by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Over When It’s Over

It has been quite a week here in the U.S. on a number of fronts. First, the U.S. men’s soccer team brought society to a halt on Tuesday afternoon with a heartbreak loss to Belgium in the second round of the World Cup. While the game showed just how far we have to go to catch up to the rest of the world, the team made all their supporters very proud. It will be interesting to see if the current soccer enthusiasm will have the “legs” to build on this momentum in the U.S. beyond the conclusion of the World Cup.

What’s Going On

As for the markets, they did not take the holiday-shortened week off as the Labor Department announced May payrolls a day early in observance of the Fourth of July. The numbers were unabashedly strong with a whopping 288,000 jobs added across the nation in May. This strong reading moved the five-month average up to 248,000 which is roughly 60,000 more than we averaged in all of 2013. Perhaps most impressive is the fact that this was during one of the worst winters on record.

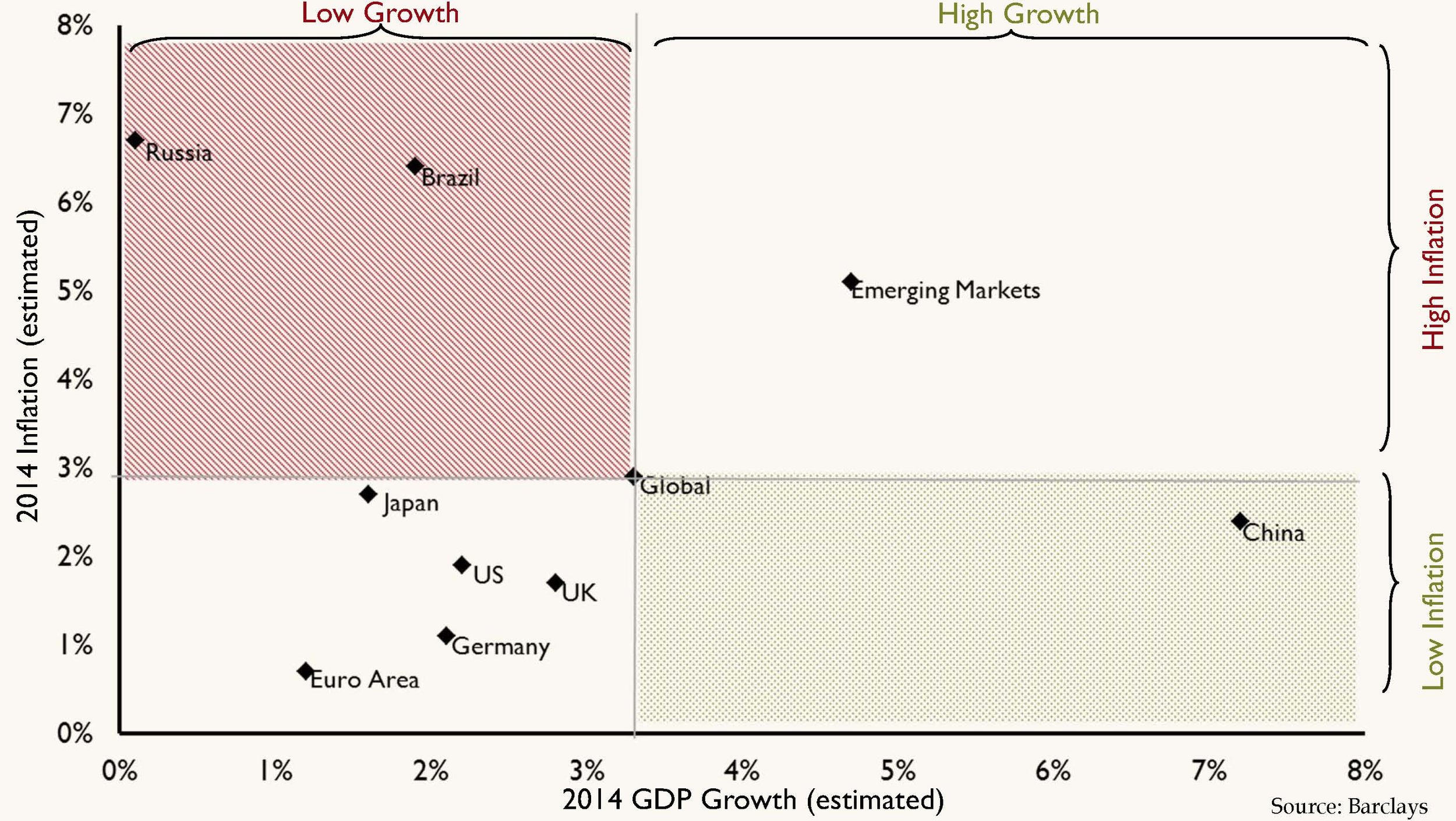

Contrary to just two months ago, all signs now point to an improving economy, but headline GDP numbers have been surprisingly weak. Mark Twain once said, “There are lies, damn lies and statistics.” As investors, we can’t rely on any one statistic to determine the direction of either the economy or the capital markets. Rather, we rely on a mosaic of information that is force-fed to us each day through our computer screens. What that information is telling us today is that we have moved from a tentative expansion to one that appears sustainable. While some may lament the speed of the recovery and robustness of economy, we would point to a lack of excess in any given area.

While consumer spending hasn’t been overly strong, it does appear to be durable because unlike recent economic expansions, this has been not driven by borrowing. While job growth has been somewhat sluggish, it also hasn’t reached inflationary levels. While housing has improved, it is far from the bubble levels experienced in 2005 and 2006 and while the stock market is at record highs, so too are earnings.

So sit back and enjoy it this Fourth of July holiday weekend. Next week we can get back to worrying about an Iraq oil shock, inflation and stock market valuations.

Our Takeaways for the Week

- Strong job growth led the Dow to break 17,000 for the first time

- While the U.S. and the UK are leading this recovery, neither remain in contention for the World Cup