Our initial U.S. economic outlook has generally played out as expected this year: continued (albeit slower) economic growth, persistent inflation, interest rate hikes and increased market volatility. However, Russia’s invasion of Ukraine was an unexpected significant development that further elevated market volatility and dampened the global economic outlook.

Give Me Fuel, Give Me Fire

Equities continue their grind harder and higher this week as optimism for economic growth remains. The S&P 500 finished the week up three quarters of a percent resulting in year-to-date gains of over 14 percent. Yields also ticked up resulting in the 10-year Treasury yielding 2.32 percent.

Market Resilience: Don't Stop Believin'

The resilience of the equity markets has been quite impressive. At the time of the February lows, pessimism was rampant. Faith in the Chinese economy was shaken, gold was on the rise and there were faint whispers of imminent recession. Fast forward six weeks and the S&P 500 has rallied

A New Day Yesterday

With U.S. large cap stocks down over 10 percent, it hasn’t been a happy new year for investors. The Fed tried to alleviate fears this week on Capitol Hill by stating that they realize the current volatility may lead to slower economic growth and thus there will be no March rate hike. While the talking heads weren’t impressed with the statement, we believe that it was a positive and highlighted the fact

May Days and Where Fall May End Up

by Jason Norris, CFAExecutive Vice President of Research

by Jason Norris, CFAExecutive Vice President of Research

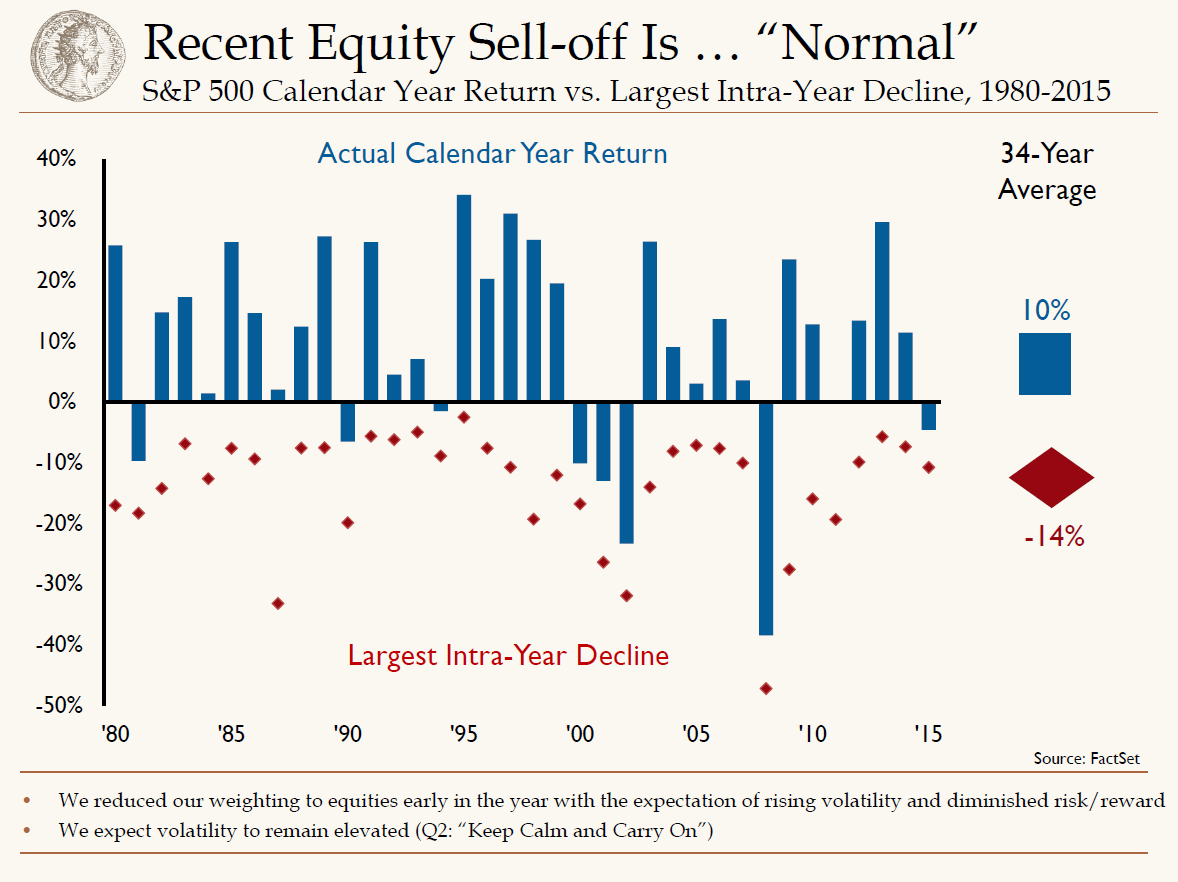

Volatility reigned supreme over the summer. The old Wall Street adage of, “Sell in May and go away,” was prophetic in 2015. Investors had become somewhat complacent the first several months of the year. The market was trading in a relatively tight range and volatility was at a minimum. In mid-May, the S&P 500 closed its all-time high of 2,130.82. As we rolled into June, the media was posing the question, “Should investors sell and move to the sidelines?” June through September is historically the worst period for investing; however, stocks are still positive. Selling in May and going away, in hindsight, would have been the right move. Emerging markets, notably China, Russia and Brazil, began to cause concerns. A major selloff in Chinese equities, lower-than-expected economic growth and a currency devaluation resulted in a major sell off in equities globally. The S&P 500 hit a low of 1,867 for the year at the end August and volatility increased meaningfully. During this period, we had to remind clients that volatility is very common; we have just been in a period of low volatility. In 2013 and 2014, only 15 percent of the time, the S&P 500 was up or down over 1 percent. In 2015, that is closer to 25 percent, which is more in-line with the long-term average. Also, the chart below highlights intra-year volatility; however on average, stocks are still positive.

Over the last 35 years, the average largest intra-year decline has been 14 percent, as shown by the red diamonds. Even in the face of these declines and volatility, the average return for the S&P 500 is 10 percent. This year, we saw a 12 percent drop from peak to trough and we believe that we have already seen the lows of 2015.

As we move into earnings season, the S&P 500 is roughly flat on the year. The volatility experienced in the summer continues as investors sort out exactly how slow global, primarily emerging market, economic growth is? How healthy is the U.S. consumer? And when will the Federal Reserve finally raise interest rates?

Regarding the Fed, the market is discounting a 30 percent chance of a December rate hike. While the employment picture in the U.S. continues to improve, low inflation and global uncertainty has kept the Fed on the sidelines. We believe that the likelihood is closer to 50/50 for a year-end rate. Whenever it occurs, the pace will be a lot slower than previous tightening cycles.

The emerging markets continue to be a headwind to U.S. growth. With recessions in Russia and Brazil, coupled with massive currency devaluations, U.S. exports continue to struggle in those markets. China, while still growing, is slowing. Earlier this month, the Chinese reported GDP growth of 6.9 percent for the third quarter. We believe that the real growth is lower, but positive. The primary slowdown is coming from the industrial areas, while the consumer continues to remain relatively strong. We’ve seen this in the individual companies we follow. For instance, Caterpillar is showing major declines in their business in China, while Apple and Nike are still experiencing growth.

Finally, while exports to emerging markets have been a headwind for the U.S. economy, the key factor is still the consumer. We believe that the state of the U.S. consumer is strong and continues to get better. Consumer confidence is high and wages are slowly moving up. The factor that we are not yet seeing on a meaningful basis is increased spending. The drop in gas prices has resulted in consumers paying down debt, rather than spending more. We believe that eventually this savings will be deployed into the economy as gas prices remain. This will result in an additional tailwind for U.S. economic growth.

With this backdrop, we believe that with interest rates rising and U.S. economy delivering healthy growth, investors should not shy away from equities. If they got out of the market earlier this year due to the volatility, we would be putting those funds back to work.

Our Takeaways for the Week

- Volatility is more common than investors perceive

- We continue to be positive on the U.S. economy and consumer

Upside Down

by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Upside Down

This has been one of the most interesting trading weeks of the year. The seasonal pattern of the stock market is to bottom in October, and rally through the end of the year. While this doesn’t happen every year, so far in October we are following that script. The S&P 500 sold off sharply following the Fed’s decision not to raise interest rates at the September meeting, but found bottom last Friday and has rallied ever since.

Often times the fourth quarter rally is led by names that have performed poorly in the first three quarters of the year. This week was no exception. Through the first nine months of the year energy, materials and the industrial sectors were down 21 percent, 17 percent and 10 percent respectively. Over the last week energy stocks are up 7 percent, the materials sector is up 6.5 percent and industrials are up 6 percent.

Two questions come to mind: First, why did this happen? Secondly, is it sustainable?

Growth stocks were in favor for the first nine months of the year. This is typical during periods of slow global growth as investors are willing to pay handsomely to get the kind of sales growth we have seen in Netflix, Amazon and the healthcare sector. At some point, these names become very expensive. The global slowdown has been led by China, and this past week economic data has been a little better in that country. Probably not enough to signal a huge change in their economy, but enough to spook investors regarding short positions in the more cyclical parts of the market.

As a firm, we believed that oil prices and the energy sector were due to rally because of supply and demand responses in the energy markets. Specifically, low oil prices have caused gasoline demand to rise here in the U.S., while simultaneously causing a drop off in oil production. Historically this combination has always led to higher oil prices and oil rallied nearly 10 percent this week alone.

Whether or not this change in the trend is sustainable remains to be seen. The developed economies of the world remain the engines of growth of the global economy. Demand from the U.S., UK and Europe need to rescue growth in flagging emerging market economies. We believe that this will be the case in the coming months, but doubt that the market will continue its recovery in a straight line. Slow growth accompanied by Fed uncertainty will lead to continued heightened volatility.

Our Takeaways for the Week

- Fourth quarter rallies are common in the stock market, and so far this quarter we are up nearly 5 percent

- We think global growth will accelerate as we move into 2015, supporting the more cyclical sectors of the S&P 500

Never Can Say Goodbye

by Ralph Cole, CFAExecutive Vice President of Research

by Ralph Cole, CFAExecutive Vice President of Research

Never Can Say Goodbye

Market volatility has historically increased before and around Fed tightenings and 2015 is apparently no exception. The Federal Reserve has now held short-term interest rates at essentially 0 percent for nearly 7 years. This policy was deemed necessary to faster recovery from the Great Recession, the biggest financial crisis since the Great Depression. The good news is that the medicine has worked and the “patient”, the U.S. economy, has been out of intensive care for a number of years.

While the U.S. economy is doing fine to varying degrees, the rest of the world appears to be struggling, especially emerging markets. Higher U.S. interest rates will hurt countries that have dollar denominated debt. Slow growth and heavy debt loads have sent emerging market stocks plunging to 5 year lows. Furthermore, if an economy outside of the U.S. has debt that is denominated in U.S. dollars, a stronger dollar hampers their ability to pay back that debt.

All of these factors are now weighing on the Fed’s decision to embark on a tightening cycle. Many believe that a delay is in order because of recent market volatility. On the other hand, Fed governors have signaled that market volatility is not reason enough to delay. Today’s jobs report did not bring much clarity to the situation. Unemployment fell to a new cycle low of 5.1 percent, and jobs grew 173,000 in August. Revisions to the prior 2 months employment growth added another 44,000 jobs than previously estimated. The market sold off today because those numbers might be strong enough to justify tightening in September. The jury is still out on these decisions and we will simply have to wait and see what the data dependent Fed decides when they meet in two weeks. We continue to believe that modestly higher rates would be a “good” thing and are confident that the U.S. economy can handle slightly higher interest rates in the coming year.

Our Takeaways for the Week

- Market volatility always accompanies the onset of a Fed tightening cycle

- Despite higher rates, the U.S. economy and stock market can continue to prosper