by Blaine Dickason

Senior Vice President

Portfolio Management and Trading

“In the near-term the election will have no effect on our policy decisions”

- Federal Reserve Chair Jerome Powell, November 7th, 2024

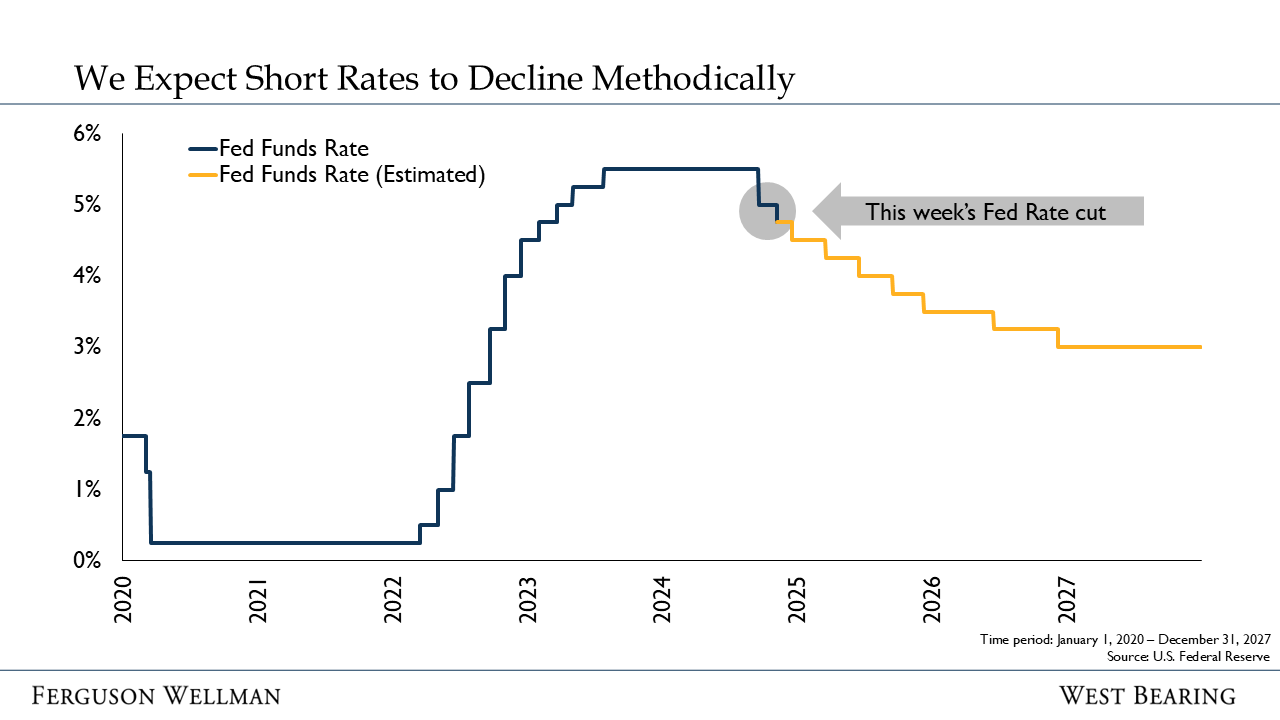

In a typical week, a .25 point interest rate cut by the Federal Reserve would likely be the top economic story in the United States. This was not a typical week. A new president-elect, as well as a flip of the Senate from Democrat to Republican control less than 48 hours before the Federal Reserve’s rate cut decision, led a supercharged week of market recalibration in consideration of this political shift.

In 2017, during his first presidential term, president-elect Donald Trump nominated Jerome Powell to be Chairman of the Federal Reserve. They maintained what could delicately be described as a tense working relationship that may have hit its low point in the fall of 2019 when President Trump tweeted “China is not our problem, the Federal Reserve is.” They now have the opportunity to work together once again, or at least until Chairman Powell’s current term as Fed Chair expires in May of 2026. Based on Chairman Powell’s direct answer to a question posed to him at his press conference yesterday, he does not intend to resign from his current position before his term concludes, even if asked or pressured by the president-elect.

Yesterday’s interest rate cut was largely anticipated by financial markets. Expectations for an additional .25 point rate cut at the Fed’s next meeting in December remains the base case, and as of this writing, is being priced at a 60% likelihood. December’s meeting, however, may be the end of what the Powell quote above considers the ‘near-term’, as both November and December rate cuts had been expected prior to Election Day. The following bullet points are areas that have the potential to alter the prevailing interest rate environment over the coming year, both as it relates to the Fed’s policy rate AND interest rates set by the market in response to growth, inflation and credit conditions.

Deficit spending remains the base case: The federal government continues to run an annual deficit, hitting nearly $2 trillion, or over 6% of GDP last year. For an economy at full employment, this is a significant level of stimulus being provided to the U.S. economy. Additionally, the U.S. Treasury must sell more bonds to make up the gap between deferral spending and federal tax revenue. At current interest rates, the cost to service our national debt will continue to climb and pressure other budget priorities.

Inflation may be more stubborn or see a second wave: Continued deglobalization and onshoring, increased use of tariffs, and lower net immigration all have the potential to stoke an increase in inflation from its current level, just above the Federal Reserve’s 2% annual target. Ongoing structural challenges related to transportation bottlenecks and our chronic housing shortage (currently estimated at over 5 million units) may also continue to apply upward pressure to prices in specific segments of the economy.

The Federal Reserve may deliver fewer rate cuts: A natural consequence of the above points is that the Federal Reserve may not be able to lower their policy interest rates as much as previously forecast while still pursuing their dual mandate of full employment and price stability. Under this scenario, the path for Fed interest rates over the coming years may result in a higher terminal or resting rate, which has implications for mortgage, credit card, car loan and other consumer lending.

This week’s Super Bowl of economic and political developments may influence, but do not initiate nor bring an end to the current economic cycle. Increased political volatility has become the new normal as the two-year election cycle regularly flips the respective party in power. We continue to monitor a multitude of macroeconomic variables as we set our investment policy into the new year.

Takeaways for the Week:

The S&P 500 hit a new record and breached the 6,000-point level for the first time in history today

Next week’s Consumer Price Index (CPI) report for October will give the latest update on Inflation, with current estimates being +2.6% year-over-year for headline and +3.3% for Core CPI