by Ralph Cole, CFA

Director, Equity Strategy and Portfolio Management

As investors, it’s important to have a view of the world and what you think the economy is going to do in the coming months and years. This informs all investment decisions from which stocks to purchase to which asset classes to over-or-underweight. Frequent followers of our blog know that we believe the economy is booming and inflation is rising but transitory interest rates will rise. This has indeed been the case since the beginning of the year, but our thesis is being challenged, and we need to check our instruments to make sure we are not missing something.

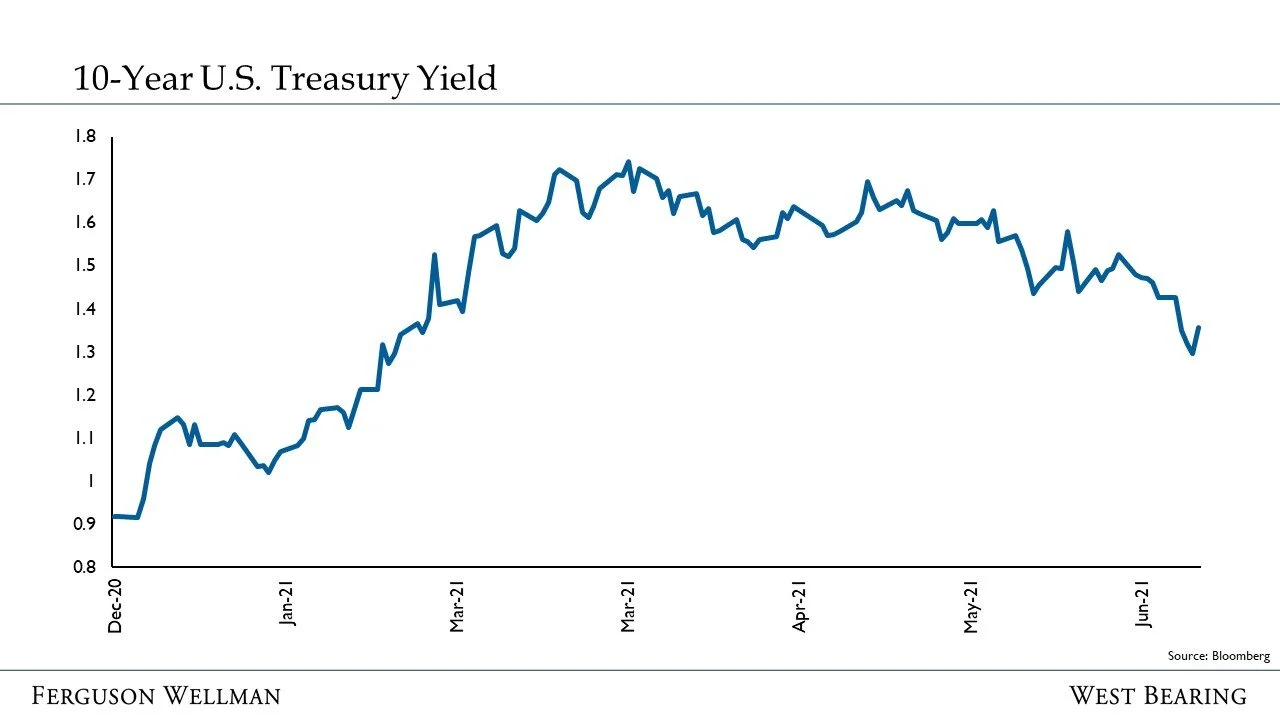

The yield on the 10-year U.S. Treasury peaked in March and has been steadily declining ever since.

What is putting downward pressure on interest rates?

1) The Fed is still purchasing $120 billion of Treasuries and mortgages every month as part of their quantitative easing program

2) Interest rates remain incredibly low around the world, and U.S. Treasury yields represent value relative to European and Japanese interest rates

3) Fiscal stimulus will wane in 2022 and 2023, which will lead to much slower growth in those years

4) People are comfortable with the transitory nature of current inflation readings and believe inflation will be lower later this year

5) The Fed is going to take away the punch bowl too soon, and slow growth in 2022 and 2023

6) After reaching 1.75 percent in March, U.S. Treasuries were simply over-sold, and people started to unwind those trades and now we have reached an over-bought level for bonds

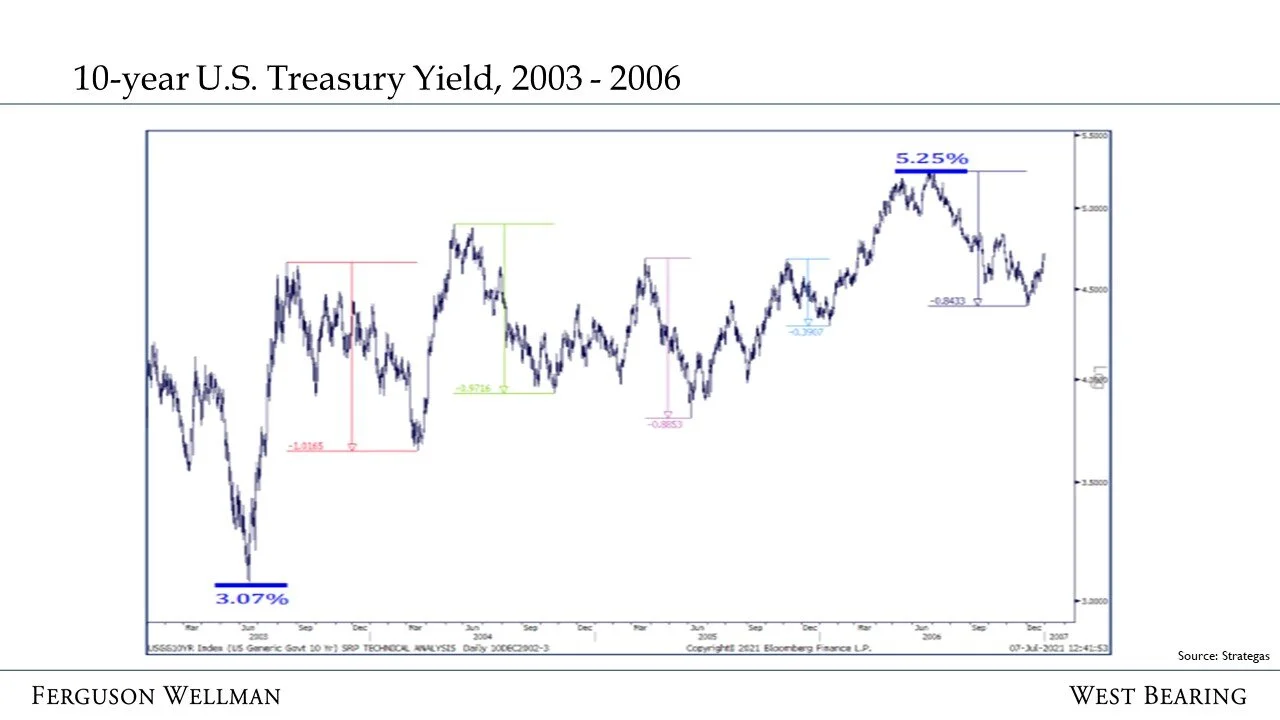

After reviewing as a team the above reasons, we believe all factors played some part in driving rates lower. We agree that the explosive growth of the first half of 2021 is behind us, and growth will be slower in future years, but we believe it will still be robust. We think that this is the pause that refreshes, and rates will continue to grind higher throughout the rest of the year. Much like the stock market, interest rates do not move in a straight line.

Our friends at Strategas shared this great chart on the 10-year yield grinding higher from 2003 through 2006. There were several reversals up and down as interest rates moved from a low of 3.07 percent, to a high of 5.25 percent.

We believe our basis thesis is intact, and thus rates will gradually rise to the 1.75 — 2.25 percent by the end of 2021.

Week in Review and Our Takeaways:

Interest rates have taken a large step backwards since March, and there are several possible reasons for the move

We still believe rates will be higher by the end of the year, but not so much higher as to cut off economic growth