Presenting our fourth quarter 2023 publication of Market Letter titled, “Inflation’s Flame Flickers.”

Dog Days of Summer

Having already digested 90% of the S&P 500’s second quarter results, investors this week parsed earnings for the major retailers still left to report. Despite the likes of Home Depot and Wal-Mart continuing the recent trend of companies delivering better-than-expected earnings, the recent rise in longer-term bond yields is dampening investors’ enthusiasm for stocks.

Third Quarter 2023 Market Letter: Standing Eight Count

Bonds Acting Like Bonds

Today the employment data for the month of June was released and was stronger than analysts’ expectations. Nonfarm payrolls increased 372,000 in the month of June, well above the estimate of 265,000. In addition, average hourly earnings growth moderated on a month-to-month basis, which should help the inflationary pressures in the economy.

Third Quarter 2022 Market Letter: Balancing Act

Read our Market Letter publication for the third quarter 2022 titled, Balancing Act, in which George Hosfield, CFA, Dean Dordevic and Brad Houle, CFA, share our thoughts on inflation, interest rates, recession risk and how to position portfolios in this environment.

Third Quarter 2022 Investment Strategy Video: Balancing Act

Director and Chief Investment Officer George Hosfield, CFA, discusses the Fed raising interest rates, peaking inflation and our view on equities and volatility across all asset classes in our Investment Strategy titled, “Balancing Act.”

Norris Interviewed on Boise Public Radio

Jason Norris, CFA, was interviewed on Boise Public Radio about the Idaho economy and recent market activity.

When It Rains It Pours

On Tuesday, inflation numbers came in hot across most components. According to the release of March inflation figures, consumer prices have risen by 8.5% over the past year and 1.24% month-over-month, a rate of increase not seen in more than 40 years.

Second Quarter 2022 Market Letter Publication: Kryptonite

The second quarter 2022 issue of Market Letter, our quarterly investment publication, titled, Kryptonite.

Raising Rates for the Right Reason

During our collective years in investment management, we’ve come to use several phrases over and over. Our long-time clients may begin to roll their eyes as we repeat an oft-used phrase, “The Fed is raising rates for the right reason.”

The Fed Is Raising Rates … Now What?

The Federal Reserve has maintained near-zero interest rates for nearly two years, and by now, it is clear this extraordinary policy is no longer needed. Over the last several months, continued elevated inflation readings, coupled with a tightening labor market, have led the Fed to suggest rate hikes are coming both sooner and faster than previously expected.

Under the Hood (of Capital Markets)

Inflation was front and center this week with the release of the December Consumer Price Index (CPI) report. Inflation of 7% Headline and 5.5% Core (ex Food and Energy) were in line with consensus expectations.

The Strong Get Stronger

This week, Federal Reserve Board Chair Jerome Powell announced that later this month the Fed will begin “tapering” its asset purchase program now that the economy has moved past the need for extraordinary stimulus. As a reminder, to combat the recessionary effects of the pandemic and stimulate the economy, the Fed reduced interest rates to 0% and reintroduced an asset purchase program to the tune of $120 billion per month. By any measure, this is a remarkably large stimulus program.

Housing Bubble 2.0?

The residential housing market can be characterized as frenzied in many parts of the country, which begs the question — is it in a bubble?

What’s the Deal with Interest Rates?

As investors, it’s important to have a view of the world and what you think the economy is going to do in the coming months and years. This informs all investment decisions from which stocks to purchase to which asset classes to over-or-underweight.

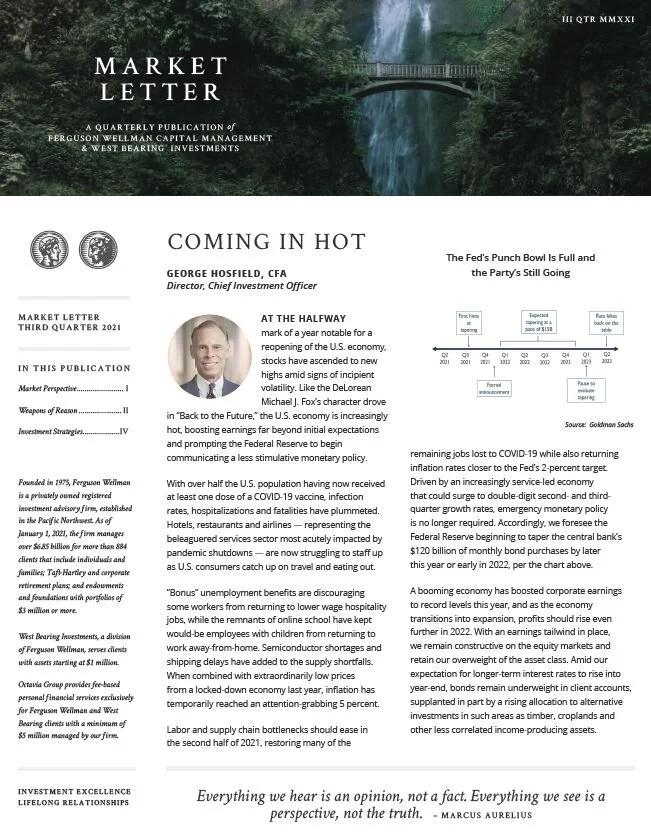

Third Quarter 2021 Market Letter: Coming in Hot

Third Quarter 2021 Investment Strategy Video: Coming in Hot

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Exit Strategy

A year ago, Federal Reserve Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” At this week’s Federal Open Market Committee (FOMC) meeting the Fed took its first tangible steps to lay the groundwork for a gradual removal of the stimulus measures enacted last year.

Statement of Confidence

Federal Reserve Chairman Jerome Powell in testimony to Congress last week said that the increase in Treasury bond yields is a "statement of confidence" in a robust economic outlook.

Yield On, Yield Off

When the Federal Reserve cut their overnight policy rate by a total of 2.0 percent to the zero bound in the fourth quarter of 2008, few investors would have anticipated it would be another seven years before the Fed felt economic conditions warranted raising that policy rate by even one-quarter percent.