We present our Outlook 2025 publication titled “Lessons Learned,” in which we discuss the resilience of the U.S. economy in 2024, highlighting the significant contributions of major technology companies to profit growth and providing insights on asset allocation strategies for 2025. Additionally, our team of analysts provide a look-back on each of the firm’s strategies and a primer on the environment for each in the year ahead.

A Debt Ceiling Primer

Now that individual taxpayers have submitted their 2022 tax returns and Tax Day 2023 is in the rearview mirror, a largely self-made crisis surrounding raising the debt ceiling will begin to resonate through the halls of Congress, possibly lasting through the summer months.

Market Letter: Stalemate

Dickason Interviewed on KGW

The Federal Reserve's quarter-point rate hike fuels more recession speculation. Blaine Dickason, senior vice president, appeared on Sunrise on KGW News on Friday, March 21 and shared our perspective on what the rate increase may mean for you.

King Dollar

The U.S. government has endorsed a “strong dollar” policy for much of the last thirty years. Besides sounding much better than the alternative, this messaging has reminded markets that the U.S. dollar remains the world’s reserve currency, despite frequent projections of its demise or threats to its dominance.

A Year Like No Other

The recent intensity of economic and earnings data matched the temperatures outside this week. In absolute terms, inflation remains too hot and while there is some evidence of moderation, the Federal Reserve doubled down on its commitment to return inflation to its 2.0% long-term target, suggesting further interest rate hikes through the end of this year.

Have Yields Peaked?

Paul Volcker assumed the chairmanship of the Federal Reserve in August of 1979 and within a year, had raised the target federal funds rate to an eye-popping 20%. This painful but necessary action broke the back of inflation which had run rampant for the prior decade.

The Fed Is Raising Rates … Now What?

The Federal Reserve has maintained near-zero interest rates for nearly two years, and by now, it is clear this extraordinary policy is no longer needed. Over the last several months, continued elevated inflation readings, coupled with a tightening labor market, have led the Fed to suggest rate hikes are coming both sooner and faster than previously expected.

2022 Investment Outlook Video: Extraordinary to Ordinary

Outlook 2022: Extraordinary to Ordinary

Laboring Along

Federal Reserve Chair Jerome Powell’s speech at last month’s Jackson Hole Economic Symposium focused market participants on the labor market ‘speedometer’ that will determine how much and for how long our central bank will maintain its current stimulus measures. The Fed has set a high bar for achieving ‘substantial further progress’ towards full employment.

Are We There Yet?

“Are we there yet?” is a familiar back seat refrain that often occurs during long, summertime road trips involving bored children and their beleaguered parents. As we transition through our second COVID-affected summer, this frustration is also felt by investors and other market participants who long for some return to “normal.” Surely, we must all be there by now, right?

Exit Strategy

A year ago, Federal Reserve Chair Jerome Powell famously said, “We’re not even thinking about thinking about raising rates.” At this week’s Federal Open Market Committee (FOMC) meeting the Fed took its first tangible steps to lay the groundwork for a gradual removal of the stimulus measures enacted last year.

An Inflation Fixation

Both the financial and popular press have been inundated with headlines on inflation. Last week’s higher than expected Consumer Price Index (CPI) report added fuel to this fire. Given the elevated inflation measures reported the last two months, two questions rise to the fore: 1) Is the inflation we are all seeing temporary or long-lasting, and 2) How and over what timeframe will the Federal Reserve address it.

Inflection Points

Earlier this month in an interview with 60 Minutes, Federal Reserve Chair Jerome Powell indicated he believed the U.S. economy “seems to be at an inflection point” due to widespread vaccinations and previously enacted stimulus measures. He added his expectation that the economy would begin to grow “much more quickly” and that the pace of job creation would accelerate.

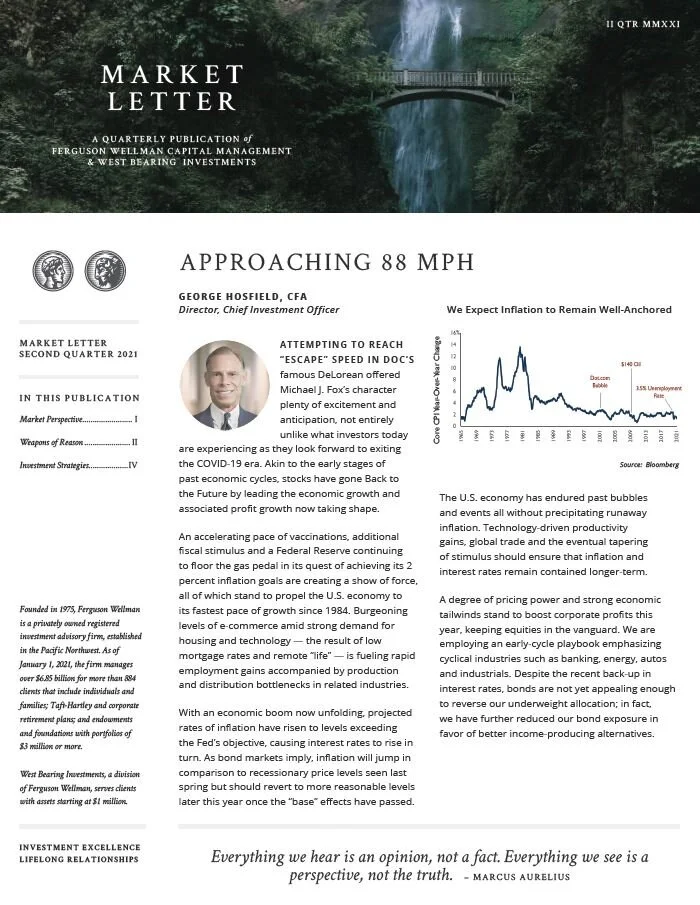

Market Letter Second Quarter 2021: Approaching 88 MPH

Quarterly publication discussing our investment strategies and the capital markets for the second quarter of 2021 titled, “Approaching 88 MPH.”

Inflation and the Recovery

Inflation expectations are rising. Next month, we begin to lap the extraordinarily low inflation measured last year when the pandemic triggered a dramatic reduction of demand for both goods and services globally. Upcoming reports may be elevated when compared to last year’s weak results and we may see 3 to 4 percent increases in inflation this spring.

Reinflation and Rotation

Today’s Bureau of Labor Statistics jobs report spotlighted the difference between Wall Street and Main Street. The net loss of 140,000 jobs in December, driven by the loss of 372,000 restaurants and bar workers, was balanced by the increasing employment in other sectors of the economy, notably the manufacturing sector. These sectors continue to heal from the wrenching effects of the pandemic that took hold in last year’s first quarter.

A Vaccination Rotation

2020 has been such a challenging year for so many, so on this Thanksgiving weekend we offer our thanks to all the healthcare workers who have provided comfort to so many amidst the COVID-19 pandemic. We are also thankful for all the researchers and volunteers who appear to have us at the doorstep of widely available vaccines with the corresponding hope for a return to normalcy. True to form, financial markets have already begun anticipating what a post-vaccine world will look like and asset prices have responded accordingly.

Yield On, Yield Off

When the Federal Reserve cut their overnight policy rate by a total of 2.0 percent to the zero bound in the fourth quarter of 2008, few investors would have anticipated it would be another seven years before the Fed felt economic conditions warranted raising that policy rate by even one-quarter percent.