2021 Annual Report

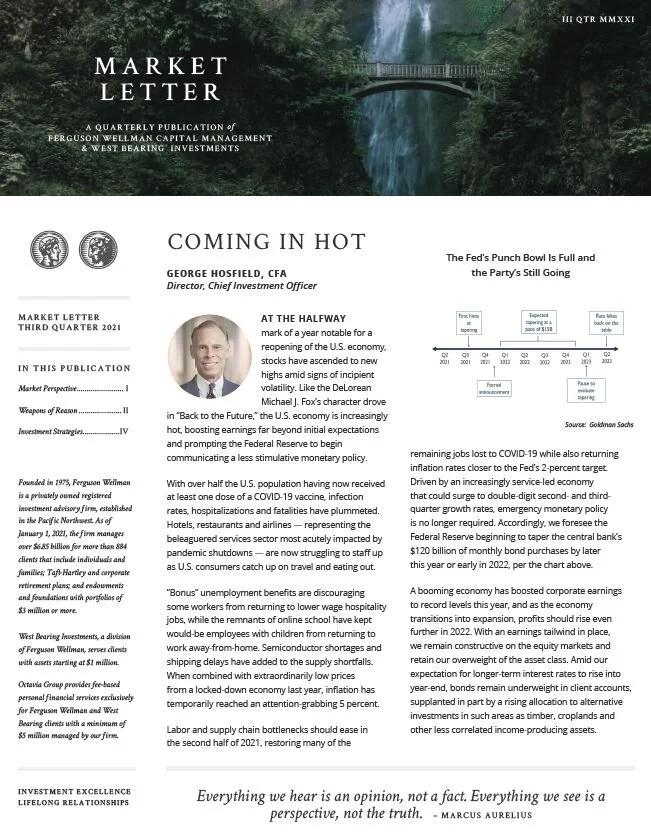

Third Quarter 2021 Market Letter: Coming in Hot

Signs!

“Signs, Signs everywhere there are [help wanted] Signs,” is how the song goes. It’s the first Friday of the month, and that means the monthly payroll report is released by the Bureau of Labor & Statistics.

2020 Annual Report

Pahlow Discusses Year-End Financial Planning Strategies on KOIN

Down in a Hole

Thursday’s unemployment claims continued to paint a dismal picture in the jobs market, where roughly 2.1 million people filed for initial claims last week, which brings the total over the last two months to roughly 40 million.

"The Bad News Won't Stop but the Markets Keep Rising"

“The Bad News Won’t Stop, but Markets Keep Rising,” read the headline of the business section of the NY Times this week. I have received many questions from many clients and friends over the past couple of weeks regarding this notion.

Ferguson Wellman and West Bearing Take Your Child to Work Day

Growth Gain, Stock Pain

Global markets sold off sharply on Wednesday and Thursday as investors continued to wrestle with a diverse set of risks.

Action and Reaction

With just a couple of weeks left to go in the second quarter, investors wanting for a lack of earnings news found plenty of economic reports and central bank meetings to freshen up their views of the macroeconomy.

A New Face

The markets had to digest weighty geopolitical headlines this week with tariffs, North Korea and a messy political landscape in the European Union dominating the news cycle.

Give Me One Good Reason

Equity markets finished the week up by 1.5 percent, and now are up almost 7 percent for the year. This is the 4th best start to the year for the S&P 500. The U.S. Treasury 10-year bond yield continued its march higher by 6 basis points, finishing at 2.65 percent.

Take the Money and Run

Global equity markets continued their hot start to the year with the S&P gaining 0.6 percent, Europe 1.25 percent and emerging markets up 1.65 percent. On the other hand, bonds declined slightly as interest rates moved higher with the 10-year U.S. Treasury yield finishing the week at 2.63 percent, its highest level since last spring.

InvestmentNews Ranks Ferguson Wellman a "Top RIA"

Ferguson Wellman Capital Management has been ranked by InvestmentNews magazine as a top investment company.

InvestmentNews named Ferguson Wellman 11 out of 15 companies in their “Western Success Stories” category in the listing of largest fee-only RIAs as organized by region as based on assets under management. Ferguson Wellman is the only firm to be included from Oregon and is the largest in the Pacific Northwest to be included.

“We are honored to be included in this impressive list of advisers by InvestmentNews. We believe it is a testament to how we have strategically grown our business and consistently focused on a high level of service for our clients,” said Steve Holwerda, CFA, principal and chief operating officer.

Founded in 1975, Ferguson Wellman Capital Management is a privately owned registered investment advisory firm, established in the Pacific Northwest. As of January 1, 2017, the firm manages over $4.5 billion for more than 760 clients that include individuals and families; Taft-Hartley and corporate retirement plans; and endowments and foundations with portfolios of $3 million or more. West Bearing Investments, a division of Ferguson Wellman, serves clients with assets starting at $750,000. (data as of January 1, 2017).

Methodology and Disclosure from Financial Advisor:

InvestmentNews qualified 1,937 firms headquartered in the United States based on data reported on Form ADV to the Securities and Exchange Commission as of Nov. 1, 2017. To qualify, firms must have met the following criteria: (1) latest ADV filing date is either on or after Jan. 1, 2016, (2) total AUM is at least $100M, (3) does not have employees who are registered representatives of a broker-dealer, (4) provided investment advisory services to clients during its most recently completed fiscal year, (5) no more than 50 percent of amount of regulatory assets under management is attributable to pooled investment vehicles (other than investment companies), (6) no more than 25 percent of amount of regulatory assets under management is attributable to pension and profit-sharing plans (but not the plan participants), (7) no more than 25 percent of amount of regulatory assets under management is attributable to corporations or other businesses, (8) does not receive commissions, (9) provides financial planning services, (10) is not actively engaged in business as a broker-dealer (registered or unregistered), (11) is not actively engaged in business as a registered representative of a broker-dealer, (12) has neither a related person who is a broker-dealer/municipal securities dealer/government securities broker or dealer (registered or unregistered) nor one who is an insurance company or agency.

Source: InvestmentNews

Data Additional Disclosures:

InvestmentNews produced this list by surveying all registered investment advisors that filed their ADV with the SEC. Ferguson Wellman (the firm) is not aware of any facts that would call into question the validity of the ranking. The firm does not believe this advertisement is inappropriate and is not aware of any unfavorable rating towards the firm. InvestmentNews pulled data from ADV filings for the ranking. All 12,000 RIAs in the United States were surveyed, then they narrowed the field down to those with assets under management of $250 million or more. For the category we were considered, there were 214 firms that qualified, and the Firm ranked 55 of the 214. Of the firms listed in the total RIA survey and ranking by InvestmentNews, 33 percent fell into the $1 billion or more assets under management category. The rating does not involve client experience and is not indicative of Ferguson Wellman’s future performance. Ferguson Wellman did not pay a fee to participate in this survey.

Low Expectations

The dog days of summer have officially set in. Millions of people took Monday off to watch the eclipse, while millions more merely peeked out their office windows.

Ferguson Wellman Ranked on Portland Business Journal Money Management List

Ferguson Wellman Capital Management and its division, West Bearing Investments, are pleased to announce that the firm has been named by Portland Business Journal as top money managers in their 2017 Money Management Firms list.

Portland Business Journal ranked Ferguson Wellman fourth in Oregon and Southwest Washington on their list of 25 money managers. The listing was created by calculating the total number of assets under management for Oregon and Clark County, Washington clients as of May 31, 2017. Forty firms were originally surveyed.

“We are always glad to see our firm listed among our Oregon and SW Washington peers. It is a real testament to the hard work and dedication of everyone at Ferguson Wellman, but even more importantly to the wonderful clients we serve,” said Jim Rudd, principal and chief executive officer.

Founded in 1975, Ferguson Wellman Capital Management is a privately owned registered investment advisory firm, established in the Pacific Northwest. As of January 1, 2017, the firm manages over $4.5 billion for more than 760 clients that include individuals and families; Taft-Hartley and corporate retirement plans; and endowments and foundations with portfolios of $3 million or more. West Bearing Investments, a division of Ferguson Wellman, serves clients with assets starting at $750,000. (data as of January 1, 2017).

Disclosures: Portland Business Journal produced this list by soliciting firms in Oregon and Southwest Washington for information regarding their assets under management. Ferguson Wellman (the firm) is not aware of any facts that would call into question the validity of the ranking. The firm does not believe this advertisement is inappropriate and is not aware of any unfavorable rating towards the firm. The rating category is the Top 25 in the Financial Services Guide, forty firms were surveyed and 62.5 percentage of advisers polled received a ranking. The rating does not involve client experience and is not indicative of Ferguson Wellman’s future performance. Ferguson Wellman did not pay a fee to participate in this survey.

Ferguson Wellman Ranked a “Top RIA” by Financial Advisor

Ferguson Wellman Capital Management has been named by Financial Advisor magazine as a top investment company. Financial Advisor named Ferguson Wellman 55 out of 214 U.S. firms in the $1 billion-and-over asset category of their registered investment adviser (RIA) rankings. Ferguson Wellman is the highest-ranked firm headquartered in Oregon. The listing is created by tracking independent investment firms registered with the SEC and ranks companies according to their assets under management as reported in their ADV forms. All firms must provide financial planning services to individual clients in order to be considered for the list.

Financial Times Names Ferguson Wellman to Top 300 RIA List

Financial Times Names Ferguson Wellman Capital Management

to Top 300 Registered Investment Advisers List

Ferguson Wellman Capital Management was recently named by Financial Times to their “FT 300 Top Registered Investment Advisers” list.

According to their detailed methodology, the RIAs are first examined via the RIA database and then only firms with $300 million or more in assets under management are considered. Next, the financial publishing company uses a formula based on six criteria and calculates a numeric score for each. Among the items of consideration are adviser assets under management, asset growth, the company’s age, industry certifications of key employees, SEC compliance record and online accessibility. According to the editors of the FT 300 RIA list, it is “presented as an elite group, not a competitive ranking of one to 300. This is the fairest way to identify the industry’s elite advisers while accounting for the firms’ different approaches and different specializations.” Over 725 RIA firms applied to be selected and of the 300 that made the list, only five firms from Oregon were selected.

“We are always pleased to see our firm mentioned on these lists among our peers,” said Jim Rudd, principal and chief executive officer. “It is a testament to the hard work and dedication of everyone at Ferguson Wellman and West Bearing, but even more importantly, to the clients we serve.”

Founded in 1975, Ferguson Wellman Capital Management is a privately owned registered investment advisory firm, established in the Pacific Northwest. As of January 1, 2017, the firm manages over $4.5 billion for more than 760 clients that include individuals and families; Taft-Hartley and corporate retirement plans; and endowments and foundations with portfolios of $3 million or more. West Bearing Investments, a division of Ferguson Wellman, serves clients with assets starting at $750,000. (data as of January 1, 2017).

###

Methodology and Disclosure from Financial Times:

The fourth edition of the Financial Times 300 has assessed registered investment advisers (RIAs) on desirable traits for investors. To ensure a list of established companies with deep, institutional expertise, we examine the database of RIAs registered with the U.S. Securities and Exchange Commission and select those that reported to the SEC and select those that had $300m or more in assets under management (AUM). The Financial Times’ methodology is quantifiable and objective. The RIAs had no subjective input. The FT invited qualifying RIA companies – more than 2000 – to complete a lengthy application that gave us more information about them. We added to this with our own research into their practices, including data from regulatory filings. Some 725 RIA companies applied and 300 made the final list. The formula the FT uses to grade advisers is based on six broad factors and calculates a numeric score for each adviser. Areas of consideration include adviser AUM, asset growth, the company’s age, industry certifications of key employees, SEC compliance record and online accessibility. The reasons these were chosen are as follows: AUM signals experience managing money and client trust. AUM growth rate can be a proxy for performance, as well as for asset retention and the ability to generate new business. We assessed companies on both one-year and two-year growth rates. Companies’ years in existence indicates reliability and experience of managing assets through different market environments. Compliance record provides evidence of past client disputes; a string of complaints can signal potential problems. Industry certifications (CFA, CFP, etc.) shows the company’s staff has technical and industry knowledge, and signals a professional commitment to investment skills. Online accessibility demonstrates a desire to provide easy access and transparent contact information. Assets under management and asset growth, combined, comprised roughly 65 to 70 percent of each adviser’s score while asset growth accounted for an additional 10 to 15 percent. Additionally, the FT caps the number of companies from any one state. The cap is roughly based on the distribution of millionaires across the U.S. We present the FT 300 as an elite group, not a competitive ranking of one to 300. This is the fairest way to identify the industry’s elite advisers while accounting for the firms’ different approaches and different specializations. The research was conducted on behalf of the Financial Times by Ignites Distribution Research, a Financial Times sister publication.

Additional Disclosures:

Financial Times produced this list by Ignites Distribution Research, a sister company of Financial Times. Ferguson Wellman (the firm) is not aware of any facts that would call into question the validity of the ranking. The firm does not believe this advertisement is inappropriate and is not aware of any unfavorable rating towards the firm. The rating category is the top 300 registered investment advisers, the number of firms surveyed was 725, and the percentage of advisers that received the rating of top 300 RIAs was 41 percent. The rating does not involve client experience and is not indicative of Ferguson Wellman’s future performance. Ferguson Wellman did not pay a fee to participate in this survey.

Profits Over Politics

As investors, the best thing about earnings season is it filters a lot of the other noise out of the market. A month ago, a tweet, tariff headlines or even a longshot tax proposal would have moved the equity markets. But now that we are in the throes of earnings season, equity investors are focused on the most important factor in investing: earnings.