by Tyler Conroy, CFP®, CPWA®

Vice President

Wealth Planning

Many companies reward employees with ownership of company stock through profit-sharing plans, employee stock ownership plans (ESOPs), or the option to purchase company stock via their 401(k) plans. This approach promotes an 'ownership mentality,' enhancing employee engagement and commitment to the company's overall success. However, withdrawals of company stock from a retirement plan or individual retirement account (IRA) are subject to ordinary income tax rates rather than the more favorable capital gains tax rates. This can be especially burdensome for those holding highly appreciated company stock in their retirement plans. To address this issue, the Internal Revenue Code (IRC) offers a little-known provision called the Net Unrealized Appreciation (NUA) rules. These rules are specifically designed to alleviate this tax burden for eligible shareholders.

Let’s look at an example to better understand how it works:

Example: Over the years, Mark has accumulated $100,000 worth of employer stock in his company's 401(k) plan through employer contributions. Due to the company's success, the stock is now valued at $500,000. If Mark were to withdraw the entire amount as a normal retirement distribution, the full $500,000 would be taxed as ordinary income. For someone in the top 37% federal tax bracket, this could result in approximately $185,000 in taxes.

However, by utilizing the NUA rules, Mark can distribute the employer stock from the 401(k) plan in a more tax-efficient manner. Upon distribution, only the initial cost basis of $100,000 is subject to ordinary income tax. The $400,000 in appreciation (the difference between the current market value of $500,000 and the cost basis of $100,000) is taxed at long-term capital gains rates when sold. With these more favorable tax rates, Mark's total taxes would decrease from approximately $185,000 to $117,000, resulting in tax savings of about $68,000!

To utilize the NUA rules, your withdrawal must meet three specific requirements:

In-Kind Transfer: Employer stock must be transferred directly from the retirement plan to a taxable brokerage account. It cannot be sold within the retirement plan and then distributed as cash for repurchase outside the plan.

Lump-Sum Distribution: The entire retirement account must be distributed within the same tax year. Non-employer stock assets should typically be rolled over into an IRA to facilitate a lump-sum distribution.

Triggering Event: NUA can only be applied following a triggering event such as death, disability, separation from service, or reaching age 59 ½.

If all these conditions are met, the cost basis of the shares becomes taxable as ordinary income in the distribution year. The NUA amount is deferred until the employer stock is sold, at which point it is taxed at long-term capital gains rates. Regardless of the holding period, NUA always receives favorable long-term capital gains treatment. Any additional gains on the shares held after distribution will be subject to either short-term or long-term capital gains rates, depending on the holding period between the distribution date and the eventual sale of the employer stock.

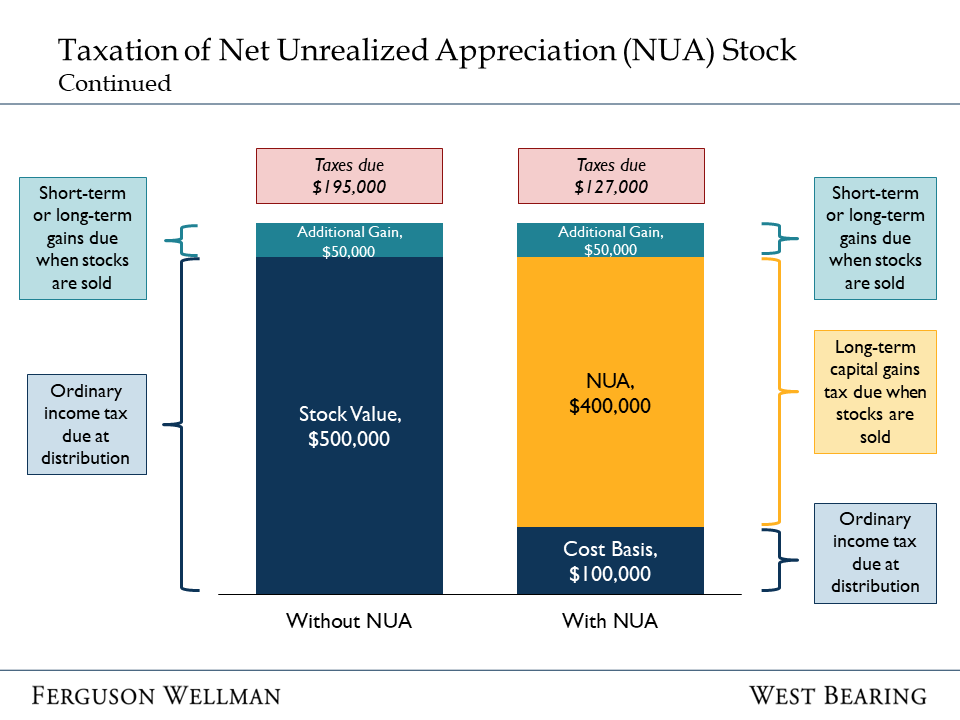

Example (Continued): Mark, who plans to retire this year, decides to utilize the NUA rules for the employer stock held in his 401(k) plan. At the time of distribution, the stock is valued at $500,000. Mark eventually sells the stock, more than one year after distribution, when its value has increased to $550,000. According to the NUA rules, Mark will owe ordinary income tax immediately on his $100,000 cost basis upon distribution. When he eventually sells the stock, he will owe long-term capital gains tax on the $400,000 of NUA. Furthermore, Mark will owe short-term or long-term capital gains tax on the additional $50,000 appreciation since transferring the stock to his brokerage account, depending on his holding period. By using the NUA rules, Mark’s total taxes would decrease from approximately $195,000 to $127,000, still resulting in tax savings of about $68,000.

While NUA rules are beneficial for some, the advantages of NUA rules vary widely depending on individual circumstances and may not be suitable for everyone. Typically, individuals with employer stock that have a low-cost basis and substantial unrealized gains, or those anticipating significant future appreciation, stand to benefit the most from this strategy. Additionally, it can be advantageous for individuals aiming for tax diversification, particularly if a large portion of their assets are held in tax-deferred accounts. By moving such assets into taxable accounts, individuals can potentially optimize their tax planning and manage their tax brackets more effectively during retirement.

There are several factors that you must consider before taking advantage of the NUA rule. Your financial situation, long-term goals, and the characteristics of your employer stock are all critical in determining whether this strategy makes sense for you. If you think this strategy may apply to you, please contact your tax advisor and portfolio manager to discuss your situation in greater detail. We can provide you with tailored advice and help you navigate this decision in alignment with your financial goals.

Ferguson Wellman, Octavia Group and West Bearing do not provide tax, legal, insurance or medical advice. This material has been prepared for general educational and informational purposes only and not as a substitute for qualified counsel. We believe the information provided is from reliable sources but should not be assumed accurate or complete. You should consult qualified professionals to understand how this information may, or may not, apply specifically to you.