We present the fourth quarter 2024 Market Letter publication titled, “Awaiting the Score,” in which Chief Investment Officer George Hosfield, CFA, outlines the positive impact of receding inflation, renewed profit growth and the Fed’s monetary policy on investors. Krystal Daibes Higgins, CFA, discusses the skepticism and evolving debate around the ROI of artificial intelligence (AI). Lastly, Brad Houle, CFA, asks the question, “How Far, How Fast?” when it comes to the Fed’s rate cuts.

Houle on KOIN Wallet Wednesday

Cooling of the Labor Market

As we celebrate Labor Day this weekend, we thought it appropriate to look at the current employment situation in the United States. The job market has been surprisingly robust since the elevated unemployment due to the COVID-19 pandemic and economic shutdown.

Federal Reserve Bank Basics

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

As investors we follow what the Federal Reserve does with a level of geeky interest generally only seen at a Star Trek convention. As a result, the Federal Reserve is a point of interest in our client communications and Outlook presentations. We thought it would be helpful to take a step back and discuss what the Federal Reserve is and what it actually does.

The Federal Reserve is the government’s bank as well as a bank to the bankers. The Federal Reserve has a dual mandate: to provide price stability and full employment. Maintaining price stability is simply not allowing inflation to be too high or too low. Presently, inflation – as measured by the Consumer Price Index (CPI) – is running at about 1.6 percent per year. This is well below the 2 percent target set by the Federal Reserve. The CPI is a basket of goods that includes expenses such as rent, consumer electronics and food. To arrive at the monthly CPI, researchers actually visit stores to price items that go into the calculation that measures inflation.

Too much inflation is a bad thing for an economy because it diminishes the purchasing power of money. Wages often don't adjust upward as quickly as fast-moving inflation, which can cause a decline in standards of living. Hyperinflation occurred in Germany in the early 1920s where the cost of living increased fifteen-fold in six months.

Too little inflation can also be damaging to an economy and ultimately impact the standard of living of consumers. Deflation occurs when prices are dropping which can become a negative feedback loop that triggers economic malaise. As prices drop, consumers delay purchases in hopes of better pricing, which causes the impacted economy's growth to slow. Japan has suffered from deflation for more than a decade. Their central bank is now trying to break the cycle by stimulating Japan's economy in an attempt to resume growth.

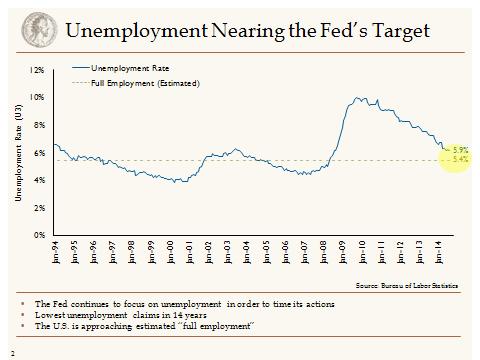

The benefits of providing as much employment as possible are fairly simple. Employed citizens pay taxes and have a tendency to buy things, which drives economic growth. The question then becomes … What is the maximum level of employment? Currently, the Federal Reserve considers 5.4 percent to be full employment. Unemployment will never be zero because there is a segment of the working-age population (from 16 to 65) that is unable to work or unwilling to work. This level of full employment varies among different countries. In some European countries full employment is a high-single-digit number and is often a function of the opportunity cost of not working.

How does the Federal Reserve affect change in the economy to meet its dual mandate? This is where the concept of the Federal Reserve gets fairly abstract. The Federal Reserve can raise or lower short-term interest rates to effectively stimulate the economy if it is growing too slowly or "tap the brakes" if the economy is growing too quickly. This link for a video, although a bit dated, does a good job of explaining the nuance of how the Federal Reserve operates.

http://content.time.com/time/video/player/0,32068,57544286001_1948059,00.html

Our Takeaways for the Week:

- We are early in earnings season for the fourth quarter of 2014 and it has been a mixed bag so far. Multinational companies are starting to show the impact of a strong dollar

- This is negatively impacting sales in some cases as a stronger dollar makes goods exported from the United States more expense to consumers in other countries

A Glimpse Into the Continuing Greek Crisis

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Greece, often referred to as “the cradle of democracy,” practices a rather messy form of government by the people. Recently, a presidential election in Greece was considered to be unsuccessful due to a lack of a majority vote in the third round of voting. Due to this failed election, the Greek Parliament needs to be dissolved and general elections need to be held. This matters because the composition of the new government is most likely going to be the Syriza Party (according to the polls). The Syriza Party is considered to be extremely left-wing and is known to be very anti-austerity and anti-European Union.

This government turmoil in Greece has caused the Athens Stock Exchange to decline by over 20 percent in the month of December. Additionally, the Greek government bond market has had a vicious sell-off, much akin to the 2010-2012 European Debt Crisis. The Greek 10-year government bond is yielding 9.3 percent, up from 5.5 percent in early September. By contrast, the Japanese can borrow money for 10 years for .30 percent and the United States 10-year bond is at 2.17 percent.

What is driving down Greek bond prices and spiking yields is the fear that if the Syriza party comes into power, they may try to renegotiate the terms of the recent bailout of the Greek government. If this negotiation does not go their way, it is possible that Greece could leave the European Union. This creates uncertainty of how the bondholders of Greek debt would be treated in this circumstance

The good news about this crisis is that it is contained in Greece. The debt of other European countries such as Italy and Spain have not been impacted. The “do-whatever-it-takes” backstop that was created by Mario Dragi and the European Central Bank has been enough to keep a debt crisis contagion from occurring. General elections in Greece are scheduled for January 25 and even if the Syriza party does come into power, their ability to reverse austerity measures and renegotiate bailout terms is uncertain.

Our Takeaways for the Week:

- Unfulfilled campaign promises are a universal feature of every form of democracy. It is highly probable that even if the Syriza Party comes into power they won’t be able to make the proposed changes.

- We wish you and your family a very happy New Year.

10 Investment Themes to be Thankful For

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

This week as we gather with friends and family to celebrate Thanksgiving we thought it appropriate to reflect upon recent investment themes for which we are thankful.

Top 10 Investment themes to be thankful for:

- The midterm elections are over. More important than the outcome is the fact that the elections have been decided and the markets have a reprieve from the election cycle until mid-2015. However, like Christmas displays now appearing in stores prior to Halloween, the 2016 election will start to dominate the news far sooner than it needs to.

- The Federal Reserve is more open and transparent than it has ever been in its history. As part of the Bernanke Fed, there was an attempt to be more open and transparent relative to communicating interest rate moves to the markets. This transparency has been continued with the Yellen Fed and has been effective in setting the expectations for investors as to the next moves of the Federal Reserve. This openness helps to mitigate the uncurtaining around Fed actions.

- Unemployment is at 5.8 percent. At the end of 2009 unemployment was at nearly 10 percent. While the labor market has been painfully slow to heal, the rate jobs are being added each month means we should reach theoretical full employment sometime in 2015. Theoretical full employment is thought to be around 5.4 percent unemployment, as every person of working age cannot be employed in the economy due to a variety of reasons.

- Oil prices have declined precipitously this year. While a decline in oil prices has been a headwind for energy stocks, it is great for U.S. consumers. When gas prices decline, it directly puts money into consumers’ pockets and should help consumer discretionary stocks.

- The municipal bond market has extraordinarily low default rates. Despite the recent default in Detroit and Puerto Rico's widely publicized troubles, the municipal bond market defaults are exceedingly rare. According to Moody's, the default rate for the entire 43 years in which the data is available is .012 percent.

- The Federal Reserve is expected to raise short-term interest rates sometime in 2015. This is good news because if this does indeed happen it demonstrates the strength of the U.S. economy. If the Federal Reserve is compelled to raise rates to keep the economy from overheating, it speaks volumes about the robust economic growth in the U.S.

- The United States has a healthy level of inflation in the economy. Inflation as measured by the Consumer Price Index is running at around 1.7 percent annually. Too much inflation in an economy is damaging, such as what was experienced in the United States in the 1970s. Conversely, too little inflation can be toxic to an economy. Deflation is when inflation turns negative and prices grind lower. This can cause a negative feedback look whereby consumers and businesses delay purchases in hope of getting lower prices

- The U.S. dollar is strong. It is said that money flows where it is treated best, and, with the robust U.S. economy, our dollar is appreciating against many foreign currencies. This will spur foreign investment in our financial markets.

- The current economic cycle shows no signs of overheating. A question we get asked frequently is how much longer does this business cycle have to go? Economic cycles die of overheating, not old age. This has been a painfully slow economic recovery that has been around for approximately 5 years. A slow growing economic expansion with no signs of a bubble in the economy has the potential to last.

- Corporate earnings remain strong. According to FactSet Research, of the 487 companies in the S&P 500 that have reported earnings for the third quarter of 2014, 77 percent have reported earnings above the mean estimate and 59 percent have reported sales above the mean estimate. This equated to a blended earnings growth rate of 7.9 percent for the previous year as of the end of the third quarter.

CPI: The Underestimation of Inflation?

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Inflation is an obtuse concept to fully comprehend. For the month of September, the Bureau of Labor Statistics indicated that the rate of inflation, as measured by the Consumer Price Index (CPI), was 1.7 percent for the last year. This would hardly be considered a noticeable price increase for most items. As a consumer, it seems that everything other than flat screen televisions is more expensive all the time, particularly if you consume prescription drugs, go to the doctor or pay for any type of tuition.

It is a fairly consistent complaint among the investment community that the CPI understates the rate of inflation. In fact, there are often conspiracy theories around the measure of inflation because the CPI is the basis for cost-of-living increases for Social Security recipients and other government payments to individuals which is consuming an ever greater percentage of the national income.

In looking at the detail of how the CPI is calculated, it is apparent that a great deal of thought went into the methodology while its value in measuring the true rate of inflation is questionable. As for the conspiracy theories around the inflation measure, it is unlikely that a giant bureaucracy is organized enough to pull off anything like that. No doubt well-meaning people work hard to produce these statics.

Too much or too little inflation is a bad thing. Excess inflation, such as was experienced in the late 1970s in the United States, or hyper-inflation that often occurs in developing nations can create an environment where costs spiral out of control. Conversely, negative inflation or deflation is also a troublesome scenario. In deflation, prices continually drop and as a result, consumption also goes down as consumers wait for lower prices. Japan has suffered from this condition to some degree for the last decade and is attempting to climb out deflation via aggressive economic stimulus.

Following aggressive monetary policy action taken by the Federal Reserve following the financial crisis, there was great concern that excess inflation would follow. Thus far, there has been no excess inflation despite the flood of liquidity put into the financial system to stimulate the economy. In fact, inflation is below where the Fed would like to see it. The Fed's preferred measure of inflation called the PCE Deflator which last month has a yearly increase of 1.5 percent and generally is lower than the CPI. The primary difference between the two measures of inflation is the PCE Deflator allows for the substitution of goods by consumers. The Fed would like to see the PCE Deflator closer to 2 percent.

The attempt to control and measure inflation produces more questions than answers. Inflation is very difficult to quantify and measure. There is no such thing as an average consumer and people are going to experience inflation very differently depending upon their stage in life and level of income. We believe that inflation is muted due to the long, slow recovery we’ve experienced since the financial crisis. The slack in the labor market and broader economy is just now beginning to get wrung out.

The attempt to control and measure inflation produces more questions than answers. Inflation is very difficult to quantify and measure. There is no such thing as an average consumer and people are going to experience inflation very differently depending upon their stage in life and level of income. We believe that inflation is muted due to the long, slow recovery we’ve experienced since the financial crisis. The slack in the labor market and broader economy is just now beginning to get wrung out.

Our Takeaways for the Week

The equity markets were strong this week, up around 3 percent as we move through third quarter earnings season. According to data compiled by Bloomberg, about 79 percent of S&P 500 companies that have posted quarterly earnings this season have topped analysts’ estimates for profit, while 60 percent beat sales projections. In addition, the hysteria around Ebola now being called “Fearbola” has hopefully subsided.

Independence for Scotland and a UK haggis famine

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Haggis is a cuisine of Scotland characterized by Wikipedia as a savory pudding containing sheep's pluck (heart, liver and lungs) minced with onion, oatmeal, suet, spices and salt mixed with stock. It is traditionally encased in the animal's stomach and simmered for approximately three hours.

The often lampooned delicacy was featured in the 1993 film, “So I Married an Axe Murder,” staring Mike Meyers. In the comedy, Mike Meyers’ character of Scottish decent when as asked about his fondness for haggis responded, “I think it's repellent in every way. In fact, I think most Scottish cuisine is based on a dare.”

On September 18, a referendum for Scottish independence from the United Kingdom will be put to a vote. Recently, polls suggest that it will be a close outcome. This situation is creating uncertainty and we have seen the pound sterling weaken as a result. At stake is revenue from the oil-rich North Sea which has been greater than 2 percent of the UK's revenues down from over 6 percent of revenue in the 1980s. The North Sea fields are off the coast of Scotland and there is some question about which country would control the revenue after a split. There have been many comparisons of an independent Scotland and Norway based on the countries similar populations and potential energy wealth. While the North Sea fields are in a period of declining production, the revenue would be material to an independent Scotland.

If a vote for independence passes, the UK's fragile recovery from the financial crisis will be called into question. The UK economy has slowly been crawling out of the economic downturn of the Great Recession in a similar fashion to the U.S. A split-off of Scotland would potentially stall the recovery.

The pending referendum has also created uncertainty relative to business investments in that there is a question about the political landscape should a split occur. In a similar situation, Quebec had a referendum for independence in 1995 that failed. However, the uncertainty that it could occur again was at least partly responsible for an economic malaise in the province and reduced business investment.

In Spain, the region of Catalonia has a referendum in November of 2014 for possible secession. The impact of this would be negative for Spain as its economy is in far worse shape than the U.S. and the UK.

While not a catastrophe in the making, an independent Scotland or Catalonia destabilizes what is a tenuous recovery in Europe. Most of Continental Europe is suffering from anemic growth, continued high unemployment, massive indebtedness and the specter of deflation. Above all, the financial markets hate uncertainty and these types of changes are potentially disruptive to the European recovery.

Other Takeaways for the Week

- Apple introduced the iPhone 6, Apple Watch and Apple Pay this week, which were generally well received. The Apple Pay secure transaction using an iPhone rather than a physical credit card has the potential to revolutionize how items are paid for at retailers.

- The late Joan Rivers often used humor regarding her financial life as part of her act. One memorable quote that bears mentioning is, “People say that money is not the key to happiness, but I always figured if you have enough money, you can have a key made.”

Sanford and Son: Bonds Hit a Rough Patch

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Sanford and Son was a TV series in the 1970s about a disagreeable junk dealer and his adult son. In one reoccurring gag in the series the main character, Fred Sanford, would dramatically grab his chest and exclaim, "Oooo….It’s the big one….You hear that, Elizabeth… I'm comin' to you." This simulated heart attack was perpetrated by the Fred Sanford character to make his point when exasperated and was always a false alarm. Recently, the junk bond market hit a rough patch with investors exiting junk bond funds, causing bond prices to decline. The question at hand is, is this correction "the Big One," meaning a new credit crisis, or simply a minor correction akin to the dramatic fake heart attack that Fred Sanford used to torture the other characters on the show?

Bonds that are below investment grade are often referred to as junk bonds due to the lower credit quality of the companies issuing the bonds. Junk bond is somewhat of a pejorative description of an important part of the bond market. Small companies that are growing, which is a large engine for the U.S. economy, often fit into the category of below investment grade credit. It is important that there are public market debt financing options available for these entities. Because of the lower credit quality, investors demand more compensation in the form of interest in order to loan these companies money. Also due to the lower credit quality, there is a higher potential default risk for these bonds.

Recently, there has been an outflow of money from high yield bond funds as investors have become nervous about the risks of below investment grade bonds. With interest rates being so low for an extended period of time, the hunt for yield by investors has been intense. Money has been flowing into the type of investments that can offer a higher income than the traditional bond market. Below investment grade bonds have been one of the asset classes that has benefitted from this cash flow. As a result, the prices of high yield bonds have been bid up and the resulting yields are down because they move inversely to one another.

The higher the risk in a bond, the higher the yield should be to compensate for the risk. The way risk is measured in high yield bonds is the yield spread over U.S. Treasury bonds. Bonds issued with the full faith and credit of the U.S. Government are considered to be riskless with respect to default. High yield bonds can default and, as a result, investors receive additional interest over a treasury bond to compensate for that risk. For example, if a U.S. 10-year Treasury bond is yielding 3 percent, a high yield bond should yield 8 percent, given the historical relationship. Traditionally, the average spread between high yield bonds and U.S. Treasury bonds is 5 percent. With the insatiable demand for income, high yield bond prices have risen to a point where investors are only getting 3 percent more interest than treasury bonds.

Our view is that this is a normal correction that has more to do with the recent stock market volatility than credit quality. The high yield market is often more closely correlated with the stock market as opposed to the bond market. On average, the underlying credit quality of high yield bonds is better than average as evidenced by the default rate. According to Standard & Poor’s, the default rate on high yield bonds has recently been around 2 percent, well below the long-term average of just over 4 percent.

With the strong demand for high yield bonds, the valuation probably did get extended; however, we don't believe this is the start of another credit crisis.

Our Takeaway for the Week

- Geopolitical events continue to drive equity and bond market volatility

Brad Houle Article in Portland Business Journal

Brad Houle, CFA, executive vice president of research, recently authored a by-line article that was included in the Portland Business Journal’s 2014 Wealth Management and Financial Services Guide. This publication is sponsored annually by the CFA Society of Portland.

Brad Houle, CFA, executive vice president of research, recently authored a by-line article that was included in the Portland Business Journal’s 2014 Wealth Management and Financial Services Guide. This publication is sponsored annually by the CFA Society of Portland.

In the article, Houle states, “While bonds do not offer a compelling value at this point, they are a necessary component of many portfolios for both individual and institutional investors.” Houle is a member of Ferguson Wellman’s fixed income team and manages the firm’s REIT investment strategy.

Click here to read “A yield austerity; how not to get burned in the bond market.”

Sovereign Debt Risk in Europe Takes a Holiday

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

We have illustrated below the details of the convergence of government bond yields between the stronger credits of Germany and the United States versus the weaker credits of Italy and Spain. Germany and the United States are arguably two of the strongest sovereign bond insurers in the world. While not perfect, both Germany and the United States have dynamic economies with reasonable levels of inflation versus economic growth. Also, both countries have excellent ability to pay their debts and are viewed as "safe haven" credits by bond investors.

Italy and Spain are a different matter. While we do believe that these countries are starting to recover from the European debt crisis, there are still many structural economic issues that need to be addressed. For example, Italy has a 12 percent unemployment compared to the six percent unemployment in the United States. However, Italy's unemployment looks very favorable compared to the 25 percent unemployment currently in Spain. In addition, both of these countries have severe demographic issues with aging populations and strict labor market regulations that make the labor force less flexible.

What changed to cause interest rates to drop from around the seven percent for a 10-year bond for Spain and Italy in 2021 to the less than three percent rate of interest they now pay were the actions by the European Central Bank or ECB. Essentially, the ECB, which is akin to the Federal Reserve for Europe, announced they would do whatever it takes to backstop these countries. These words gave bond investors the confidence that Italy and Spain will have the ability to honor their debt obligations. Financial markets run on confidence, and this was enough to cut the borrowing costs of these countries by half.

Countries compete for capital from investors. Investors strive to get the best return for the risk that they are taking. Given this set of facts, buying United States treasury bonds versus European country debt seems like a much better investment from a risk versus reward standpoint. While the words of the ECB do merit more investor confidence, there is still underlying credit risk that does not seem to be properly priced into European government debt.

This week there was an event in Portugal that highlighted this risk. During the European debt crisis, Portugal was in a similar position to Italy and Spain. Portugal had a heavily indebted economy with structural economic issues and a high cost of borrowing based on perceived credit risk. Portugal fell under the ECB umbrella and their borrowing costs have declined in a similar fashion to Spain and Italy. However, this week Portugal's Banco Espirito Santo announced that they were having issues meeting debt payments on some short-term borrowing the bank had done to fund operations. This news was enough to cause a one day .30 percent increase in the yield of the Portuguese 10-year bond and a broader decline in European stock markets. While relatively minor, this incident demonstrates the market confidence in European sovereign debt markets is on the razor's edge and credit risk is probably not properly reflected in the possible risk of this debt.

Our Takeaways for the Week

- U.S. Treasury debt is more attractive than European sovereign debt

- While we do believe interest rates will rise in the U.S. as economic growth continues, there is a cap on how high interest rates will climb. Investors will favor U.S. Treasury bonds over European bonds which will help keep rising rates in check

An Interest in Interest Rates

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

At the beginning of the year, we stated our belief that interest rates would gradually rise as three things occurred in 2014: the economy gains strength, unemployment continues to drop and bond market investors anticipate the Fed raising short-term interest rates. Thus far in 2014, the bond market has not been aligned with Ferguson Wellman's interest rate forecast. We continue to look for signs that our thesis was off-the-mark, but the fundamentals that lead us to this conclusion remain.

After a rough start to the year that was attributed to extreme winter weather, we believe the gross domestic product (GDP) growth can exceed 3 percent without making any heroic assumptions. In 2013, there was significant fiscal drag as government cut spending. This year, the drag of government cuts should roll off and government spending will be additive to GDP growth. Unemployment continues to move downward with the most recent reading being 6.3 percent. In addition, the “wealth effect” of last year's strong stock and real estate returns should add to consumer spending which comprises two-thirds of the economy. With the aforementioned set of economic circumstances, a 10-year Treasury over 3 percent by year-end is not out of the realm of possibilities.

It is difficult to pinpoint reasons that interest rates have continued to drop this year. Theories include the potential for quantitative easing in Europe, short covering by traders and perceived slowdown in economic growth. Addressing these topics independently, there is thought that the European Central Bank will engage in aggressive quantitative easing similar to what we’ve seen in the U.S. and Japan recently. In other words, the Federal Reserve in the U.S. is buying much of the bond issuance from the U.S. Treasury in an attempt to keep interest rates low. Bonds of developed market countries in the European Union have had strong price performance since the recent debt crisis whereby the yields on Spanish and Italian bonds are not that different than U.S. Treasury bonds. The U.S. has far higher credit quality than these European countries; one can understand investor preference in owing U.S. Treasuries over European country debt.

Short covering is the unwinding of a position by an investor which is designed to gain in value when interest rates climb. Many investors have positions that are bearish “bets” on U.S. interest rates. As rates have declined this year and have not climbed as anticipated these investments lose value. Then as investors unwind these types of trades, it can cause upward pressure on bond prices which correspondingly moves interest rates lower.

Lastly, belief in slower economic data would also potentially cause interest rates to drop because it would signal a slowing economy and a delay in the Fed raising short-term interest rates. Most recently, a disappointing retail sales report for the month of April was cited by some as evidence that the economy is slowing.

We believe that the recent movement in interest rates is mostly a short-term phenomenon. The economic recovery has solid momentum and as a result interest rates should move higher slowly over time. Presently, we are underweight fixed income for our clients and have invested the accounts defensively as a result of our interest rate forecast.

Our Takeaways for the Week

o We still believe interest rates will move higher throughout the remainder of 2014

o The U.S. economy is gaining momentum during the second quarter

Will Unemployment Be the Rat in My Kitchen?

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

The British reggae band, UB40, was formed in 1978 and, according to Wikipedia, went on to have more than 50 singles on the UK Singles Chart and achieved considerable international success, selling over 70 million records. During the late 1970s and early 1980s, the economy in the UK was depressed with high unemployment and the band's name reflected the economic environment of the time. UB40 is a reference to a document to obtain unemployment benefits from the UK government. The designation UB40 stood for Unemployment Benefit, Form 40. As investors, we have been very focused on unemployment in this country, which is measured by two different measures, U-3 and U-6.

The most widely quoted measure of unemployment is collected by the Bureau of Labor Statics and is called U-3. This gauge of joblessness simply assesses the percentage of the labor force not employed. Total labor force is defined as the number of employed plus unemployed. Presently, the U-3 is 6.7 percent and has been as high as 10 percent following the Great Recession.

U-6 is a measure of underemployment that is presently 12.7 percent and was as high as 17 percent in the time following the financial crisis. U-6 determines the unemployed as well as those that are working part-time but desire full-time work. It includes workers that are overqualified for their current position based on education or experience level as well as those that are considered to be marginally attached to the workforce. Marginally attached workers are persons that have not looked for work in the past 12 months yet indicate that they are open to being employed.

Currently, full employment, as based upon the U-3 number, is considered to be between 4 and 5 percent. Full employment is an evaluation of unemployment whereby the vast majority of employable people are employed. Unemployment never drops to zero because there is a segment of the population that is unemployable.

Despite the continued slack in the labor market, we view the economy as still growing. The unemployment rate as measured by U-6 or U-3 continues to go down, just at a rate that is slower than most investors would like to see. We continue to expect stronger economic growth for the rest of the year as we get past the weather impacted data from the winter months.

Takeaways for the Week:

- Companies are in the midst of reporting first quarter earnings. Of the S&P 500 companies that have already reported their earnings, more than half the companies beat sales expectations and 75 percent have beat earnings expectations

- Apple had stronger than expected earnings and raised the dividend and increased their share repurchase

Be Careful What You Say

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

Flash Boys

“High-frequency trading” (HFT) was a huge media topic this week due to author Michael Lewis’ appearance on last weekend’s “60 Minutes” as part of his promotion of his latest book titled Flash Boys. What captured media attention was his claim that the stock market was a "rigged game." This statement was based upon his research for Flash Boys that detailed the impact of high-frequency trading on the stock market. HFT is a very complex trading strategy that relies on computers to trade at lightning speed to make a small amount of money on a huge volume of trades. In fact, it is theorized that 30 to 50 percent of the current stock exchange volume is HFT.

High-frequency trading is an extremely complex issue that simply can't be summarized by declaring the stock market a "rigged game." In most forms, HFT is not illegal. It falls into a grey area of trading. If certain investors have a speed advantage, is that unethical? It is hard to say and supporters of HFT maintain that it adds liquidity to the market and facilitates trading. However, the aspect of HFT that is not defensible is that it also allows these trading firms the ability to know what other investors are doing and trade ahead of them. This practice is called "front running" which is certainly unethical and illegal.

The issue is so broad and complex, it is very difficult to determine who is doing what, and how that is impactful to the stock market as a whole. This is not a new issue for regulators who have been looking at HFT for some time now. We think the good news is that the recent attention on the topic will result in appropriate market reforms which will benefit investors. Financial markets operate on the confidence of the participants, and anything that enhances transparency and confidence benefits all investors.

While Mr. Lewis is a great writer and entertaining storyteller, his comments are unnecessarily inflammatory and might be intended to sell books and maximize the value of a possible film adaptation.

Employment Numbers March On

Turning to the capital markets, today the March employment numbers were released with a 192,000 increase in nonfarm jobs and a slight uptick in the unemployment rate to 6.7 percent. The consensus among economists was for a 200,000 increase in jobs. Due to the late-December expiration of long-term unemployment benefits, there was an expectation that the employment numbers would be even stronger than anticipated.

Historically, when long-term unemployment benefits run out, there is a significant pickup in employment. The “whisper number” was for a gain of 250,000 or more jobs. Defined as the number economists secretly hope will be the outcome, the “whisper number” usually is not reached by consensus and therefore is rarely published as an estimate. The bottom-line is that markets perceived the March job creation as a mild disappointment which resulted in some weakness in the equity markets.

Takeaways for the Week

- We view the current employment data to be moving in the right direction

- We are not overly concerned with the monthly volatility of the labor statistics

Puerto Rico Debt Crisis

by Brad Houle, CFA

Executive Vice President

by Brad Houle, CFA

Executive Vice President

As of late, Puerto Rico has been in the news due to financial problems that stem from too much debt, a shrinking population and weak economic growth. Consequently, Puerto Rico's debt has now been downgraded to below investment-grade status. Puerto Rico is a territory of the United States and as a result is able to issue municipal debt that is federal and state tax-free to investors in every state. Puerto Rico has roughly $70 billion in outstanding debt that is widely owned by municipal bond investors in high-tax states with limited municipal bond supply due to Puerto Rico’s favorable tax treatment and ample supply.

The government of Puerto Rico has been taking steps to stabilize their economy. Governor Alejandro Garcia Padilla has enacted drastic pension reform and economic growth has improved recently. However, Puerto Rico needs to access the bond market next month with a planned $3 billion dollar bond sale. In order to attract investors, Puerto Rico will have to pay a high single-digit rate of interest in order to compensate investors for the default risk. We believe that Puerto Rico will be able to successfully issue this debt which should shore up the finances as well as lessen the news flow. Additional liquidity coupled with less financial media attention should allow for a rebound in the prices of the debt.

While the situation in Puerto Rico appears to have stabilized, the territory is not yet out of the woods. There are still high levels of unemployment and violent crime and a business climate that is considered to be unfriendly. If the financial situation gets worse, there is some question whether the U.S. Government would step in to provide assistance. This is a complicated situation in that Puerto Rico is a territory and not a state. Detroit was allowed to go bankrupt and received no state or Federal assistance. In addition, there is not a clear mechanism for an orderly bankruptcy due to the territory status.

If the situation in Puerto Rico becomes more serious, some are concerned that it would become a systemic crisis across the municipal bond market. In past municipal bond market corrections, we have used the dislocation to buy bonds at attractive valuations for our clients. Overall, municipal bonds have been a very safe investment, specifically according to Moody's for the last 40+ years, only .012 percent of municipal bonds have defaulted. Said differently, Strategas Research has calculated that of the greater than 1 million municipal bond issues outstanding only 71 have defaulted between the years of 1970 and 2011.

Our takeaways for the week:

- We have not actively purchased Puerto Rico debt for our clients in the past and are not buyers at this time. We view Puerto Rico debt as a “hold” for investors that do own the debt. Presently, the situation is characterized by more smoke than fire. Following a successful bond offering and as news flow abates, there will probably better opportunities to exit positions in Puerto Rico debt if individual risk preferences warrant doing so.

- This week we saw the S&P 500 hit new all-time highs.