by Jason Norris

Director Equity Research and Portfolio Management

The first three weeks of the second quarter have been tough for both equity and bond investors. After a great start to the year, there hasn't been any place for investors to hide in April. The chart below highlights that the three major equity classes, as well as bonds, have all posted negative returns, with Small Caps now down close to 4% for the year.

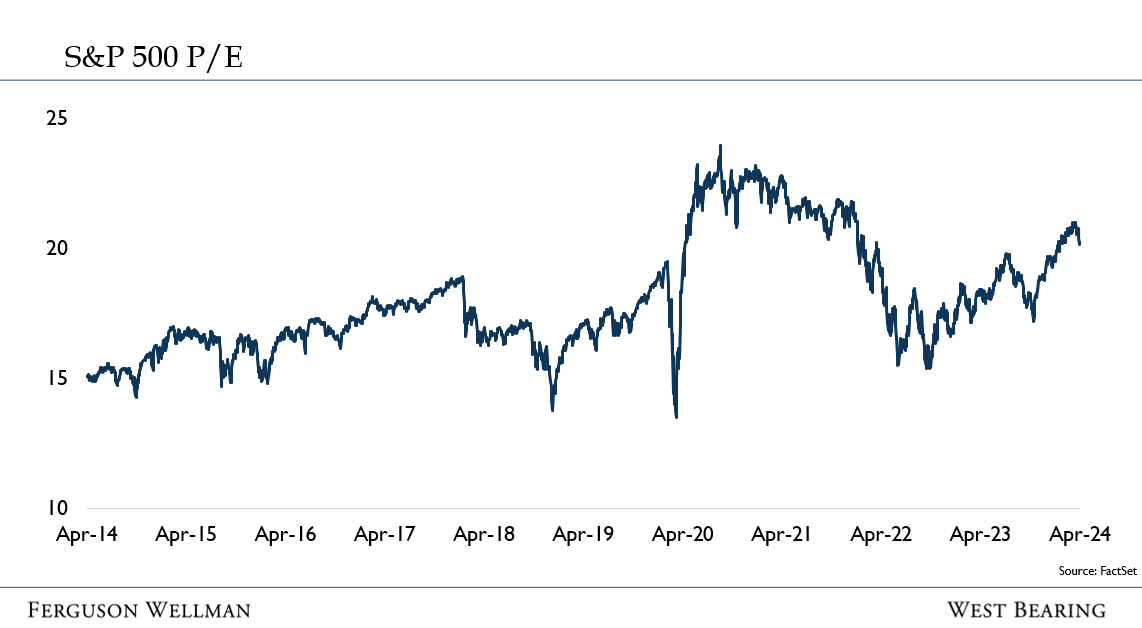

What’s spooked investors has been the increase in interest rates over the last several weeks. Coming into 2024, investors were anticipating the Federal Reserve to lower rates anywhere between 0.75% and 1.50%. However, with the economy continuing to remain strong, the labor market tight and inflation a bit stickier than anticipated, the Federal Reserve has been bringing down these expectations. Thus, we’ve seen the yield on the 10-year treasury increase from 4.0% at the end of March to 4.63%. When rates move up this quickly, it puts pressure on stocks, with valuation often the first thing impacted. The most common valuation metric investors use is the Price-to-Earnings ratio, or P/E. The higher the number, the more “expensive” the stock market is. The P/E of an investment is based on earnings growth and interest rates. If earnings growth is healthy and interest rates are falling and/or low, P/Es can stay higher. However, if rates increase, then that can put downward pressure on P/Es, thus also applying pressure on stocks. The chart below shows the P/E for the S&P 500 which was at the higher end of its historic range at the end of the quarter.

The decline we’ve seen in equities, specifically the S&P 500, has come from contraction of the P/E multiple. Earnings growth has remained strong, estimated to be 10% in 2024. Earnings for the first quarter are even coming in better than expected. While only 14% of the S&P 500 have reported, earnings have beaten expectations by over 5%.

In addition to valuation, company financials are also impacted by higher rates. If a company relies on debt financing, then higher rates increase financial risk. With small cap companies, according to Strategas, 44% of Russell 2000 companies are not profitable, thus higher rates and higher risk.

As such, our focus in client portfolios remains Large Cap quality stocks. We reduced our Small Cap and Emerging Market exposure at the end of 2023 to reduce equity risk.

Tax Man

The U.S. Treasury had its largest one-day receipt of tax collections in history on April 15. $155 billion was sent to the Treasury earlier this week, over $30 billion more than the previous record. With the economy growing, people employed and strength in equities last year, taxes were up.

Takeaways for the Week

Equities continued to trend down this week with the S&P 500 falling over 3%, led lower by Technology stocks and Small Caps.

The labor market shows no signs of recession with unemployment claims still at historic lows.

Next week, one third of the S&P 500 will report earnings, including bellwethers Visa, Google, Microsoft and Chevron.