first two years of production, we expect the oil markets to tighten faster than investors currently believe. We would observe that the incremental U.S. liftings that have driven production growth globally are of much shorter duration than the marginal production of 2008 from the Gulf of Mexico. Deepwater projects can take 5-10 years to produce first oil and, when it finally comes, wells under extreme pressure miles below the seafloor produce at persistently high flow rates for project lives that can last up to 30 years. The point is that supply elasticity is likely to bite much faster this time around and, even with the production backdrop pre-shale, low prices didn’t last for long in 2009. So in this festive season, be thankful for the boost to disposable income that today’s low oil prices provide, but don’t expect them to last.

Our Takeaways from the Week

- The U.S. continues to demonstrate its global economic leadership as blue chip stocks prepare to close out another good year

- $60 oil prices provides a meaningful boost to U.S. consumers, but low prices are likely to prove fleeting

Take Me to the Top

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Take Me to the Top

The most common question we have been getting as of late is when is the market pullback going to occur? Stocks are up over to 200 percent from the March 2009 bottom and 75 percent from the most recent market correction (of 15 percent) in October 2011. While it has been almost three years since a major correction, history has shown this trend can continue for quite a bit longer. To that point, Cornerstone Macro Research gathered some data on previous market pullbacks which are highlighted in the chart below.

History shows that there have been numerous periods of much longer durations when stocks have climbed without a major pullback. If you simply look at the fundamentals of the stock market, an argument can be made that the S&P 500 can continue to move higher without a meaningful pullback. First, U.S. economic growth is improving and global GDP should continue to trend in the mid-single digits, resulting in continued earnings growth. Second, with low inflation and low interest rates, the valuation of the equity market is still attractive and the Price-to-Earnings multiple of the S&P 500 still has room for upside from 15.6x at present. While there will always be unforeseen shocks, the risks in the system are not as predominate as we saw in 2011 (Europe debt crisis, U.S. debt downgrade, Fiscal austerity) or 2000 (stretched valuation, falling consumer sentiment, manufacturing data weakening). However, risks that investors should be cognizant of are a spike in oil prices due to Middle East tensions, China’s economic growth slowing meaningfully, and an adverse reaction to Federal interest rate hikes in 2015.

What Do You Do For Money?

Earnings kicked off this week with mixed results from large cap technology. Specifically, there was divergence within the internet ad space, with Google growing and Yahoo stagnant. One wonders how long the Yahoo board will give CEO Marissa Mayer to achieve the turnaround. Intel delivered a strong quarter due to PC upgrades primarily from businesses as Microsoft sunsets its client support for Windows XP. This strength is allowing the company to return cash to shareholders through an announced $20 billion repurchase plan. While Intel stock reacted very favorably to the announcement, it was disconcerting that their mobile business continues to underachieve. This division lost over $1 billion while grossing a mere $51 million in revenue (down from $292 million a year ago). Intel’s move into this area looks to have been a failure which leads us to speculate where they will have to make an acquisition in order to penetrate the market.

Takeaways for the Week

- The start of the earnings season has resulted in no major market moving results

- Tensions in the Middle East and Ukraine may have a minor effect on U.S. markets, and unless we see a spike in oil, they should not hinder economic growth

Slow Ride

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

Slow Ride

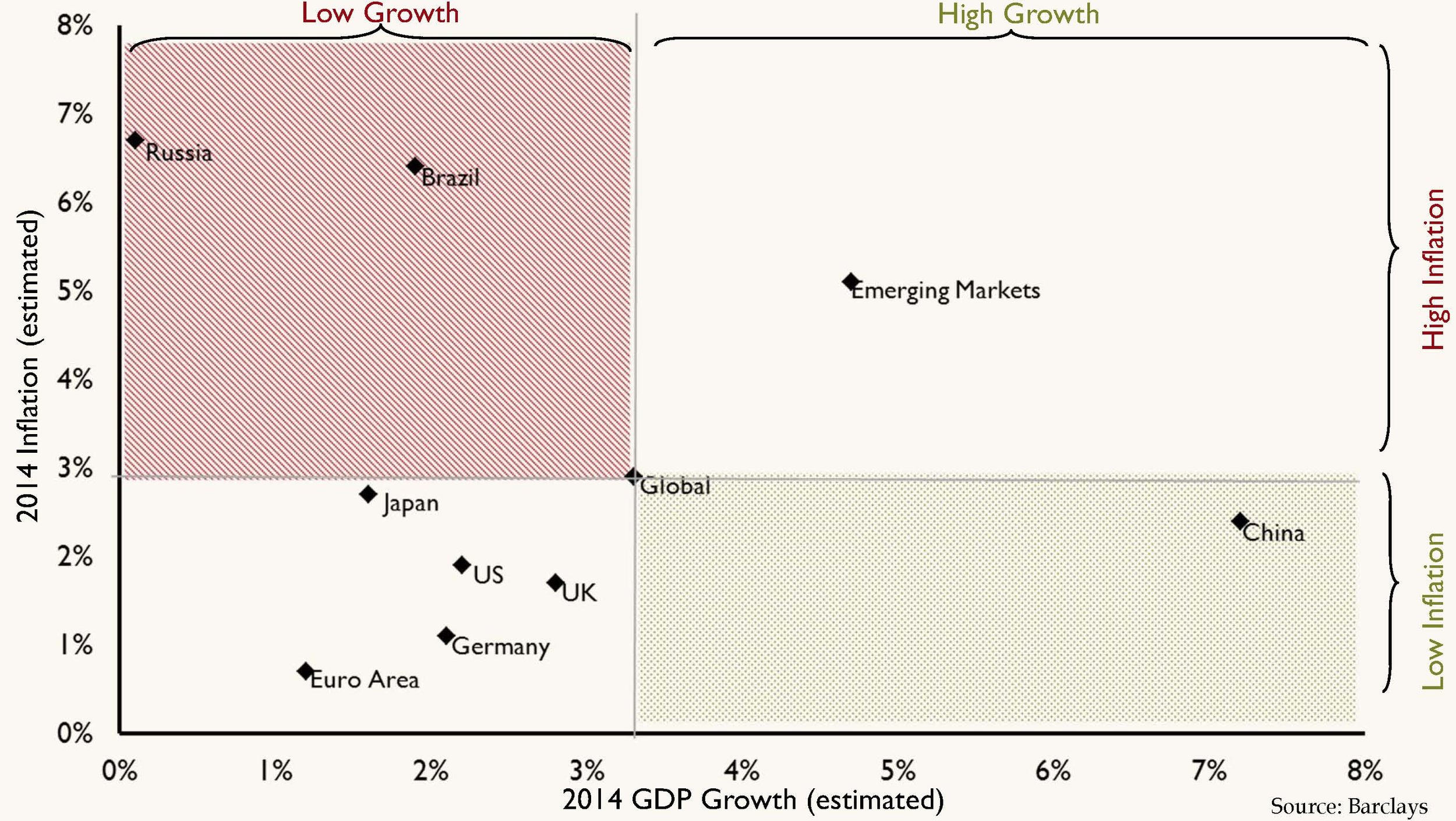

This week, the World Bank lowered their global GDP assumptions for 2014 to 2.8 percent from 3.2 percent. The bank cited the BRICs (Brazil, Russia, India and China) as well as the U.S. as culprits for the lowered estimates. We believe the slowdown in the U.S. is solely a first quarter event due to weather, and we expect to see acceleration throughout the year. China’s growth, though slowing, is still relatively robust and inflation remains under control. Regrettably, Brazil and Russia have not fared as well. As the chart below highlights, Brazil and Russia are stuck in a slowing growth, high inflation environment that is difficult to overcome. With high inflation, there is pressure to raise interest rates, but that leads to increased headwind for growth.

Unfortunately for Brazil, the build up for the World Cup has not provided the added stimulus that was hoped for. Corruption and cronyism have proved to be rampant and the economy has not seen the desired lift. There was the expectation that the employment opportunities would bring about an economic boost for their citizens. However, this hasn’t happened and there remains strong sense of frustration among the public.

London Calling

Earlier this week, there were protests centered in London (with minor demonstrations in Paris and other European cities) due to the growth of the online transportation company, Uber. This company is disrupting the “old” taxi cab model by allowing customers to access drivers of vehicles for hire through a mobile app. This disruption allows consumers to by-pass the classic taxi for a private hire, which in many instances, may be cheaper and more convenient. The company started in San Francisco and is expanding globally.

The protests may have had an unintended counter effect. A lot of the general public, especially in Europe, have not heard of Uber, thus these actions just put the start-up on the front pages. Competition for the general public is usually a good thing in pushing prices down and improving service. However, as a CNBC reporter stated, the French public are in favor of the protests, but that doesn’t come as a surprise “in a country where competition is not really a key word and where a strike is probably some sort of national sport.” On a final note, Uber recently completed a round of financing which valued the company at close to $18 billion.

The Mob Rules

While stocks hit new highs at the beginning of the week, geopolitical issues in the Middle East have tempered those gains. With militants gaining control of key cities in Iraq, the supply of oil has now come into question. This has resulted in a run up in the price of crude. We are of the belief that the price of oil will remain stable as the U.S. continues to increase its supply over the long term. However, we will continue to experience short term volatility due to global tensions and we remain overweight the energy sector based on our thesis that the global economy remains in expansion mode. This recent spike has resulted in the sector being the best performer this last week.

Takeaways for the Week

- Key emerging markets are struggling with flagging growth and high inflation and investors have to be selective

- In aggregate, global growth is still healthy and the U.S. should lead the developed world

- The U.S. will make it out of the first round of the World Cup and Germany will win it all