Annual presentation from Ferguson Wellman sharing our views for the year regarding the global economy and capital markets, as well as a planning update from our wealth management team.

What Goes Up, Must Come Down ... Eventually

This week investors shrugged off hotter-than-expected inflation data, one of the most important data inputs for the Fed in deciding its next policy moves. The impact of the Fed aggressively raising rates over the past year has brought inflation down from a whopping 9% in June 2022 to 3% by the end of 2023. The Fed’s ultimate target is 2%. Much like updating a computer, the last bit sometimes takes the longest.

Productivity = Prosperity

By March, our feelings of excitement for a new year have generally worn off and we have settled into our winter routines. The hope of an early spring and longer days are normally what carries us through the season, but this year, more excitement is brewing.

2024 Investment Outlook Webinar Video: Sticking the Landing

Annual presentation from Ferguson Wellman sharing our views for the year regarding the global economy and capital markets, as well as a planning update from our wealth management team.

Fourth Quarter 2023 Market Letter: Inflation's Flame Flickers

Presenting our fourth quarter 2023 publication of Market Letter titled, “Inflation’s Flame Flickers.”

Third Quarter 2023 Investment Strategy Video: Standing Eight Count

Third Quarter 2023 Market Letter: Standing Eight Count

Labor Market in Limbo

It is no surprise that all eyes are focused on the economic headlines – investors and consumers are searching for tangible pieces of information to guide decision-making and create a logical roadmap for 2023. You don’t need to look far to see the latest news plastered across the media: corporate layoffs.

Bonds Acting Like Bonds

Today the employment data for the month of June was released and was stronger than analysts’ expectations. Nonfarm payrolls increased 372,000 in the month of June, well above the estimate of 265,000. In addition, average hourly earnings growth moderated on a month-to-month basis, which should help the inflationary pressures in the economy.

The Calm after the Storm

While it was a relatively quiet week of macroeconomic news, investors are still busy making sense of the inflation and interest rate paradox: that is, inflation stoking recession fears, but also rising rates to combat inflation also stoking recession fears.

When It Rains It Pours

On Tuesday, inflation numbers came in hot across most components. According to the release of March inflation figures, consumer prices have risen by 8.5% over the past year and 1.24% month-over-month, a rate of increase not seen in more than 40 years.

Second Quarter 2022 Market Letter Publication: Kryptonite

The second quarter 2022 issue of Market Letter, our quarterly investment publication, titled, Kryptonite.

The Fed Is Raising Rates … Now What?

The Federal Reserve has maintained near-zero interest rates for nearly two years, and by now, it is clear this extraordinary policy is no longer needed. Over the last several months, continued elevated inflation readings, coupled with a tightening labor market, have led the Fed to suggest rate hikes are coming both sooner and faster than previously expected.

A Quick Look Under the Hood

The S&P 500 is up over 15% this year and up almost 35% over the last 12 months. This week, the Dow Jones Industrial Average eclipsed 35,000 — another “round number milestone.”

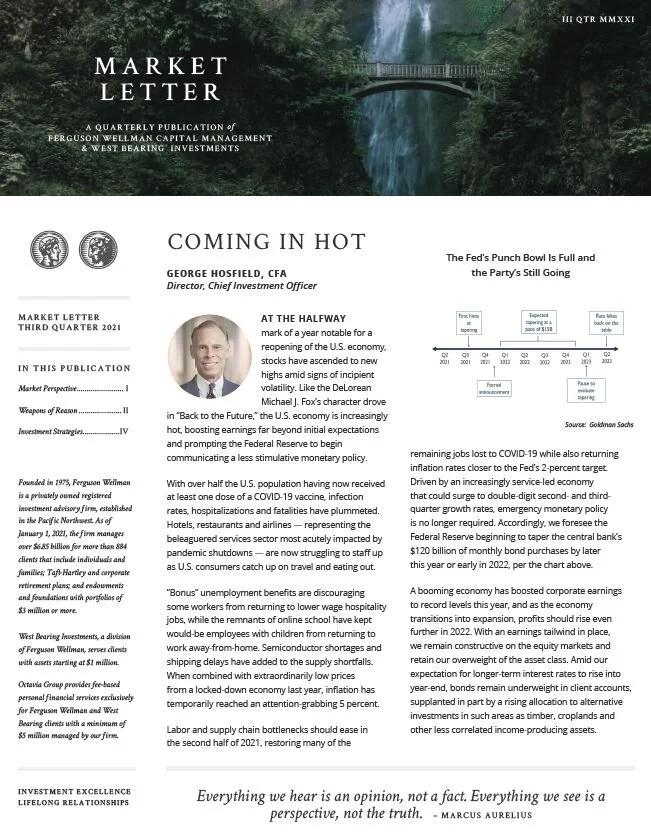

Third Quarter 2021 Market Letter: Coming in Hot

Third Quarter 2021 Investment Strategy Video: Coming in Hot

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Exit Strategy

A year ago, Federal Reserve Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” At this week’s Federal Open Market Committee (FOMC) meeting the Fed took its first tangible steps to lay the groundwork for a gradual removal of the stimulus measures enacted last year.

Second Quarter 2021 Investment Strategy Video: Approaching 88 MPH

Q2 2021 Investment Strategy Video with Brad Houle, CFA, head of fixed income at Ferguson Wellman and West Bearing Investments.