by Scott Christianson, CFP®

Executive Vice President

Portfolio and Wealth Management

For those with many years before retirement, Social Security appears to be a straightforward arrangement: once you retire, you will receive a monthly check for the rest of your life. However, there are several complexities to be aware of as you approach retirement. For example, the timing of when you begin to take benefits can greatly alter the size of your benefits. The options you choose are impactful, and importantly, are mostly irrevocable. Carefully reviewing your options beforehand can ensure that you put yourself in the best position to maximize benefits.

Qualifying for Retirement Benefits

To be eligible for Social Security benefits, you or your spouse must have worked for at least 10 years (a total of 40 quarters) and must have been earning above the minimum amount that is set each year. For those with a longer work history, benefits are based on the 35 years with the highest amount of earnings. Adjusted annual earnings are factored into a monthly retirement benefit amount and are capped at a maximum set by the Social Security Administration. For 2022, the maximum threshold for taxable earnings is $147,000. For high-income earners who earned above the maximum taxable earnings, their benefits are calculated based on the highest level.

This calculated benefit amount is known as your primary insurance amount, a figure which represents your monthly benefit at (normal) full retirement age. Full retirement age as defined by the Social Security Administration is between ages 66 and 67, depending on your birth year.

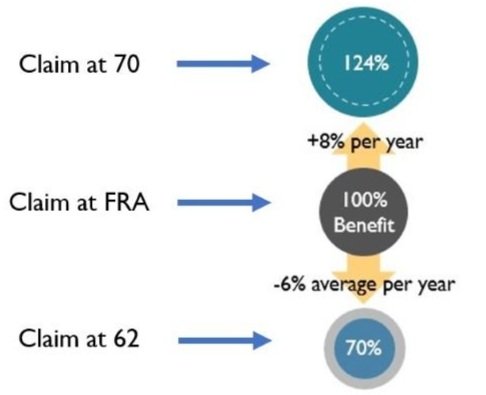

When You Claim Benefits Determines How Much You Will Receive

Although full retirement age falls between ages 66 and 67, individuals can claim benefits starting as early as age 62. However, in order to collect benefits earlier than full retirement age, benefit amounts are reduced by approximately 6% per year. For those looking to claim benefits beyond full retirement age, there is an increased benefit amount of 8% per year until age 70. These adjustments for claiming earlier or later than full retirement age are adjusted for each month you postpone claiming, so you don’t have to wait until your birthday each year to receive the improved benefit. Claiming anytime between age 62 to age 70 will be adjusted accordingly.

Source: J.P. Morgan Guide to Retirement

Monthly benefits are also adjusted each year to reflect the cost-of-living increases overtime. This adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers, differing slightly from headline inflation figures. If there is no cost-of-living increase in the index, benefit amounts stay the same that year.

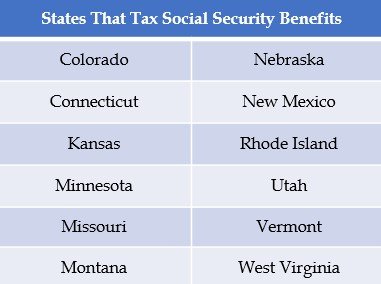

Taxes and Working Can Reduce Benefits

An unfortunate surprise for many retirees is that depending on your income, up to 85% of your social security benefits may be federally taxable. Certain states also levy income taxes on Social Security benefits, thus further reducing the value.

Source: AARP

The Social Security Administration will also reduce your monthly benefit payment to cover the premiums for Medicare Part B. These premium amounts are adjusted annually depending on the costs for coverage set by Medicare. The amounts also factor in your modified adjusted gross income for the year. For higher-earning taxpayers, an income-related monthly adjustment amount extra charge is added to the Medicare premium.

Another surprise that can catch an early Social Security claimer off guard is that working can temporarily reduce your benefits if you have not reached full retirement age. It is important to emphasize, however, that this reduction in benefits is not permanent. Earlier withheld benefits are paid out after you reach full retirement age through a readjusted benefit amount. For those working past full retirement age, there is no reduction in benefits.

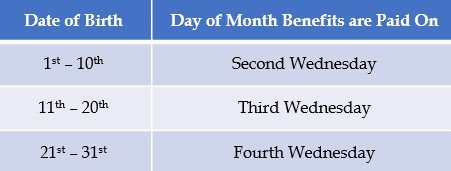

How and When to Apply for Retirement Benefits

In the most practical sense, beginning the process of claiming benefits is rather uncomplicated. You can either start your application online, over the phone or at your local Social Security Administration office. It is advisable to apply for benefits approximately three months before you would like to start receiving them. Benefits are paid out for the month prior, and the day you are paid is based on which week of the month you were born in.

Source: Social Security Administration

The decision of when to claim your benefits is largely a product of your need for cashflow, other resources available to you and importantly, your longevity. For those who are married, divorced, widowed or have minor children, there are additional considerations to review. Our colleague Charissa Anderson, CFP®, CDFA®, recently covered some of these dynamics in the third quarter 2022 issue of our Wealth Management Insights publication.

Using informed decision-making and strategically evaluating your options is the most sensible approach to maximizing your earned benefits. Our wealth management team at Ferguson Wellman and West Bearing has tools to compare and evaluate your options in conjunction with your overall retirement plan.

We encourage you to reach out to your portfolio manager if you have any questions about claiming your Social Security benefits.

Ferguson Wellman, Octavia Group and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.