It is no surprise that all eyes are focused on the economic headlines – investors and consumers are searching for tangible pieces of information to guide decision-making and create a logical roadmap for 2023. You don’t need to look far to see the latest news plastered across the media: corporate layoffs.

A series of layoffs were recently announced, concentrated mostly within the technology space. Google announced it was cutting 12,000 jobs, which is a 12% reduction in their workforce. This mirrors a similar announcement from Microsoft where 10,000 jobs were cut. Both companies cited exponential growth during the pandemic resulting in a need for hiring, but economic uncertainty led to the decision to proceed with layoffs. Salesforce, Spotify, and even financial institutions such as Goldman Sachs and Blackrock, have all released similar announcements. Corporate behemoths will always capture the headlines, but we are seeing a similar pattern with temporary workers across the country. Temporary employment is a leading indicator, where other labor market statistics such as the unemployment rate are lagging indicators. As seen below, we have witnessed five consecutive months of declines in temporary employment which is typically viewed as an indicator of broader job losses. This trend was also seen prior to recent downturns in 2001 and 2007-2009.

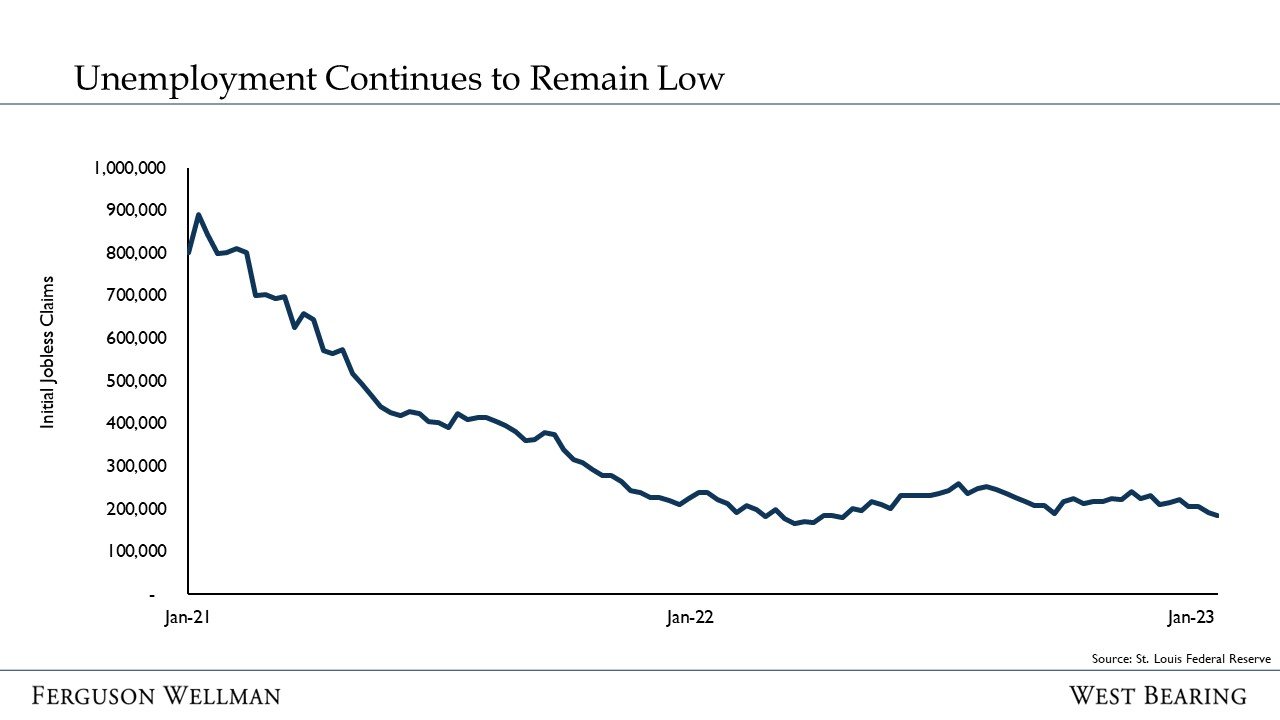

The layoff announcements appear in direct contrast with recent unemployment data - the December unemployment rate of 3.5% is below the 5.7% average seen between 1948 and 2022. Initial jobless claims for the week ending January 21 fell by 6,000 to a seasonally-adjusted 186,000 which is near pre-pandemic levels and indicates the labor market remains tight. Initial jobless claims are also a leading indicator, like temporary employment. To see jobless claims decrease over the last few weeks and still remain below average is an interesting trend when compared to the temporary job losses.

The jobs data will be a key topic of discussion at the upcoming February 1 Federal Reserve meeting and all eyes will be on the labor market. The U.S. is experiencing an “economic dislocation" in that there are more jobs available than unemployed workers. An analysis of the open jobs in November showed a majority were attributed to small businesses, which hire based off the current demand, not the projected. Since small businesses have been having difficulty filling these positions, they are pressured to continue to increase wages to attract workers. The labor market is supported by small business hiring, so when this tapers off, the Fed might get the data they are seeking.

Takeaways for the Week:

Despite the headlines highlighting a slew of corporate layoffs, the unemployment rate and initial jobless claims indicate a healthy labor market.

The next Fed meeting will likely result in a quarter-point hike and should bring the Federal funds rate to a target range of 4.5-4.75%. From there, the Fed will discuss how much more they need to hike rates to result in the economic slowdown needed to curb inflation.