As we came into the week, markets were continuing to sell off in response to the U.K.’s vote to leave the EU. After falling 1.8 percent on Monday, the S&P 500 began to rally on Tuesday. Through today, the market was up over 3 percent this week. International stock marke

Patience

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Patience

It’s been a strange week in “Euroland.” After a resounding “no” vote on the Greek debt bailout referendum last Sunday, it appeared that Greece was on its way out of the Eurozone. Capital markets promptly sold off early in the week.

Today it appears that Greece has delivered a reasonable response. “The program they are presenting is serious and credible,” said French President François Hollande.

We must admit that we have a tad bit of Greek fatigue in recent weeks, but it is clear that Greece is on everyone’s mind these days. The country has presented a 3-year plan, which is better than some of the temporary schemes that have been floating around the past few months. If it is accepted over the weekend, markets should continue to move higher along with yields. The removal of this distraction will allow the ECB to continue focusing on the nascent European recovery.

We continue to have our doubts for the long-term sustainability of Greece within the Eurozone. It doesn’t appear to us that the Greek people are committed to the structural changes that need to take place in order to pay their debts and make their economy more competitive in the future. This will not be the last time we talk about Greece’s debt, economy and leadership.

Roller Coaster

Compounding the volatility induced by Greece was the roller coaster known as the Chinese A-share market. As China tries to open its capital markets, they also must learn how to govern them. Much like holding water in your hands, the tighter you grip, the more water that slips through your fingers. Confidence in the system is the most important element to a successful exchange. The more China tries to prop up their market the less confidence investors have in their system.

We are more concerned with underlying growth in China’s economy than we are with the volatility in their A-share market. It is clear that China’s growth is slowing and it is nowhere near the 7 percent reported by the Chinese government. Growth around the world is challenged and China’s growth is needed until the stimulus by other countries gets their economies growing.

We will continue to monitor their real economy closely in the coming months. We expect growth to pick up around the world in the second half of the year, but that forecast has come into question in recent weeks.

Our Takeaways for the Week

- Proper investment patience kept prudent investors from overreacting in a week packed with news flow

- Growth in the second half of the year should propel markets modestly higher

Spinning Wheel

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Spinning Wheel

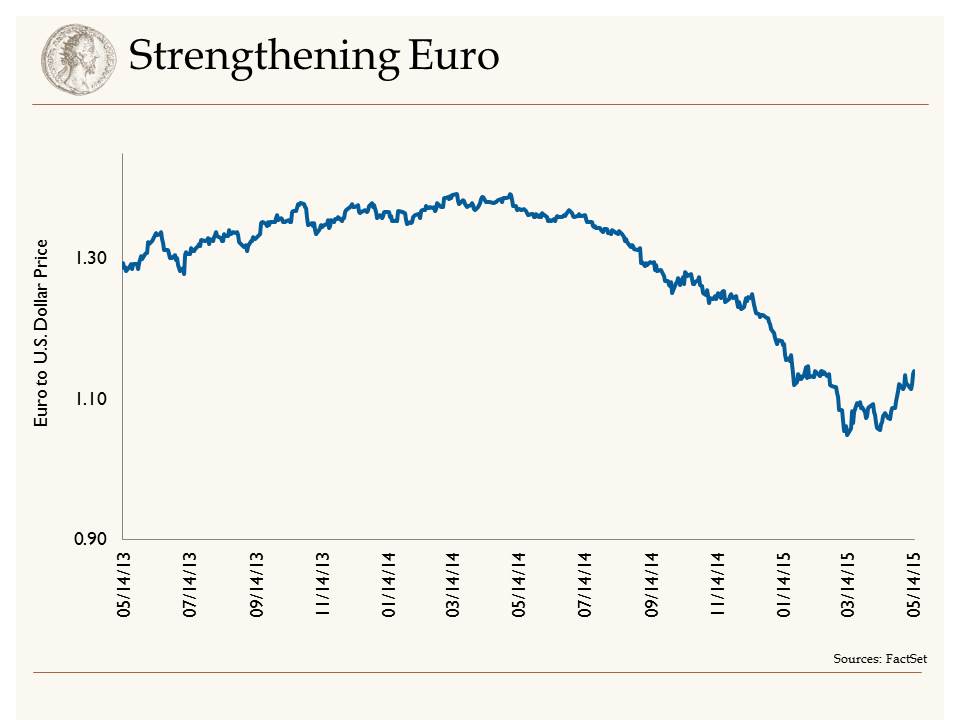

The strong dollar has been a headwind for S&P earnings so far this year. However, that headwind appears to be dissipating. Having traded at $1.40 less than a year ago, by last month the Euro had plunged to $1.05. The Euro's 25 percent devaluation has been a positive development for European economies. Paired with quantitative easing, this has led to a rally in European equity markets.

As confidence has started to build in the Eurozone, we have seen economic growth starting to accelerate. In fact, first quarter GDP in the Eurozone was 1.6 percent, which compares favorably to the meager .2 percent reported in the U.S. for the first quarter. This change at the margin, with Euro growth outpacing U.S. growth, has led to a strengthening of the Euro relative to the U.S. dollar. As Shawn Narancich stated in our March 13 blog, "the dollar was due for a break after such a parabolic run." Since mid-March, the Euro has strengthened 8.5 percent relative to its U.S. counterpart. We view this moderation in dollar strength as a positive for U.S. multi-national companies, and we also see it as a healthy indicator for the capital markets. We still believe that the dollar will strengthen against the Euro as the year moves along, but it will be gradual.

Finally

Along with a rally in the Euro, we have seen a rally in interest rates since the end of January. The U.S. 10-year bond yield bottomed at 1.64 percent in January; today it stands at 2.23 percent. Not only have U.S. bond yields risen over that time period, but so have yields in Europe. After bottoming at .08 percent, the German 10-year bund now stands at a .70 percent yield. We have long maintained that higher global yields would result in higher rates here in the U.S. and we believe yields are finally starting to discount expectations of stronger global growth in coming quarters.

Takeaways for the week:

- The dollar has taken a pause against the Euro, and we view this as healthy for the global economy

- Higher yields are reflecting higher growth prospects in the second half of 2015

Market Letter First Quarter 2015

Please click here to find our Market Letter First Quarter 2015. We hope you find our economic insights interesting and informative.

Pushin' Forward Back

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The official start of earnings season kicks off next week and it looks like earnings for the broad market are going to be negative five percent. There are two main culprits for this. First, the recent strength in the U.S. dollar took large multinational companies by surprise, which resulted in major revenue and earnings revisions lower in 2015. The S&P 500, a standard large cap equity benchmark, has approximately 35-40 percent of its constituent’s revenues outside the United States. Therefore, a major strengthening of the U.S. dollar (see the below chart) results in U.S. goods being more expensive.

For example, if $1.00 = 0.80 Euro, then if a U.S. manufacturer were selling a $100 item in Europe, customers there would be spending 80 Euros. With the recent strengthening, $1.00 is now the equivalent of 0.95 Euros, thus that same $100 item would cost 95 Euros. This is a major price increase and headwind for U.S. exporters. We saw this instance with companies like Microsoft, Caterpillar, and more. On the other hand, the weakening Euro makes those products cheaper in the U.S. Thus, we believe European exporters should stand to benefit from this, and will be a catalyst to stimulating growth in Europe. As such, we recently increased our exposure to the International markets.

Down In a Hole

The other culprit for the major negative revisions for earnings is the reduction in the price of oil. In the past six months, the price of oil has been cut in half which is having a dramatic effect on the earnings in the oil patch. The year-over-year change in energy earnings in the first quarter is a negative 65 percent. Excluding this area of the market, earnings are forecasted to grow by three percent.

Outshined

These two attributes are setting up for a tough year for headline growth numbers. Earnings growth estimates have declined from seven to two percent for 2015. However, if you exclude Energy, earnings growth should come in closer to nine percent. Our belief is the overall economy is improving and the consumer will be the main beneficiary. While recent consumer spending data has been mixed, we are seeing an improving trend, particularly in consumer confidence. Therefore, continued low interest rates and energy prices throughout 2015 are a tax cut for consumers, and with a tightening labor market, we expect to see an increase in wages. This is all setting up to be a good year for “Main Street.”

Our Takeaways for the Week:

- The strong dollar and low oil prices are a headwind for US earnings growth

- Main Street will be the winner in 2015

Take Your Time

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Take Your Time

Greece and Euro Area finance ministers reached a tentative agreement Friday to buy time for Greece to get their financial house in order. The EU has agreed to provide liquidity for up to four additional months if Greece provides a sufficient list of measures they are willing to undertake.1

Greece will have a primary budget surplus in 2015 which means they will have a budget surplus - if you don’t count debt payments. While this may seem unrealistic, it does mean the Greek government could continue to operate if they stop paying their creditors. However, this would not be in the best interest of anyone. Greek bonds would drop in value, as would some of the bonds of other peripheral countries. This situation is known as financial contagion. Greece in and of itself is not a huge economy (it is approximately the size of Indiana), but the world is trying to judge the effectiveness the European Union. Can they hold it together?

We believe that the EU can indeed keep it together in the near-term. In the future, it may be in the best interest of some countries, Greece as one example, to move out of the Eurozone. If a country finds itself politically unable to work within the confines of the European Union, they may want to exit the agreement in order to control their own budgets and currency. The EU would rather have this happen during a time of strength, rather than at a time of ongoing economic stress.

Waiting on a Friend (Fed)

The Federal Reserve board meeting minutes were released Wednesday and markets deemed them to be dovish; meaning that the Fed is afraid of raising rates too soon and choking off a fragile recovery. The surprise to us is that people continue to refer to this as a recovery. Both U.S. GDP and the S&P 500 are at all-time highs and the U.S. passed through recovery territory years ago. While nothing is a foregone conclusion, we believe the Fed will raise rates later this year. There will be a lot of hand wringing over the first Fed rate hike (there always is), but we believe the economy is on very sound footing and can handle higher rates. While it could happen in June, it will most likely happen in the second half of the year. This topic will be discussed ad nauseam throughout the year, but we view tightening as a positive. A rate hike will be a signal to the markets that the financial crisis is officially behind us and extraordinary measures of liquidity are no longer needed.

Takeaways for the Week:

- The Greek debt story is not over, but they do have more time

- We expect the Fed to raise rates later this year

1 Source: Bloomberg

Slowdown?

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The first couple weeks of trading in October have been volatile, primarily on the downside. While the U.S. economy continues to print positive data points, most other regions around the globe seem to be experiencing some headwinds. We continue to see deteriorating economic data coming out of the Eurozone. Germany had been stronger; however, recent data is pointing to the country possibly entering into recession. Industrial production and manufacturing orders came in weak, and this concern has pushed the yield on the 10-year German Bund to 0.84 percent.

China is a wildcard as well. Growth has been slowing moderately; however, Thursday evening technology investors were greeted with bad news from a key component supplier. Microchip Semiconductor, a supplier of chips that go into a broad array of consumer, household and industrial products, issued a warning citing weakness in China. The company believes this is a short-term issue, but demand just three months ago was strong. This resulted in a drubbing of the Philadelphia Semiconductor index and caused the industry to be down over 5 percent on Friday. Even though there may be some general hiccups in demand, we continue to play the semiconductor space through specific technologies and applications, primarily in the wireless space.

We don’t anticipate a slowdown here in the states. The U.S. economy should continue to exhibit solid growth and decouple itself from the rest of the globe. The most recent positive development has been the decline in energy prices over the last couple weeks, which will result in a nice increase of discretionary income for U.S. consumers.

When Doves Cry

The Fed released its meeting minutes earlier this week and the capital markets were pleasantly surprised. There had been some concern that the Fed may become more hawkish and looking to tighten. However, contents of the minutes showed the Fed to be focused on the data. They highlighted benign inflation, a strengthening U.S. dollar (which is positive for low inflation) as well as increased risks of a global slowdown due to Europe’s stalling growth. We still believe that the Fed will be looking to raise the funds rate in the second quarter of 2015. Even though inflation remains low, U.S. economic growth will support the beginning of a rate hike cycle.

European Central Bank President Mario Draghi also signaled his dovish intentions for the ECB earlier this week. At a speaking engagement in Washington D.C., he stated that the bank was willing and able to alter its current bond buying program which may eventually move from just asset-backed securities to actual sovereign debt. We believe the ECB will be active in the market and will attempt to push growth higher to fight any possibility of deflation.

Our Takeaways for the Week:

- While the Eurozone looks to be slowing, U.S. economic growth remains healthy which is positive for both the U.S. dollar and equities

- The Fed will remain data dependent when determining when to increase rates, which probably won’t happen for another 6-9 months