As of Thursday this week, roughly one-third of the S&P 500 companies have reported earnings for the fourth quarter of 2016. Of the 171 companies that have reported earnings 8 percent were in-line with expectations, 19 percent had a negative surprise and 72.6 percent reported a positive

Spinning Wheel

by Ralph Cole, CFA

Executive Vice President of Research

by Ralph Cole, CFA

Executive Vice President of Research

Spinning Wheel

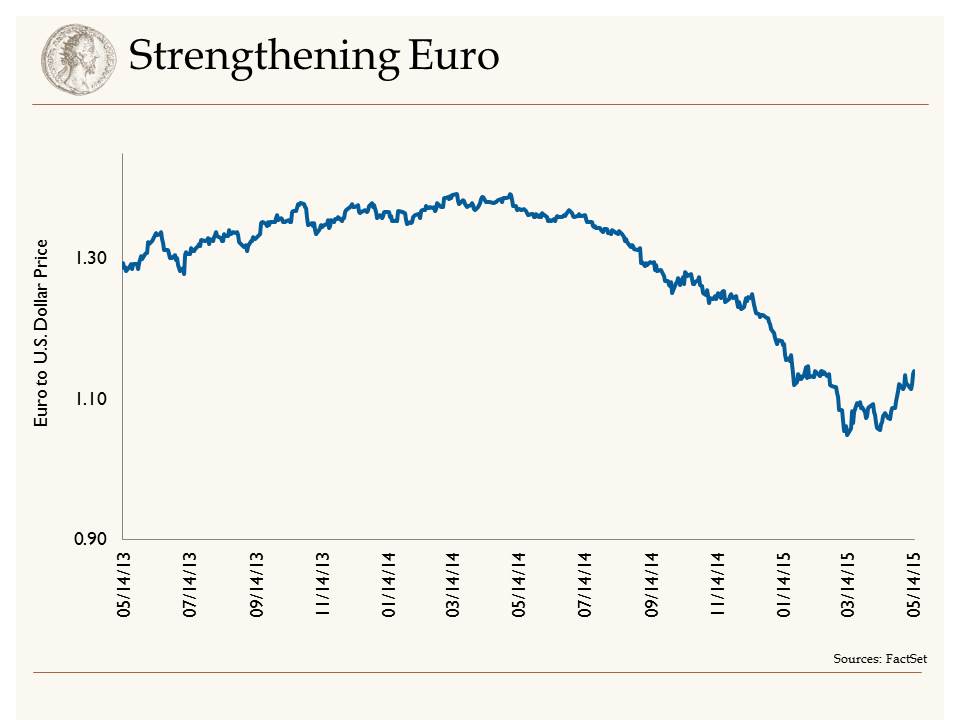

The strong dollar has been a headwind for S&P earnings so far this year. However, that headwind appears to be dissipating. Having traded at $1.40 less than a year ago, by last month the Euro had plunged to $1.05. The Euro's 25 percent devaluation has been a positive development for European economies. Paired with quantitative easing, this has led to a rally in European equity markets.

As confidence has started to build in the Eurozone, we have seen economic growth starting to accelerate. In fact, first quarter GDP in the Eurozone was 1.6 percent, which compares favorably to the meager .2 percent reported in the U.S. for the first quarter. This change at the margin, with Euro growth outpacing U.S. growth, has led to a strengthening of the Euro relative to the U.S. dollar. As Shawn Narancich stated in our March 13 blog, "the dollar was due for a break after such a parabolic run." Since mid-March, the Euro has strengthened 8.5 percent relative to its U.S. counterpart. We view this moderation in dollar strength as a positive for U.S. multi-national companies, and we also see it as a healthy indicator for the capital markets. We still believe that the dollar will strengthen against the Euro as the year moves along, but it will be gradual.

Finally

Along with a rally in the Euro, we have seen a rally in interest rates since the end of January. The U.S. 10-year bond yield bottomed at 1.64 percent in January; today it stands at 2.23 percent. Not only have U.S. bond yields risen over that time period, but so have yields in Europe. After bottoming at .08 percent, the German 10-year bund now stands at a .70 percent yield. We have long maintained that higher global yields would result in higher rates here in the U.S. and we believe yields are finally starting to discount expectations of stronger global growth in coming quarters.

Takeaways for the week:

- The dollar has taken a pause against the Euro, and we view this as healthy for the global economy

- Higher yields are reflecting higher growth prospects in the second half of 2015

Pushin' Forward Back

by Jason Norris, CFA

Executive Vice President of Research

by Jason Norris, CFA

Executive Vice President of Research

The official start of earnings season kicks off next week and it looks like earnings for the broad market are going to be negative five percent. There are two main culprits for this. First, the recent strength in the U.S. dollar took large multinational companies by surprise, which resulted in major revenue and earnings revisions lower in 2015. The S&P 500, a standard large cap equity benchmark, has approximately 35-40 percent of its constituent’s revenues outside the United States. Therefore, a major strengthening of the U.S. dollar (see the below chart) results in U.S. goods being more expensive.

For example, if $1.00 = 0.80 Euro, then if a U.S. manufacturer were selling a $100 item in Europe, customers there would be spending 80 Euros. With the recent strengthening, $1.00 is now the equivalent of 0.95 Euros, thus that same $100 item would cost 95 Euros. This is a major price increase and headwind for U.S. exporters. We saw this instance with companies like Microsoft, Caterpillar, and more. On the other hand, the weakening Euro makes those products cheaper in the U.S. Thus, we believe European exporters should stand to benefit from this, and will be a catalyst to stimulating growth in Europe. As such, we recently increased our exposure to the International markets.

Down In a Hole

The other culprit for the major negative revisions for earnings is the reduction in the price of oil. In the past six months, the price of oil has been cut in half which is having a dramatic effect on the earnings in the oil patch. The year-over-year change in energy earnings in the first quarter is a negative 65 percent. Excluding this area of the market, earnings are forecasted to grow by three percent.

Outshined

These two attributes are setting up for a tough year for headline growth numbers. Earnings growth estimates have declined from seven to two percent for 2015. However, if you exclude Energy, earnings growth should come in closer to nine percent. Our belief is the overall economy is improving and the consumer will be the main beneficiary. While recent consumer spending data has been mixed, we are seeing an improving trend, particularly in consumer confidence. Therefore, continued low interest rates and energy prices throughout 2015 are a tax cut for consumers, and with a tightening labor market, we expect to see an increase in wages. This is all setting up to be a good year for “Main Street.”

Our Takeaways for the Week:

- The strong dollar and low oil prices are a headwind for US earnings growth

- Main Street will be the winner in 2015

One Thing Leads to Another

by Shawn Narancich, CFAExecutive Vice President of Research

by Shawn Narancich, CFAExecutive Vice President of Research

Too Much of a Good Thing?

As Europe begins to make a down payment on its one trillion euro quantitative easing program, the U.S. dollar’s rapid gains have become parabolic and begun to take a dent out of investors’ U.S. stock portfolios. A strong currency is commonly cited for its endearing qualities of reducing inflation and attracting investment, but with the trade-weighted dollar up almost 25 percent since last summer, more and more companies are watching their bottom lines suffer as foreign profits get translated into fewer dollars. We would observe that when an asset’s orderly gains begin to rise at an accelerating rate, the asset is beginning to resemble a bubble, regardless of whether it is tech stocks in early 2000 or the dollar at present.

Bidding Adieu to ZIRP

Because the U.S. economy continues to outpace those of other developed nations at a time when the Fed is preparing to raise interest rates, we aren’t calling for a top on the dollar, but we do believe it is due for a breather. What we would conjecture is that the best of the greenback’s gains may have already been realized, acknowledging that while the Fed’s mandate to promote full employment is being realized, it is in danger of falling short of its other goal, that of maintaining stable prices (defined roughly as two percent inflation). We envision lift-off from the Fed’s zero interest rate policy (ZIRP) later this year, but with inflation increasingly subdued at the imported goods level in addition to that caused by lower oil prices, the Fed is unlikely to tighten as aggressively as the dollar would imply.

Skate to Where the Puck Will Be

We observe in bemused fashion the financial press waxing bearish about the supposed lack of storage capacity for U.S. oil production. Yes, storage builds have occurred at the Cushing, Oklahoma delivery site for the commonly quoted West Texas Intermediate (WTI) oil contract, as an unusually large amount of refining capacity has been temporarily idled for seasonal maintenance and one northern California refinery is offline because of the United Steelworkers’ refinery strike. This too shall pass. With gasoline refining margins now surpassing the robust level of $30/barrel (thanks to strong demand stimulated by low pump prices and discounted WTI oil), refiners are heavily incented to return idled capacity as soon as possible.

Always Darkest Before the Dawn

Are oil prices at a bottom today? Markets tend to overcorrect on the way up and do the same thing on the way down, so although fundamentals of the oil market don’t appear to support $45/barrel oil for any substantial length of time, the price of oil could go lower in the next month or two. But we don’t manage client portfolios with a one or two month time horizon and what we will say is that this cycle is playing out just like we would expect. U.S. drilling activity has plummeted in response to low oil prices, down 42 percent since September, while demand for gasoline, diesel and jet fuel hasn’t been this robust in years. By our estimation, faster demand growth and U.S. production that we believe is set to begin declining are the key ingredients to a recipe for higher prices in the second half of this year. Being overweight energy stocks has not felt good lately, but we are confident that the bearish headlines on oil herald something much more constructive for energy investors.

Our Takeaways from the Week

- Increasingly heady dollar gains are beginning to negatively impact U.S. stock prices

- The most recent declines in oil appear long in the tooth