by Joe Herrle, CFA

Vice President, Alternative Assets

The last time I wrote the blog was April 14 and inflation data was the topic du jour. Serendipitously, the July inflation announcement was the major market event this week. So, to keep me honest, let us revisit some items from the April post.

The week of April 14, March inflation data was released, and prices had risen 8.5% from a year earlier. This was the highest rate in more than 40 years. At the time, energy was the most significant contributor, and we were coming off of a post-Omicron wave of reopening, leading to higher services inflation. Also, at the time, it looked likely that we were near peak inflation as energy prices looked like they would soon fall, and we were coming off of a base effect.

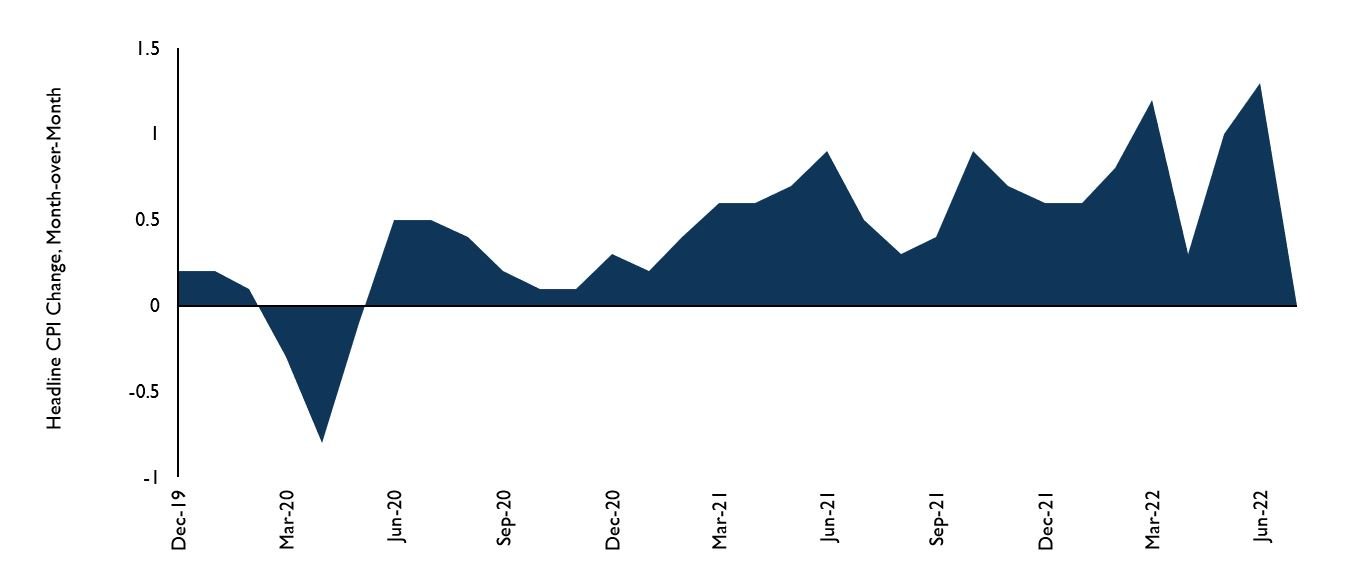

Well, it took four months, but it would appear that we have now reached peak inflation or at least a plateau for now, after reaching 9.1% in June. On Wednesday, the Consumer Price Index (CPI) data was released for July, and prices rose 8.5% from a year ago. This is still a high reading, of course, but month-over-month, prices were FLAT. This makes July the first month since May 2020 without an increase in that measure. Actually, if you don’t round the inflation number, prices fell 0.02% from June to July. Core inflation, excluding food and energy, rose 0.3% — below analyst expectations and the softest since March.

Aside from the CPI number, there is more evidence that we might have hit or are nearing peak inflation:

The Producer Price Index (PPI), a measure of inflation from the perspective of companies that produce goods, declined 0.5% in July from June.

Energy prices have declined during August, with gasoline prices falling over 20% since mid-June.

Supply chain problems appear to be easing.

The growth rate of M2, a measure of the supply of money in circulation, has declined. A decline in the rate of M2 growth generally corresponds to lesser inflation.

However, there is hard data and anecdotal evidence (aside from my grocery bill) that the fight against inflation is not over yet:

Ford is raising prices on F-150 Lightning electric trucks by 18%.

Disney is raising Disney+ ad-free streaming prices by 38%.

Manhattan rents are jumping to a record high.

Average hourly earnings in July accelerated 0.5% from June and 5.2% from a year ago.

Clearly, the Federal Reserve still has its work cut out for it. One month is not a trend, but the recent July inflation print is a move in the right direction. We might not give Fed Chair Jerome Powell a standing ovation just yet, but perhaps a polite golf clap is in order.

Source: Bloomberg

And, importantly, it would appear that the market agrees. The stock market rallied on the inflation data in the belief that the lower reading will take pressure off the Fed to continue with the aggressive 0.75% hike path of the last two meetings. Additionally, the VIX, a measure of market volatility, closed below 20 for the first time since April. This, and the market rally, tells us that market participants believe a soft landing is possible. That is, Jerome Powell does not need to be Volker 2.0 and raise rates aggressively.

Takeaways for the Week

The Summer stock market rally has continued this week, with the S&P 500 rising 16% off the lows in mid-June.

Over 90% of S&P 500 companies have reported earnings, and results have been better than expected. Sales growth of 15.2% and earnings growth of 8.1% exceeded expectations by 3.5% and 3.7%, respectively.