by Blaine Dickason

Senior Vice President

Trading and Fixed Income Portfolio Management

The recent intensity of economic and earnings data matched the temperatures outside this week. In absolute terms, inflation remains too hot and while there is some evidence of moderation, the Federal Reserve doubled down on its commitment to return inflation to its 2.0% long-term target, suggesting further interest rate hikes through the end of this year. Labeling the U.S. economy in recession remains in doubt as the second consecutive quarter of negative inflation-adjusted GDP is in sharp contrast to nominal, or current-dollar, GDP that has averaged over a 7% increase in the first half of this year. After the busiest week of the quarter for corporate earnings, a greater percentage of S&P 500 companies are exceeding their revenue and earnings estimates when compared to their historic averages. In sum, there was an excess of both signal and noise to sort through this week.

FOMC Hikes Rates 75 Basis Points… Now at “Neutral”

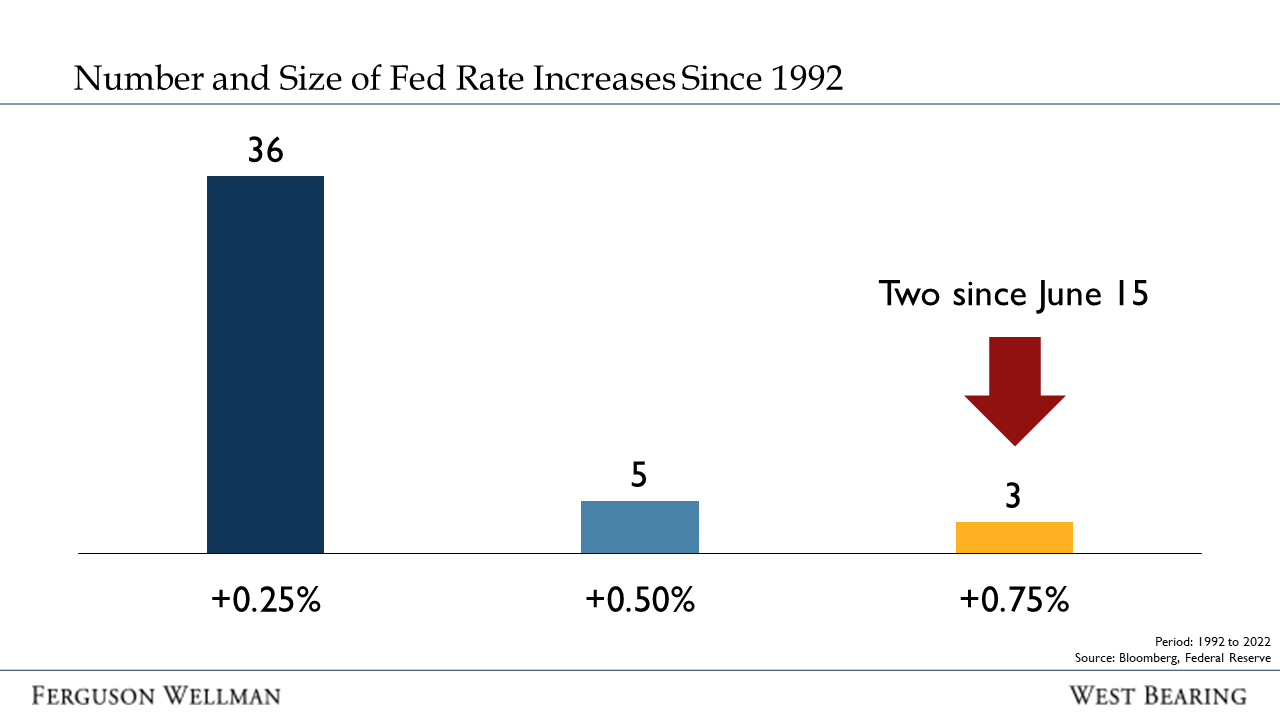

This week, the Federal Reserve increased rates for the fourth time in the current tightening cycle that began in March. Over the last 30 years, there have only been three Fed rate hikes of 0.75% and none greater. Two of those three hikes have occurred in just the last two months. This is a clear sign they are serious, if not behind the curve, in addressing the runaway inflation we’ve all experienced this year. By most estimates, the new Fed funds range of 2.25% - 2.50% is now back to the theoretical “neutral” rate after several years of being stimulative. In simple terms, the Federal Reserve has fully lifted its foot off the proverbial gas pedal but has not yet begun applying significant pressure to the brake.

Based on comments from Fed Chair Jerome Powell, we may have seen our last 0.75% increase this cycle. Hiking rates past neutral will be data-dependent and likely use a more measured approach with less forward guidance. At this point, it is uncertain whether less guidance ultimately means fewer additional rate hikes. In a sense, it is easier for the Fed to quickly hike rates back to neutral; determining how far and how long to continue into restrictive territory is where there is a much greater margin for error.

Source: Bloomberg, Federal Reserve

Interest rate policy is a blunt tool to manage inflation lower and only works if aggregate demand is reduced. It is not effective at addressing the supply-side constraints responsible for much of the current inflationary pressures. As a result, tightening financial conditions can have a long and variable lag time before their full impact is realized. Whether looking at the housing sector, or various manufacturing surveys, it’s clear that higher interest rates are already having their intended effect of dampening demand.

Technical Recession?

Thursday’s report that GDP contracted by 0.9% in the second quarter confirmed what many had feared, namely that the U.S. economy was in a technical recession after consecutive negative GDP reports in the first two quarters of the year. While it may take a few months for the National Bureau of Economic Research (NBER) to weigh in with a formal declaration, the underlying trends confirmed multiple measures of economic activity are indeed slowing down.

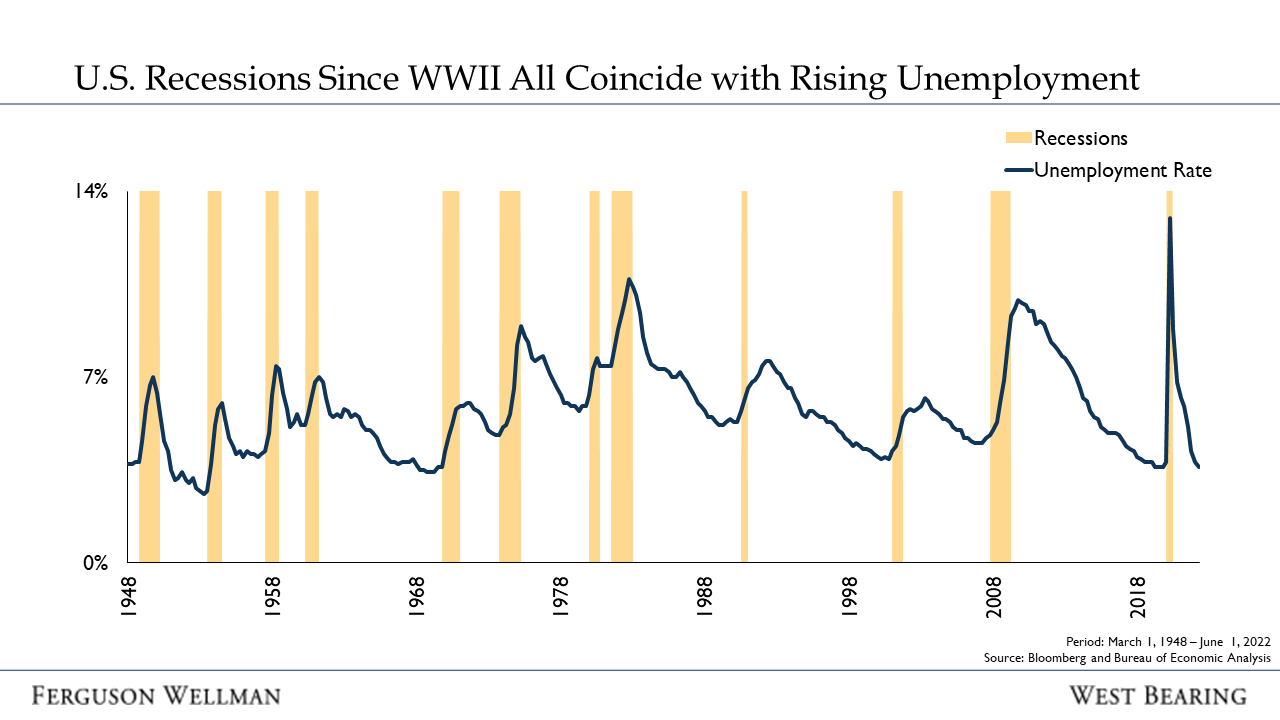

Inventory drawdown in the quarter was enough to tip the final reading into negative territory. Since GDP is reported in real terms, the +8.7% price deflator this quarter reflects the massive gap between the nominal and inflation-adjusted measures of economic output. There have been 12 official recessions in the U.S. since World War II and all of them have had a sharp increase in the unemployment rate. The current combination of strong nominal output and unemployment at fifty-year lows reminds us that significant momentum remains in the economy.

Source: Bloomberg, Bureau of Economic Analysis

Supply constraints continue to be more pervasive and longer lasting than anyone anticipated. As a result, the Federal Reserve is having to “do more” to combat inflationary pressures which carries risks as they tighten financial conditions. There will be two more monthly reports of inflation (CPI) and employment before the Federal Reserve’s next meeting in late September. Optimists will be pulling for further evidence of moderating inflation, giving the economy its best chance for a soft landing. Regardless of whether the first two quarters of the year are labeled a recession, it has been a year like no other.

Takeaways for the Week

The Federal Reserve has increased interest rates four times this year. The average performance of the S&P 500 on those four days is +2.3%

S&P 500 companies are now expected to have grown revenue by 12.1% and earnings by 7.7% during the second quarter of 2022