The U.S. government has endorsed a “strong dollar” policy for much of the last thirty years. Besides sounding much better than the alternative, this messaging has reminded markets that the U.S. dollar remains the world’s reserve currency, despite frequent projections of its demise or threats to its dominance.

Spinning Wheel

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Spinning Wheel

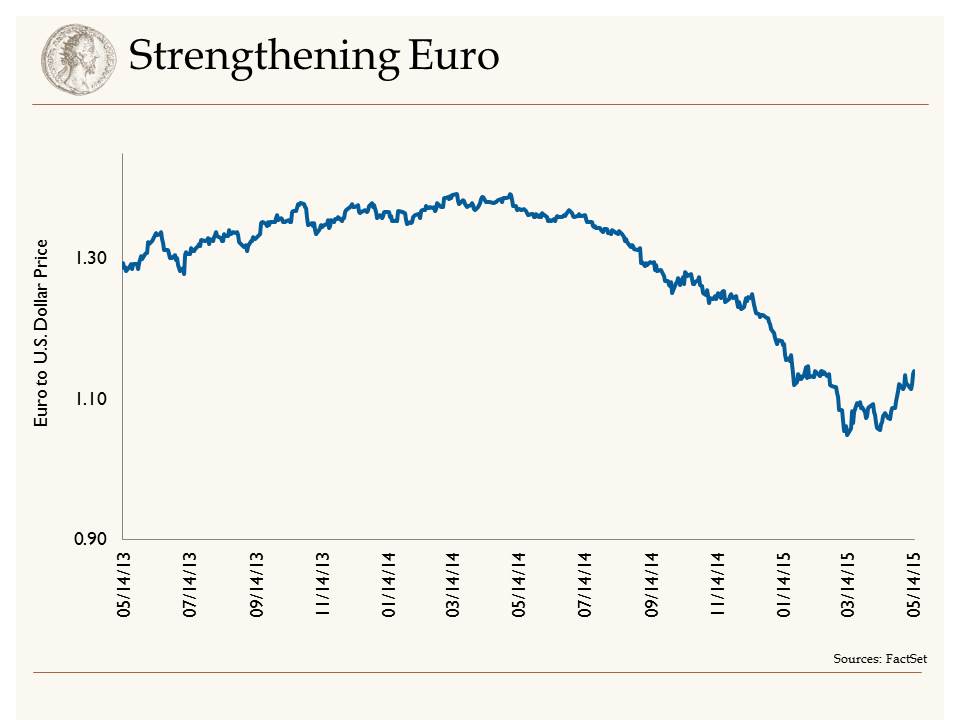

The strong dollar has been a headwind for S&P earnings so far this year. However, that headwind appears to be dissipating. Having traded at $1.40 less than a year ago, by last month the Euro had plunged to $1.05. The Euro's 25 percent devaluation has been a positive development for European economies. Paired with quantitative easing, this has led to a rally in European equity markets.

As confidence has started to build in the Eurozone, we have seen economic growth starting to accelerate. In fact, first quarter GDP in the Eurozone was 1.6 percent, which compares favorably to the meager .2 percent reported in the U.S. for the first quarter. This change at the margin, with Euro growth outpacing U.S. growth, has led to a strengthening of the Euro relative to the U.S. dollar. As Shawn Narancich stated in our March 13 blog, "the dollar was due for a break after such a parabolic run." Since mid-March, the Euro has strengthened 8.5 percent relative to its U.S. counterpart. We view this moderation in dollar strength as a positive for U.S. multi-national companies, and we also see it as a healthy indicator for the capital markets. We still believe that the dollar will strengthen against the Euro as the year moves along, but it will be gradual.

Finally

Along with a rally in the Euro, we have seen a rally in interest rates since the end of January. The U.S. 10-year bond yield bottomed at 1.64 percent in January; today it stands at 2.23 percent. Not only have U.S. bond yields risen over that time period, but so have yields in Europe. After bottoming at .08 percent, the German 10-year bund now stands at a .70 percent yield. We have long maintained that higher global yields would result in higher rates here in the U.S. and we believe yields are finally starting to discount expectations of stronger global growth in coming quarters.

Takeaways for the week:

- The dollar has taken a pause against the Euro, and we view this as healthy for the global economy

- Higher yields are reflecting higher growth prospects in the second half of 2015

Movin' On Up

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Movin’ On Up

U.S. oil production is finally starting to fall. After unrelenting production increases for the past several years, weekly oil production numbers have begun to decrease. In response to falling oil prices rig counts have dropped dramatically here in the U.S. The number of rigs operating in the U.S. is down 53 percent from the peak reached last year. This change has helped to drive West Texas Intermediate (WTI) oil prices back up to the mid-$50 range from a low of $43 just one month ago.

We would be remiss if we didn’t point out that the global demand for oil continues to rise. This is the other half of the supply-demand relationship that ultimately determines oil prices. The International Energy Agency (IEA) increased their expectations for global oil demand an additional 90,000 barrels per day, bringing their 2015 projected increase of daily oil demand to 1.1 million barrels per day.

No Expectations

Earnings season is a fickle, nuanced and fascinating time of year for portfolio managers. After each quarter of business, companies report their earnings and sales to analysts and the public. Companies guide investors to what they think earnings will be in future quarters. When a management team realizes that they are going to materially beat or miss their earnings guidance they announce it before the scheduled earnings release date which is called a pre-announcement. The pre-announcement ratio is calculated by taking the number of negative pre-announcements and dividing it by the number of positive pre-announcements by company. Strategas Research Partners calculates that the ratio is 6.2 to 1 this quarter, versus a long-term average of 2.73. This is actually a very positive contrary indicator for the market. Companies have lowered expectations so much, that they usually end up beating the lowered bar. While this is only a short-term indicator, it may help explain positive stock movements on relatively weak earnings.

Takeaways for the week:

- Oil companies have drastically cut the number of oil rigs operating in the U.S., which will help improve the supply demand balance for crude oil in the coming months

- The stronger dollar and lower energy prices have led companies to pre-announce lower earnings for the first quarter of 2015

S&P: 500 Shades of Profit

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

S&P: 500 Shades of Profit

Blue-chip U.S. stocks are again in record territory, reminding investors of the powerful backdrop that near-universal easy money policy has in keeping the capital markets liquid. The start to 2015 shares parallels with the same period last year, when growth worries precipitated by a severe winter domestically and concerns about Fed tapering gave way to a better economy in the second half of the year. This time around, a seemingly intractable conflict in eastern Ukraine, our next installment of the Greek funding drama and fears of the effects of a strong dollar on fourth quarter profits combined to put a chill in markets to begin the year. But once again, stocks have climbed the proverbial wall of worry as fourth quarter profits have come in better than expected, a new truce in eastern Ukraine between government forces and Russian sponsored rebels was reached, and the new leaders of Greece practice the well-worn art of brinksmanship. The result for fixed income investors is reduced returns as benchmark Treasuries have lost some of their flight-to-safety bid.

Ringing the Cash Register?

With gasoline prices having plunged to the $2.00-per-gallon level, investors could be forgiven for expecting a better retail sales report than that which was delivered for January. Lower gas prices have freed up well over $100 billion of disposable income for the U.S. consumer, so why have retail sales declined for two consecutive months? Clearly, the math of lower fuel prices dampens the headline number, but the expectation is that savings at the pump will be spent elsewhere. Some of the explanation appears to reside in historical data showing that consumers don’t immediately spend windfalls from sources such as tax rebates and savings at the pump and, in deference to the latter, our opinion is that low energy costs will prove to be fleeting. Notwithstanding our skepticism about today’s low price of oil, we would observe that the U.S. consumer is in great shape, benefitting from faster job growth, benign inflation overall and the wealth effect from higher home prices and values of investment portfolios. So despite weakness in the past couple retail sales reports, we believe it’s premature to give up on the U.S. consumer. In fact, we believe consumption expenditures will lead the economy to new record highs in 2015.

Glimmers of Hope in Europe

Despite being disadvantaged by rigid labor laws that prevent free hiring and firing and excessively high tax rates the Continent’s sluggish economy picked up ever so slightly in the final quarter of last year. While a 1.4 percent growth rate is nothing to write home about, it beats recession. It also acknowledges the salving impact of low European interest rates and fuel costs, a dramatically weaker euro that has stimulated export, and tentative labor market reforms in Spain that have begun to have their intended effect. Meanwhile, Germany remains Europe’s economic engine and primary beneficiary of the weaker currency. European investors cheered the economic news and positive developments on the geopolitical front by bidding blue-chip shares there to new 7-year highs.

As the sun begins to set on another earnings season, we feel reasonably good about the results that have been delivered. For the most part, U.S. companies have done a solid job offsetting strong dollar headwinds with continued efficiency gains and additional sales from a relatively healthy U.S. economy.

Our Takeaways from the Week

- As another decent earnings season begins to wind down, U.S. stocks are back at record highs

- Disappointing retail sales in January are likely to give way to healthier gains ahead

Federal Reserve Bank Basics

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

As investors we follow what the Federal Reserve does with a level of geeky interest generally only seen at a Star Trek convention. As a result, the Federal Reserve is a point of interest in our client communications and Outlook presentations. We thought it would be helpful to take a step back and discuss what the Federal Reserve is and what it actually does.

The Federal Reserve is the government’s bank as well as a bank to the bankers. The Federal Reserve has a dual mandate: to provide price stability and full employment. Maintaining price stability is simply not allowing inflation to be too high or too low. Presently, inflation – as measured by the Consumer Price Index (CPI) – is running at about 1.6 percent per year. This is well below the 2 percent target set by the Federal Reserve. The CPI is a basket of goods that includes expenses such as rent, consumer electronics and food. To arrive at the monthly CPI, researchers actually visit stores to price items that go into the calculation that measures inflation.

Too much inflation is a bad thing for an economy because it diminishes the purchasing power of money. Wages often don't adjust upward as quickly as fast-moving inflation, which can cause a decline in standards of living. Hyperinflation occurred in Germany in the early 1920s where the cost of living increased fifteen-fold in six months.

Too little inflation can also be damaging to an economy and ultimately impact the standard of living of consumers. Deflation occurs when prices are dropping which can become a negative feedback loop that triggers economic malaise. As prices drop, consumers delay purchases in hopes of better pricing, which causes the impacted economy's growth to slow. Japan has suffered from deflation for more than a decade. Their central bank is now trying to break the cycle by stimulating Japan's economy in an attempt to resume growth.

The benefits of providing as much employment as possible are fairly simple. Employed citizens pay taxes and have a tendency to buy things, which drives economic growth. The question then becomes … What is the maximum level of employment? Currently, the Federal Reserve considers 5.4 percent to be full employment. Unemployment will never be zero because there is a segment of the working-age population (from 16 to 65) that is unable to work or unwilling to work. This level of full employment varies among different countries. In some European countries full employment is a high-single-digit number and is often a function of the opportunity cost of not working.

How does the Federal Reserve affect change in the economy to meet its dual mandate? This is where the concept of the Federal Reserve gets fairly abstract. The Federal Reserve can raise or lower short-term interest rates to effectively stimulate the economy if it is growing too slowly or "tap the brakes" if the economy is growing too quickly. This link for a video, although a bit dated, does a good job of explaining the nuance of how the Federal Reserve operates.

http://content.time.com/time/video/player/0,32068,57544286001_1948059,00.html

Our Takeaways for the Week:

- We are early in earnings season for the fourth quarter of 2014 and it has been a mixed bag so far. Multinational companies are starting to show the impact of a strong dollar

- This is negatively impacting sales in some cases as a stronger dollar makes goods exported from the United States more expense to consumers in other countries

New Year, New Worries

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Deja Vu

Much like January of last year, U.S. stocks are off to a rocky start in the New Year, thanks to a European economy on the verge of stall speed and a plummeting price of oil that’s making investors feel like something other than a small surplus of excess production is afoot. Even after the recent volatility, blue chip stock prices have still tripled since their lows exiting the financial crisis in 2009 and have outperformed international stocks by a whopping 70 percent over the past five years. The question on everyone’s mind is whether a U.S. economy, having now wrapped up what we expect to have been its third consecutive quarter of 3 percent or better growth, can continue to decouple from troubled economies abroad. We still believe that will be the case, as Americans benefit from lower energy prices and a much healthier job market, but positive equity returns in 2015 aren’t likely to come as easily as they did last year.

Banking on Profits?

Our expectation is for U.S. profits to grow by mid-to-high single digit rates in 2015 but, at least for the final quarter of last year, Wall Street expectations are much more subdued. As the fourth quarter earnings season kicks off, investors are expecting earnings to have grown at just a 1 percent clip, reflecting plunging oil prices that will assuredly dent the profits of big oil companies like Chevron and Exxon. What Wall Street may be missing is the positive impact of low oil and natural gas prices on 90 percent of the market’s constituents that are net users of oil and natural gas. While earnings for multi-national companies are likely to be dampened by the stronger U.S. dollar, a clear plurality of publicly traded companies will benefit from lower energy costs that should help boost profit margins.

Regardless of your persuasion, few will argue about the decidedly poor results that banks delivered this week as JP Morgan, Bank of America, Wells Fargo, and Citigroup reported earnings that collectively fell by 12 percent in the period. Unfortunately for investors, the numbers came up short of expectations in all but one case (Wells Fargo), prompting sell-offs in all four names. While lending volumes have picked up in recent quarters, net interest margins are under pressure as deposit costs remain near zero and new loans are underwritten at increasingly low rates. JP Morgan demonstrated that legal costs related to the housing crash remain a meaningful expense item years after the fact, while each of the investment banks reported disappointing results from fixed income, commodities, and currency trading. As reporting season transitions to a broader swath of companies next week, we expect to see more encouraging results.

Off Target

In a move only mildly surprising to those who have followed its travails in Canada, Target announced this week that it will be exiting the country just two years after its first store opening up north. Having never made a penny there, the general merchandiser’s new CEO Brian Cornell has pulled the plug, acknowledging that management couldn’t foresee profits before 2020. The result of Target’s Canadian misadventures? Nearly $6 billion of accumulated losses and write-downs, equivalent to more than the company’s entire profitability for the past two years combined. Yes, this is what gets CEO’s fired, and is a key reason why prior leader Gregg Steinhafel showed himself to the door early last year.

Our Takeaways from the Week

- Lower stock prices in the New Year reflect worries about flagging growth internationally and dislocations in key foreign currencies

- Fourth quarter earnings season is off to an inauspicious start thanks to disappointing results at four major banks

10 Investment Themes to be Thankful For

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

This week as we gather with friends and family to celebrate Thanksgiving we thought it appropriate to reflect upon recent investment themes for which we are thankful.

Top 10 Investment themes to be thankful for:

- The midterm elections are over. More important than the outcome is the fact that the elections have been decided and the markets have a reprieve from the election cycle until mid-2015. However, like Christmas displays now appearing in stores prior to Halloween, the 2016 election will start to dominate the news far sooner than it needs to.

- The Federal Reserve is more open and transparent than it has ever been in its history. As part of the Bernanke Fed, there was an attempt to be more open and transparent relative to communicating interest rate moves to the markets. This transparency has been continued with the Yellen Fed and has been effective in setting the expectations for investors as to the next moves of the Federal Reserve. This openness helps to mitigate the uncurtaining around Fed actions.

- Unemployment is at 5.8 percent. At the end of 2009 unemployment was at nearly 10 percent. While the labor market has been painfully slow to heal, the rate jobs are being added each month means we should reach theoretical full employment sometime in 2015. Theoretical full employment is thought to be around 5.4 percent unemployment, as every person of working age cannot be employed in the economy due to a variety of reasons.

- Oil prices have declined precipitously this year. While a decline in oil prices has been a headwind for energy stocks, it is great for U.S. consumers. When gas prices decline, it directly puts money into consumers’ pockets and should help consumer discretionary stocks.

- The municipal bond market has extraordinarily low default rates. Despite the recent default in Detroit and Puerto Rico's widely publicized troubles, the municipal bond market defaults are exceedingly rare. According to Moody's, the default rate for the entire 43 years in which the data is available is .012 percent.

- The Federal Reserve is expected to raise short-term interest rates sometime in 2015. This is good news because if this does indeed happen it demonstrates the strength of the U.S. economy. If the Federal Reserve is compelled to raise rates to keep the economy from overheating, it speaks volumes about the robust economic growth in the U.S.

- The United States has a healthy level of inflation in the economy. Inflation as measured by the Consumer Price Index is running at around 1.7 percent annually. Too much inflation in an economy is damaging, such as what was experienced in the United States in the 1970s. Conversely, too little inflation can be toxic to an economy. Deflation is when inflation turns negative and prices grind lower. This can cause a negative feedback look whereby consumers and businesses delay purchases in hope of getting lower prices

- The U.S. dollar is strong. It is said that money flows where it is treated best, and, with the robust U.S. economy, our dollar is appreciating against many foreign currencies. This will spur foreign investment in our financial markets.

- The current economic cycle shows no signs of overheating. A question we get asked frequently is how much longer does this business cycle have to go? Economic cycles die of overheating, not old age. This has been a painfully slow economic recovery that has been around for approximately 5 years. A slow growing economic expansion with no signs of a bubble in the economy has the potential to last.

- Corporate earnings remain strong. According to FactSet Research, of the 487 companies in the S&P 500 that have reported earnings for the third quarter of 2014, 77 percent have reported earnings above the mean estimate and 59 percent have reported sales above the mean estimate. This equated to a blended earnings growth rate of 7.9 percent for the previous year as of the end of the third quarter.