by Peter Jones, CFA

Senior Vice President

This week, there was a plethora of economic and company-specific news for investors to digest. Specifically, the release of first quarter U.S. GDP, reported quarterly earnings by major technology companies and the unanimous vote by Twitter’s board to approve Elon Musk’s offer to take the company private. In response to this news, the market declined 4%, with all of the weekly losses occurring Friday afternoon.

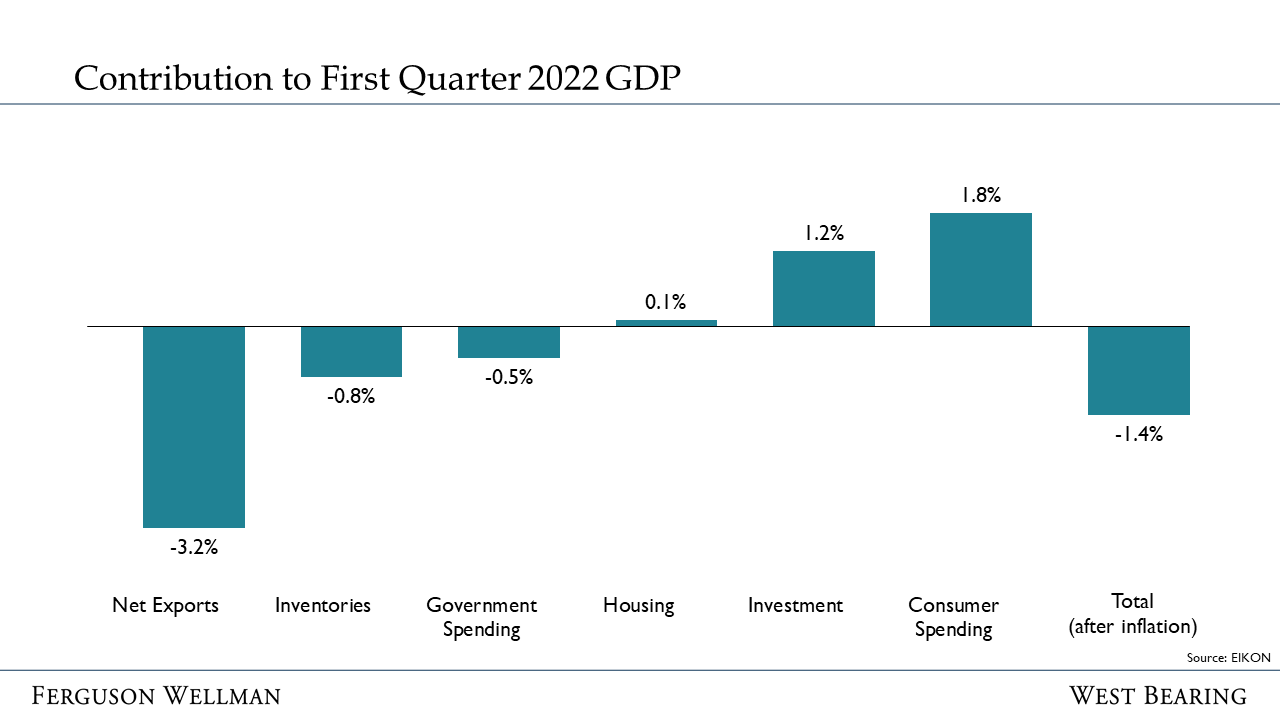

As it relates to GDP, the headline number was broadly disappointing. In fact, after inflation, U.S. GDP shrank at an annual rate of 1.4% compared to last quarter. However, looking beneath the surface, the details were far more encouraging. So much so, in fact, that the market responded by rallying 3% on Thursday when the data was released. Specifically, in nominal (before inflation) terms, the U.S. economy grew at a 6.5% annual rate. Even more, the decline was solely driven by net exports as the U.S. imported an atypically large amount of goods compared to the amount exported. This is largely a function of continued supply chain disruption as the world emerges from the COVID-19 pandemic and a number that is likely to moderate, or even reverse, in the coming quarters.

The economic drag from net exports was an astounding 3.2%. On the flip side, the more important components of economic growth, namely consumer spending and business investment were quite encouraging; consumption grew 2.7% and investment 2.3% compared to the previous quarter. To be clear, we do not believe this data is suggestive of a recession to come in 2022. The components and their contribution to GDP are detailed below.

Source: EIKON

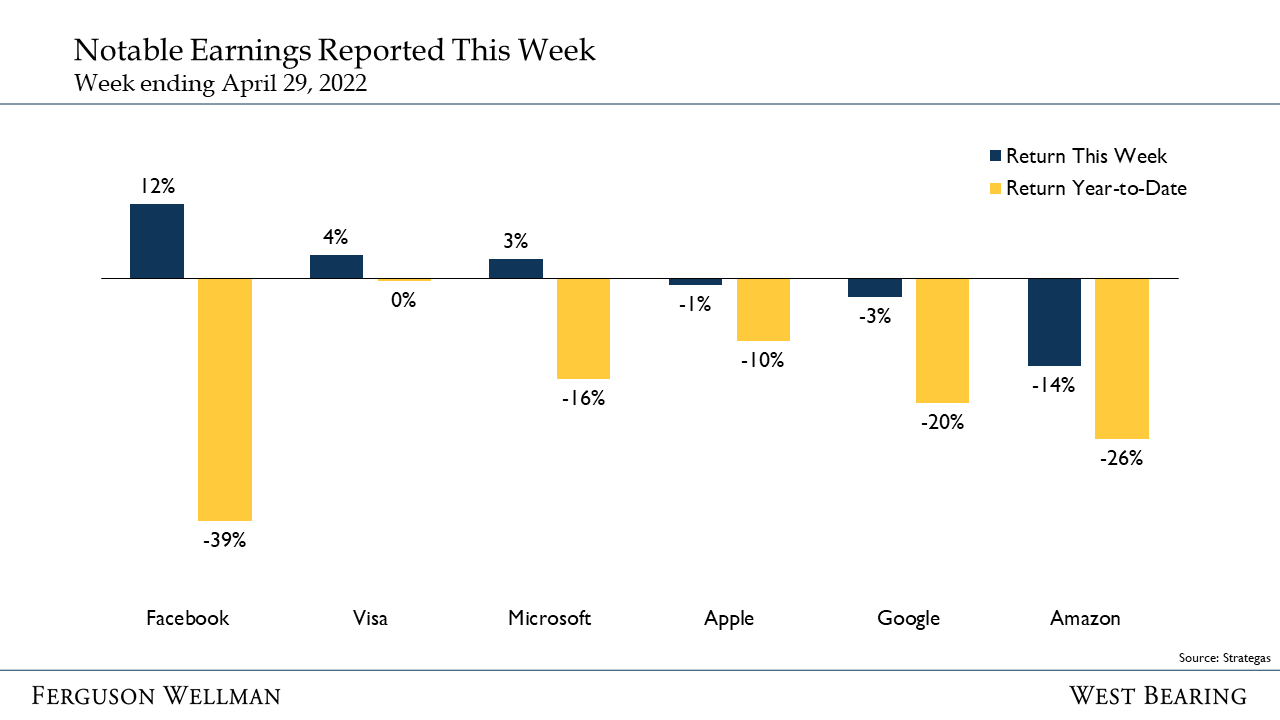

On the corporate side, Apple, Amazon, Microsoft, Google, Facebook and Visa released earnings reports. These bellwether companies account for more than 22% of the S&P 500 market capitalization. Reactions to these reports were mixed, as can be seen in the chart below, with Facebook, Visa and Microsoft in positive territory and Apple, Google and Amazon declining. On balance, these behemoth internet and technology companies have been underperformers so far in 2022. These companies have high valuations due to expectations for durably high levels of growth, and when inflation and interest rates rise, as they have this year, these “growth” companies tend to underperform.

Source: Strategas

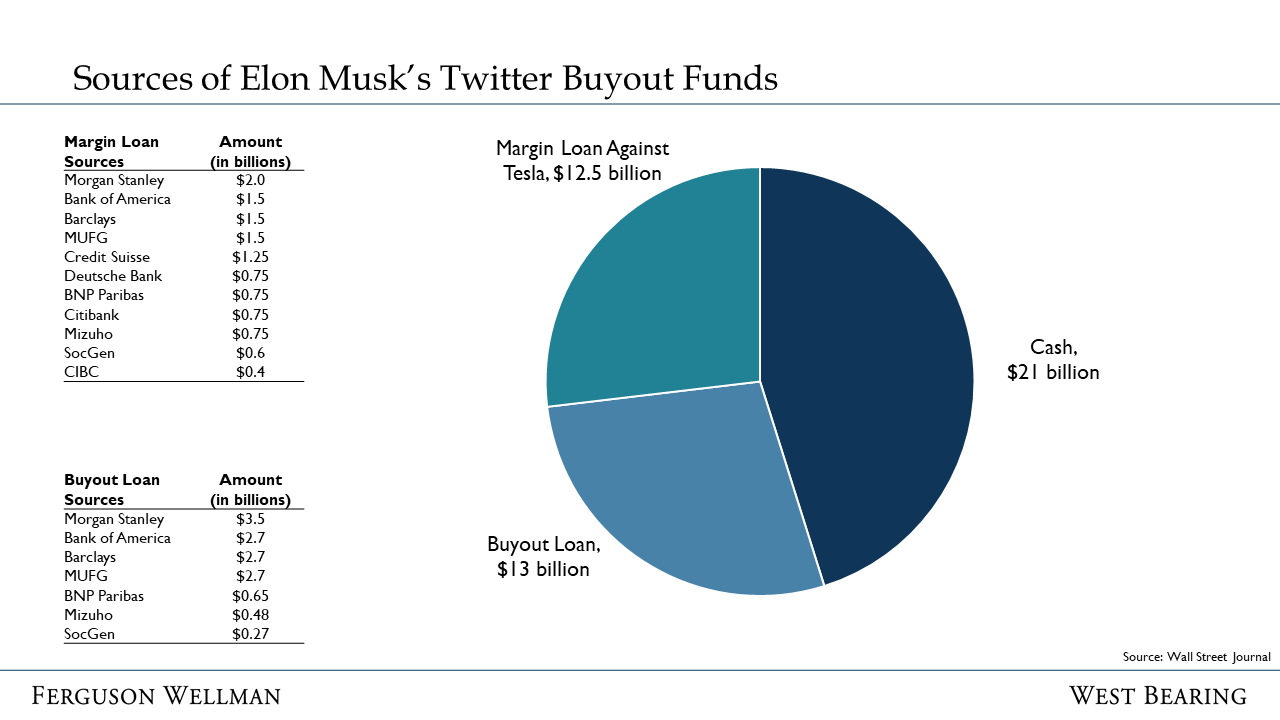

Lastly, and more impactful to the headlines than to the market itself, Twitter’s board unanimously approved Elon Musk’s bid to take the company private. Musk has described himself as a ‘free speech absolutist’ and as such has the goal of less content moderation on the platform. Given this goal, coupled with Musk’s generally eccentric behavior, the announcement has caused a rift between investors, the media and politicians. Despite the lack of antitrust considerations in taking the company private, the risk that Musk will not secure funding or that reactive regulations diminish the appeal of buying the company, Twitter continues to trade at nearly a 10% discount to the price offered by Musk.

A major side story to this brief, yet eventful, negotiation is the impact on Musk’s holdings in Tesla. Tesla stock represents a majority of the world’s richest person’s $200 billion dollar fortune. To fund the purchase of Twitter, Musk would have to both borrow against and sell Tesla stock (graphic below). Perhaps out of fear of Musk’s attention being directed elsewhere in addition to selling pressure in Tesla shares, Tesla stock declined 13% this week, erasing more than $100 billion in market capitalization and $15 billion of Musk net worth.

Source: Wall Street Journal

Week in Review and our Takeaways:

Despite the disappointing headline U.S. GDP number, the details under the surface lend confidence to our thesis that we will not enter a recession this year

Major technology and internet companies reported quarterly earnings this week, with mixed results

Elon Musk’s bid to take Twitter private is more impactful for media headlines than it is for the broader markets