Last Friday, the market closed out the day, week, month and quarter all with negative returns. Fears of higher inflation, more tightening by the Federal Reserve and potentially lower corporate earnings weighed on investors’ minds. The S&P 500 broke below the June low last week, extending the bear market that began in January. At 269 days as of quarter end, this is the most protracted correction since the March 2009 low. Surprisingly, the market decided to pull a 180 early this week, returning almost 6% on Monday and Tuesday. So, what was the deal?

Third Quarter 2021 Market Letter: Coming in Hot

Third Quarter 2021 Investment Strategy Video: Coming in Hot

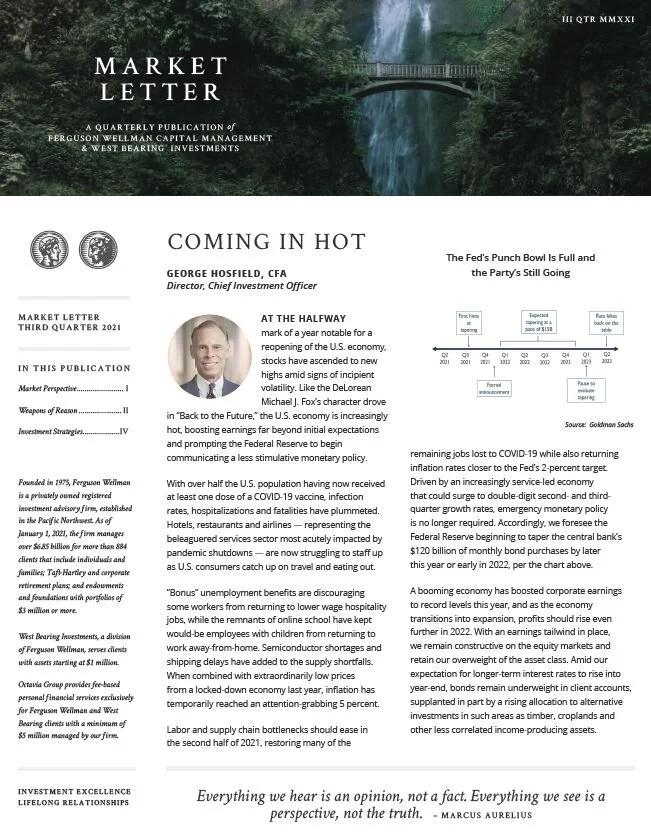

George Hosfield, CFA, chief investment officer and director of the firm, discusses our third quarter outlook.

Yield On, Yield Off

When the Federal Reserve cut their overnight policy rate by a total of 2.0 percent to the zero bound in the fourth quarter of 2008, few investors would have anticipated it would be another seven years before the Fed felt economic conditions warranted raising that policy rate by even one-quarter percent.